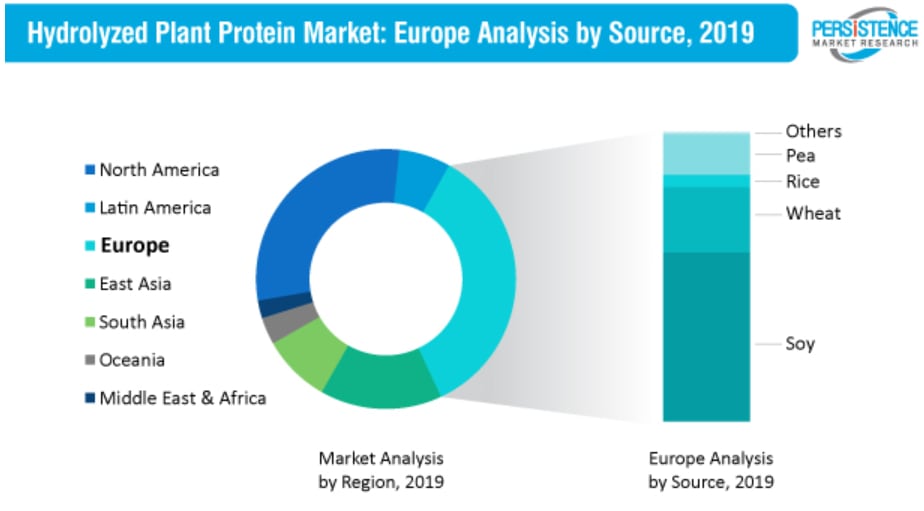

The global hydrolyzed plant protein market is likely to witness growth of over 4% year-over-year, and surpass sales of 563,000 million tonnes in 2019 – with Europe leading the way, according to analysis by Persistence.

According to the market researcher’s latest global market study on hydrolyzed plant protein titled ‘More than Just Veganism, Health, and Wellness’, hydrolyzed plant proteins were once used only as flavour enhancers and witnessed sluggish growth during 2014-2017.

However, since then the food and beverage industry has been hard-pressed to come up with protein-rich products and the role of hydrolyzed plant proteins has evolved from being a mere flavor-masking agent. The sector picked up pace in 2018 and global sales soared to 515,000 million tonnes, equalling a market valuation worth US$1.6 billion.

‘Tectonic shift’ in demand for plant-based sources

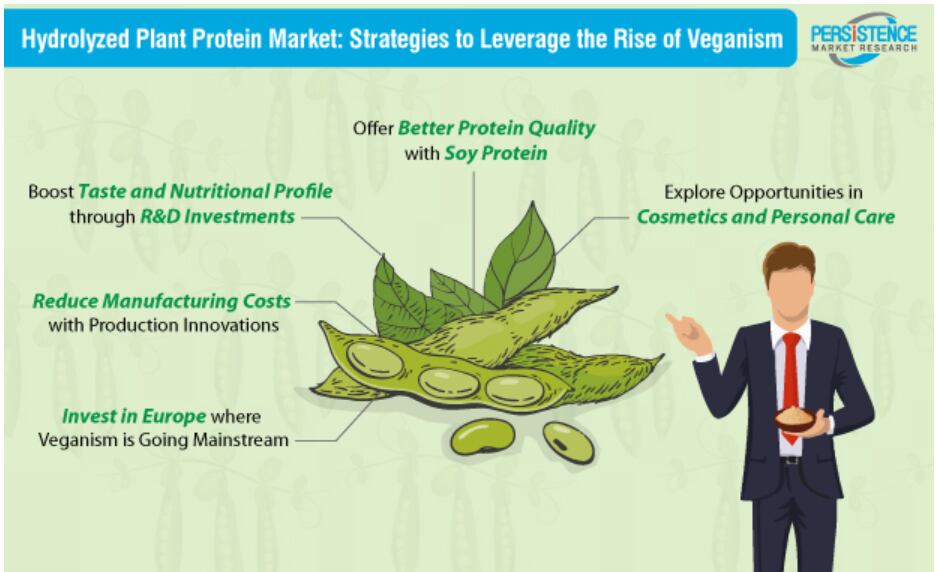

The hydrolyzed plant protein landscape is likely to gain momentum in the coming years, and it is primarily attributed to the increasing vegan population, mainly in Europe where veganism is going mainstream, stated the report.

“With ongoing advancements in food technologies and growing demand for vegetarian ingredients, the hydrolyzed plant protein landscape is showing immense potential for innovation,” it noted. “Manufacturers are likely to enter a wider range of categories, as the demand is expected to go beyond food & beverage industry, spreading across the health and nutrition sectors.”

The global food sector is undergoing a conspicuous transformation as there has been a tectonic shift in demand for plant-based sources in various food products, according to the analysis. The wave of veganism is only getting stronger and so is the consumer demand for food products with plant-derived ingredients. As the adoption of plant-based and fortified food is surging exponentially, the plant protein industry is expected to reach new heights in terms of innovation in extraction, modification, and functionalization of hydrolyzed plant protein.

But MSG is headache

However, the high content of monosodium glutamate (MSG) in hydrolyzed plant proteins continues to be a bottleneck for pervasive adoption, said the report, as consumers show an “unprecedented alacrity to read labels to spot ingredients with a bad rep in terms of potential side effects”.

In addition, market players along the entire hydrolyzed plant protein value chain are struggling to bring down manufacturing costs. This has created a catch-22, noted the research, where higher prices are putting consumers off, whereas reluctance to pass on the cost to end-users is leading to a squeeze in profit margins.

Despite these headwinds, the report observed that soy-based hydrolyzed plant protein powder is growing in food and beverage applications, owing to protein’s push as a weight-loss ingredient.

In 2018, soy protein accounted for nearly 63% revenue share of the hydrolyzed plant protein market and it is expected to continue getting better scores than wheat, rice, or pea proteins in this landscape, it said.

“Manufacturers are focusing on improving fineness in the texture and improved particle suspension in hydrolyzed plant protein powders to capitalize on the rise in demand,” it wrote. “Protein powders are gaining popularity over liquid variants owing to their superior emulsification properties. Eventually, hydrolyzed plant protein powders are expected to gobble a whopping three-fourth revenue share of the market, and their demand in the F&B segment will create new opportunities for market players in the coming years.”

Companies move to strengthen their positions in the sector

The potential of the market is also illustrated by the strategies of the leading companies in the sector, who are joining forces with each other through strategic partnerships and collaborations to strengthen their position in this market.

For instance, in February 2018, Cargill Incorporated and Archer Daniels Midland Company entered a joint venture—SoyVenTM—in Egypt, to cater to the increasing domestic demand for higher-protein soybean meal and soybean oil from both the food manufacturing and animal feed sectors.

Companies are also boosting investments in research & development (R&D) in this area. Leading manufacturer of hydrolyzed plant protein, Roquette, for example, has opened a new R&D laboratory in Panevezys, Lithuania, which will be dedicated to the “valorization of all fractions of various crops through innovations in the latest techniques for manufacturing plant-based protein”.

Companies -- especially in Europe -- are also focusing on launching new varieties of hydrolyzed plant proteins. For instance, in February 2019, PEVESA developed a non-allergenic and non-GMO variety of a new rice protein concentrate, which it naturally sources and contains 80% protein.

‘Leading market players will enter new areas of applications’

“Modern consumers’ appetite for high-protein foods and beverage is aligning with the growing demand for plant-based proteins and this will foster growth for hydrolyzed plant protein market,” concluded the report.

“However, manufacturers who will be able to cut the manufacturing costs down to a significant level will only succeed at maintaining their position amidst the emergence of low-cost vegetarian alternatives for animal-based proteins. Leading market players will enter new areas of applications, such as animal feed and cosmetics, to expand their presence beyond the food & beverage industry as consumers are becoming aware of the negative impacts of MSG in hydrolyzed plant proteins.”