Younger consumers, famous for being better behaved than previous pleasure-seeking generations, are more likely to pay higher prices for organic food and drink, according to market research firm Mintel.

Millennials (aged 25-34) and Gen Zs (aged 16-24) in France, Germany, Italy, Spain, and Poland, are the most likely to buy organic food and drink. They are also willing to pay more for these products.

Nearly 40% (38%) of Spanish Gen Zs say organic products present good value for money, in comparison to 26% of all Spaniards. Meanwhile, young Germans are less willing than their Spanish counterparts to pay extra for these products: 27% of 16-24-years-olds accept higher prices for organics, compared to 21% of the German population as a whole.

“Generation Z has grown up at a time when health and wellness is high profile,” said Katya Witham, Global Food & Drink Analyst at Mintel. “For younger generations, the social and environmental impact of consumption is of great importance and this is likely to help fuel future growth of the organic sector. Moreover, the prevalence of foodies among younger consumers creates an opening for more premium organic convenience products that are designed for the food-obsessed who want to eat well on-the-go or prepare upscale healthy food and drink easily and quickly at home.”

Europe is at the forefront of organic food and drink innovation

It’s not just young people with a hunger for organics. According to the Mintel Global New Products Database (GNPD), the total share of new global food and drink product launches with organic claims has risen from 6% to 10% between August 2009 and July 2019.

Europe is leading the way. In the 10 years to July 2019, the number of European food and drink launches with an organic claim has shot up from 9% to almost a fifth (17%). Current leading innovators include France (accounting for 22% of all organic launches in Europe between August 2018 and July 2019), Germany (20%) and Spain (9%).

Mintel research shows that the share of organic food and drink launches in Europe with “suitable-for” (free-from) claims experienced impressive growth over the past 10 years, rising from 20% to 43% between August 2009 and July 2019. Ethical claims have also witnessed a similar increase during the same time period. While 23% of all organic food and drink launches in Europe were positioned as “ethical” and “environmental” 10 years ago, this proportion grew to 41% in the year to July 2019.

The rich man’s luxury?

While price has traditionally been a barrier for uptake among shoppers, with organic often dubbed a ‘rich man’s luxury’, what’s behind the current trend? “There are numerous reasons for the growing popularity of organic food and drink among European consumers,” Witham told FoodNavigator. “While the reasons may vary depending on the regional context, growing consumer concerns for food safety, the natural environment and human health are some of the main drivers that fuel this trend.”

A clean label ticket is a particular feather in the bow of organic products. “Consumers are asking more questions about how their food is made, and are avoiding products that might contain anything artificial or toxic,” said Witham. For example, 50% of Spanish consumers claim to buy organic food and drink products to avoid artificial additives and preservatives, whereas 42% of Italian consumers do so to avoid pesticides and chemicals as well as hormones in animal products.

Europeans are attracted to the health and environmental benefits of organic food

Perceived health benefits and environmental and ethical considerations are other draws, explained Witham. In Spain and Poland, health reasons are the most commonly expressed motives for purchasing organics for 42% and 44% of consumers respectively. In France, 46% of organic food and drink consumers say they buy these products because they are better for the environment, while 20% buy them for ethical reasons.

Perhaps unsurprisingly, the booming veganism/plant-based trend is also assisting organic growth. It is “one of the hottest trends in food and drink right now, so it seems natural that organic producers are linking the two. According to our research, almost half of vegan food and drink products launched in the past 12 months were positioned as organic. Given the trend towards veganism, plant-based organic brands are taking their lack of animal-derived ingredients to the next level."

What about food waste?

Linked to growing environmental concerns among consumers, however, is the issue of food waste and its contribution to greenhouse gas emissions. Organic fruit and vegetables have a shorter shelf live than conventional food. Might this fact store up potential impending headwinds for the organic sector?

“Since organic produce hasn’t been treated with the chemicals used on conventional products to boost their resilience, it has generally a shorter shelf life,” agreed Witham. “While this does not appear to be hampering the organic market growth at the moment, the issue of food waste and its negative impact on the environment could be a potential threat in the future. As consumers move toward more conscious consumption and are more mindful of their own negative habits, they will expect companies to support them in this goal of reducing their consumption footprint.”

Witham suggests that with the spotlight being firmly on food waste reduction, organic brands and retailers will benefit from looking back through their production process and supply chain for ways in which they can minimise wastage.

“This could be by harvesting fewer resources at the beginning of the process or by putting every bit of the harvest to good use. Not only will this be well received by consumers looking for sustainable brands, it will likely also save those brands money as they will be making more while using less.”

Too many organic labels are confusing and counterproductive

Another criticism of organics is an over-proliferation of labelling schemes. This can leave shoppers at best confused and at worse resentful. “Despite the growing popularity of organics in Europe, Mintel research highlights that some consumers are still sceptical towards the concept of organic produce,” explained Witham.

“For example, 47% of Germans say it’s not clear why some organic products cost more than non-organic products. In Italy, 55% of consumers perceive little difference in quality between organic and conventional products. And in France, 63% of consumers claim they need more scientific evidence that organic products are healthier than non-organic products.”

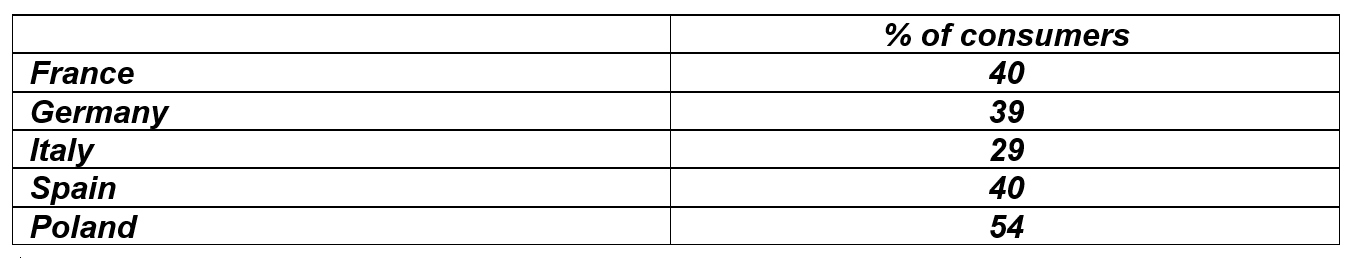

Mintel’s research finds that a significant proportion of consumers across five European markets surveyed say that putting an organic label on a product is just an excuse for companies to charge a higher price. “It is not surprising, considering the typically higher cost of organic foods and beverages, that consumers are increasingly hard-pressed to justify the added expense.”

The younger generation might just be bucking this trend though.

Mintel’s Global Food and Drink Analyst Katya Witham will present at Anuga 2019 the on the 7 October at 15.30 on the topic Organics in Europe: Meeting the challenges of a new generation.