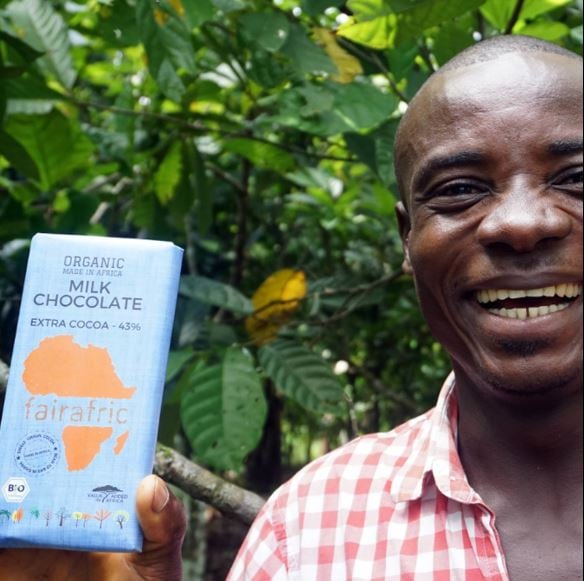

The idea for Fairafric – a chocolate bar that is grown, harvested, processed and packed in Africa – began in 2013 when Hendrik Reimers was backpacking around Africa. Reimers realised that people could earn much more if the agricultural commodities they grow were transformed into finished products in Africa.

Since then, Fairafric’s journey has involved several fundraising campaigns that have allowed it to begin making premium, organic chocolate in Ghana and shipping it around the world.

Its core mission - to keep value in Ghana - is achieved in several ways, Julia Gause, sales manager at Munich-headquartered Fairafric told FoodNavigator.

Firstly, it chooses to source organic rather than Fairtrade cocoa to make its chocolate. “In Ghana, the premium for organic beans is three times as high as the Fairtrade premium which is why we indeed pay the highest price you can pay in Ghana,” she said.

Secondly, it has begun buying shares for its cocoa farmers, making them "brand co-owners".

At the start of this year, Fairafric launched an investment campaign on the online platform Seedrs that allowed people to register and buy shares of the company. In parallel to this, it used some of the money raised during its most recent Kickstarter campaign (more than triple its €27,000 target) to set up a foundation that owns Fairafric shares on behalf of its farmers.

“We have already reserved a bunch of shares for our farmers during this Seedrs campaign […] and any dividends these shares will ever make will be handed on to the farmers, according to the volumes of beans they have contributed to the chocolate production,” said Gause.

“These people – friends, long-term supporters, fans and people who believe in our business model – are now investors and shareholders. We take enormous pride in this way of doing business and want our customers and suppliers to be in the same boat with us, having a perfect alignment of interests."

Keeping high-value processing in Africa

There have been fears that the cocoa sector could face shortages of its key crop due to labour shortages.

As younger generations in the major cocoa-producing countries, Cote d’Ivoire and Ghana, reject the meagre incomes that a career in cocoa farming usually promises. Establishing a chocolate manufacturing sector in Africa could be one way of addressing the unwelcome prospect of cocoa shortages caused by farm labour shortages.

However, two separate challenges need to be addressed, said Gause: higher and more secure incomes for farmers in rural Ghana and more job opportunities in its urban areas.

“On the one hand, cocoa farmers need to be trained and educated in cultivating their beans – also facing the challenges of climate change – and need to be paid fair prices. By paying the highest premium one is allowed to pay in Ghana, the premium for organic beans, we are tackling this challenge already.”

Fairafric also works in close contact with Yayra Glover, its partner cooperative, to find ways to increase farmers’ income. This summer it planted coconut trees on smallholders’ plots of land, for instance, which can boost farmers’ income.

“On the other hand, of course, young and well-educated people want to work in jobs that are [matched] to their skill set,” said Gause. “Somebody who has studied does usually not want to work on a cocoa farm. That’s why it is so important to support the emerging processing industry in the Global South and to leave as much of the value creation process there as possible."

FairAfric has retail listings in specialist shops in Germany, Austria, and Switzerland as well as organic supermarkets in Germany. It is also sold in one supermarket chain in Cairo, its first listing on the African continent, and worldwide via its website.

In 2018 Fairafric produced a total of 250,000 chocolate bars, each weighing 100 g and wrapped in Natureflex foil, a biodegradable and compostable packaging – “a great replacement [for aluminium foil] that is compatible with our machines, food security and the environment”.

Demand for Fairafric chocolate has so far outstripped supply, leading to some shortages over the summer.

To make the chocolate, Fairafric works with a local strategic partner, Niche Cocoa Industry, a fully Ghanaian, privately-owned cocoa processor that makes cocoa mass and cocoa butter.

Niche Cocoa Industry also has a small chocolate manufacturing factory, near the capital, Accra, where it makes chocolate for the Ghanaian market under its own Niche brand and other national brands (such as RoyalGhanada and Kana) as well as Fairafric for the international market.

“In Niche’s chocolate factory, there are engineers, food scientists and technicians working – a lot of them have studied and they earn at least six and a half times as much as the current Ghanaian minimum wage. These are the kind of jobs that are interesting for young, well-educated people!”

The workers making Fairafric’s chocolate enjoy numerous benefits: permanent contracts, health insurance, free transport and a13th-month salary.

According to Gause, finding skilled labour to work in the factory was easy as the number of well-educated people in Ghana is much greater than the number of available jobs, making the factory positions highly sought-after.

‘We should push the Made in Africa brand’

Manufacturing products in Africa is a viable business model for the many commodities that are grown in Africa, said Gause.

“All commodities which are exported to Europe as non-processed raw materials are potential products which would allow a similar business model,” she said.

The brand has been experimenting with flavours to find which are the most popular. Its range currently includes three types of milk chocolate (34% cocoa with sea salt; 43% cocoa; and 60% cocoa) and three types of dark chocolate: 70% cocoa; 80% cocoa and 70% cocoa with cocoa nibs.

Eight bars cost €23.90 from its online shop.

Solino Coffee and Kaffee Kooperative are two start-ups doing just that, growing, harvesting, roasting and packing coffee in Ethiopia and Rwanda respectively.

Meanwhile, Aduna is a UK company that recently launched a range of herbal teas made with African superfoods such as baobab and moringa, which are manufactured and packed in a BRC-accredited factory in Kenya.

“We are in close contact with [Solino and Kaffee Kooperative], as we can learn a lot from each other and together we should push the brand Made in Africa.”

Challenges

However, Fairafric's journey has not been without its bumps.

“There have been a lot of challenges, and there still are. A major challenge obviously was to find the most suitable suppliers and partners both in Ghana and Germany,” said Gause.

“One of the most memorable stories is probably when the shipping line that was also shipping our very first Made in Africa chocolate went bankrupt and the chocolate was stuck on a cargo ship for several weeks until the issue was solved. This was during our first Kickstarter campaign, but in the end, all backers received their rewards.

“We, of course, try to learn from all the things that happened in the past, so all these challenges, in the end, can be considered as part of an overall learning process. One of the most important things we take away from the past years is that producing chocolate in Ghana isn’t always easy, but it’s definitely worth all the efforts! Working with the team in Ghana and receiving so much support from all over the world makes us incredibly happy and proud.”