Humans have been consuming insects for centuries. They are rich in protein – gram for gram, they are high in protein than beef, chicken, or pork – and most are low in fat and cholesterol.

Insects also contain essential amino acids and trace minerals and vitamins, including calcium, phosphorous, iron, and niacin.

It is only recently that insects have (intentionally) made their way from natural habitats into finished food products, sports nutrition powders, pet food, and restaurant menus. This is largely due to their minimal ecological footprint.

Crickets, for example, are said to produce 11 times more food than cattle, for the same amount of feed and 1,000 times less water. Mealworms, to use another example, produce at least 14 times fewer greenhouse gas emissions than cattle.

While the insect category remains niche, it is heading towards the mainstream, with British bank Barclays estimating the insect protein market could be worth up to US$8bn (€7.27bn) by 2030.

According to Woven Network, the UK ‘could be a lead in this’. “The UK economic opportunity is potentially huge,” confirmed the UK membership organisation’s managing director Nick Rousseau.

That is, of course, if regulators succeed in balancing safety with innovation, he suggested at the Westminster Food & Nutrition Forum in London this month.

Insects: Eaten for centuries, yet a novel food?

Globally, around 2bn people in more than 130 countries already regularly eat insects as a source of protein. China alone has approximately 300 varieties of edible insects.

Yet, in these scenarios, insects are harvested from the wild. Farming insects for food, creates a different scenario – and one that sees insects fall within the definition of novel food as food ingredients isolated from animals.

Parts of insects (such as legs, wings, and heads), as well as whole insects, fall within this definition.

This means that insects products require pre-market authorisation from the European Food Standards Agency (EFSA). Authorisation is dependent on the completion of a full scientific dossier demonstrating safety.

While no such application has yet been approved, a number are under review. These include submissions for the house cricket, black soldier fly, honey bee, migratory locust, grasshopper, and mealworm.

“There are quite a variety of products which should come through,” said Rousseau of those currently under appraisal. While the approval timescale is not yet known, Woven Network’s managing director stressed that “Currently, unless you are approved, you can’t be trading”.

Post-Brexit trade and sourcing

If insects are currently unauthorised novel foods – as are CBD-infused products at present – then one would be forgiven for wondering why they are still on the market.

“There is a bit of a hiatus while we are waiting for these [novel food applications to go through],” said Rousseau. “These are still legal – that is my understanding.”

Of course, whether these applications are approved or not, there are hundreds of other varieties yet to be submitted. These include scorpions, tarantulas, and other ‘lovely delicious creatures’ that Rousseau said are ‘not currently likely to be approved’. In this respect, Novel Foods Regulations are ‘narrowing the field’, he suggested.

The UK’s impending withdrawal from the European Union has also created some uncertainty among Woven Network’s members.

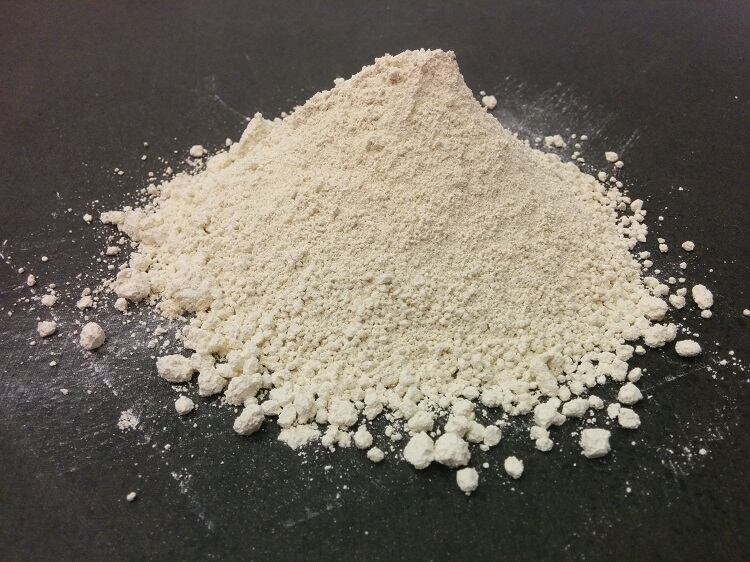

“The EU is a key market for us,” said Rousseau, particularly for insect snack brand Eat Grub, whose range includes ‘Crunchy Roasted Crickets’, ‘Cricket protein Powder’, and ‘Edible Grasshoppers’. “Eat Grub exports extensively into Europe, so anything that would be a barrier to that would be a problem.”

Stressing the importance of trade negotiations with the EU, Rousseau added: “My nervousness is that we are having that conversation with the US…”

Raw ingredient sourcing is another hot topic for the insect sector, particularly in the UK. “There is a growing body of insect farming activity and industry across Europe, but that tends to be more expensive as a raw material than if you were to import it from somewhere like China, where they have centuries of [experience] in insect farming,” we were told.

As it stands, the EU accepts insect protein from ‘a restricted number’ of countries: Switzerland, Canada, and South Korea. Yet, not the UK – as until 1 February, it remains a member of the EU-28.

Rousseau urged the UK to not only accept insects raised on home soil, but to incorporate Thailand into its insect protein supplier list. “Thailand has been producing insects and eating insects [for centuries] …people are now farming them at scale.

“Yes, it is a backyard operation, yes there isn’t massive biodiversity security around it, they are being fed of all sorts of interesting stuff, but they are producing good protein and that is really helpful and really valuable.”

Balancing safety and innovation

Moving forward into a post-Brexit UK, Woven Network’s managing director argued for balance, above all – between safety and innovation.

Rousseau is confident insects are safe to eat: “Millions of people have eaten insects all over the world for centuries. Have you read of anyone dying from insects?”

Yet, he admitted that insect protein is ‘not a well-understood thing’. Do we reject it due to this lack of understanding? he asked the audience at the event, “No, we need more evidence.”

In terms of human safety, allergenicity could be one issue. Unintended consequences of bringing a novel food into the food system, is another.

Referring to mad cow disease, a neurodegenerative disease of cattle which can cause a fatal variant in humans, Rousseau said “a lot of regulation in Europe affecting inspects are a result of that absolutely horrendous situation…affecting the farming industry across Europe.

“We don’t want to feed things into the food system that will create unintended consequences. So, everything is now locked down. You can only feed insects with a very narrow number of things.”

Rousseau called for more investment in research to better understand, and manage, the risks. This could not only ensure consumers are safe, but also ensure “that we can expand the market”.

“We need more investment in research to understand the risks, to manage those risks, and to make sure consumers are safe. But [also so] that we can expand the market.”