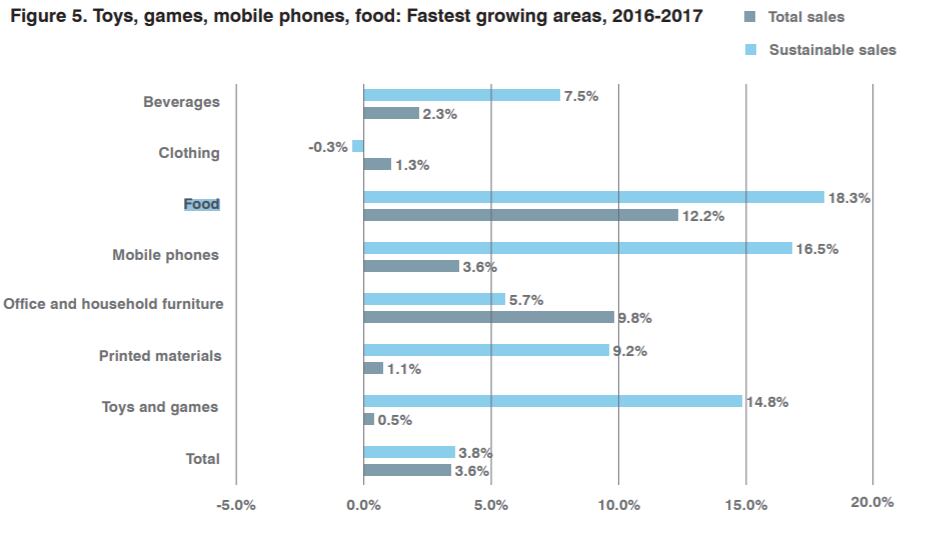

The first retail survey of its kind, commissioned by the European Commission Directorate-General for Trade, covered seven other retail product groups: beverages, clothing, computers, household and office furniture, mobile pho

nes, printed materials, and toys and games.

However, the food sector stood out, with food products showing the highest growth of sustainable product sales (18.3%) in the last five years. In addition, 98% of food retailers reported increased sales of sustainable products over the past five years (compared to 85% for all), and 97% of food retailers expected sales in sustainable products to increase in the next five years, compared to 92% for all sectors.

‘Consumer brands that demonstrate commitment to sustainability outperform those that don’t’

The ITC report is not the first to reveal the growing demand for sustainably produced products among consumers in recent years. According to market research firm Nielson, which carried out an online survey of 30,000 consumers in 60 countries in 2015, 68% said they were willing to pay extra for sustainable goods, up from 50% two years earlier. Companies that demonstrated a commitment to sustainability also saw their sales grow four times higher than those that did not.

But the ITC report is the first survey to investigate the sourcing strategies among retailers.

It discovered that 98.5% of those surveyed considered sustainability as a factor in product sourcing. In addition, 96% had implemented strategies to buy from sources that were certified as socially or environmentally sustainable. Three-quarters had sustainable sourcing commitments, which they implement through voluntary sustainability standards or corporate sustainability codes of conduct.

The highest commitments to sustainable sourcing were among Dutch (91%) and German (84%) retailers.

Consumers increasingly seek products that reflect ethical treatment of workers and are environmentally conscious

“‘The traditional way of doing business is outdated. It is time to think and act with respect and engage all actors in a virtuous circle,” said David Gobert, general director of coffee company Les Cafés Dagobert, who was interviewed in the ITC survey.

“Our company is born from an extremely personal ambition to link to producers, and break the unfair global coffee market that provokes very vulnerable situations through volatility and speculation. It has now been 10 years that we are working on sustainable chains for coffee, with quite a successful approach that does not need the big speculators and traders, and builds on simple human relationships with all our suppliers and directly with cooperatives and producers.”

“We believe in a fair distribution of profits and benefits, and in doing business transparently,” added Luca Zocca, director of marketing and responsibility at Italian organic fruit and vegetable firm Brio.

“We use sustainability standards to support organic farming, bring farmers together, protect biodiversity and nature, and safeguard human health. We also direct our activities towards a sustainable financial model aimed at fairly distributing the income generated along the supply chain, from farmer to end user.”

Which sustainability standards are being applied?

More than 60% of retailers in all eight sectors looked at were using more than three standards or codes for sourcing sustainable products.

Organic and Fairtrade were the most frequently used standards in the food sector. The report noted that 25% of retailers used organic standards for sourcing food products, and 15% of retailers used Fairtrade. In the beverage category, 26% and 21% of retailers used these standards for sourcing beverages in 2015-2017 respectively.

The EU is the second largest market after the US for products produced in compliance with organic standards, according to the study. Germany and France were the largest EU markets for organic products, with €10 billion and €7.9 billion respectively in retail sales, accounting for just over half of the EU market. Global retail sales of Fairtrade certified products rose over 80% from €4.36 billion in 2010 to €7.88 billion in 2016, according to Nielson.

Recommendations for policymakers, retailers and suppliers

EU Trade Commissioner Cecilia Malmström said: “In the EU we have put sustainability at the heart of our trade policy. This study shows that this was the right decision. Consumers increasingly care about where their products come from, and how they were made – they want to know that when they buy something, that the climate and workers’ rights have been respected. The good news is that retailers are beginning to respond. Today’s findings emphasise that we all have a role to play, as citizens, consumers, workers or entrepreneurs, in promoting open, fair and ethical trade.”

Yet she said more action was still needed. “It is not just at EU level that action is required. National policymakers, local authorities, industries, individual companies and individual consumers have a role to play too. So far, voluntary standards have led the way, but for sustainable sourcing to be mainstreamed, governments and civil society must also show political will. We know that a growing number of consumers are already behind this endeavour, so I am optimistic that if we all work together, there can be a bright future for sustainable sourcing in the EU and beyond.”

Reflecting on the crucial role that the demand for sustainable products plays for retailers and across value chains, ITC Executive Director Arancha González said: ‘This report carries an important message, especially for non-European businesses seeking to export to buyers in the EU: sustainability is key to your business model if you are to succeed in winning over European customers and consumers.’

Key findings

- Consumers in major European Union markets demand more social and environmental engagement from retailers and greater transparency.

- Retailers see a continuous rise in demand for sustainable products and are realigning their strategies with consumer demand.

- Retailers are increasingly working in partnership with suppliers – both inside and outside the European Union – to introduce environmental and social standards.

- The market sustains more retailers which founded their companies based on sustainability principles and strategies.

- Policymakers should support retailers to accelerate the growing trend, as a way to transition to mainstream business models that are environmentally and socially conscious.

- Suppliers in the EU and outside of it will find an economically viable, growing market for these products.