Challenger brand Oatly is one of the best known in the dairy alternative category. Following a $200m boost led by private equity giant Blackstone earlier this year, the business is now valued at $2bn – an eye-watering sum for a company almost unheard of just five years ago.

So how did this ‘relatively small’ Swedish challenger brand grow to turnover $200m in global revenue in 2019, and be on track to bring in $350m in 2020?

“It has been a rocket ship,” said Oatly’s UK General Manager Ishen Paran. There have been ‘difficult decisions’ and ‘risky’ changes, he added: “It hasn’t been easy.”

‘Shifting people away from dairy, using oats’

Many consumers unaware of Oatly’s history may be surprised to learn the business was founded in 1994 – by Professor Richard Öste at Lund University in Sweden.

Sustainability, nutrition, and taste were the key drivers behind the brand mission, Paran explained at start-up event Bread & Jam last month.

“Twenty-five years ago, [Öste] had the vision to create a food product that was good for health and did not tax the planet,” he told delegates, with the aim being to “shift people away from dairy, using oats”.

Today, Oatly estimates the greenhouse gas emissions of its oat drink to stand at 0.34kg, which is less than both soy and cow’s milk. Water required to produce the oat drink (around 48L of water per litre) is also lower than cow’s milk and other milk alternatives. And concerning land use, oats use 80% less land compared to that required for dairy production.

On a macronutrients level, oats are ‘nutritionally balanced’, the country manager explained. They are also ‘high in fibre’. Further, oats are ‘very neutral in taste’: “Taste is still the key driver for purchase decisions. This has been fundamental in terms of the success of Oatly over [the] years.”

However, despite the founder’s clear vision, the brand was not disrupting global dairy for the first 20-odd years of its existence. Why not? “It’s quite simple,” said Paran: “We used to act like a big food company.”

This phase of ‘following the rules’ and making decisions based on consumer research came to an end in 2012 when the Board hired a new CEO.

Sitting between ‘good’ and ‘f**king fearless’

Entrepreneur Toni Petersson was appointed CEO late 2012. Without any F&B experience to speak of, Petersson brought a vision that aligned with that of Öste – to change the food system – as well as a ‘great understanding of how to connect and engage with people’, according to Paran.

The CEO developed a strategy designed to set Oatly apart from the ‘Big Food’ way of thinking. On a four-point axis – labelled ‘scared sh*tless’, ‘good’, ‘f**king fearless’, and ‘evil’ – Petersson believes 90% of all businesses are ‘scared sh*tless’.

Petersson wanted Oatly, however, to sit in the top right quadrant, between ‘good’ and ‘f**king fearless’.

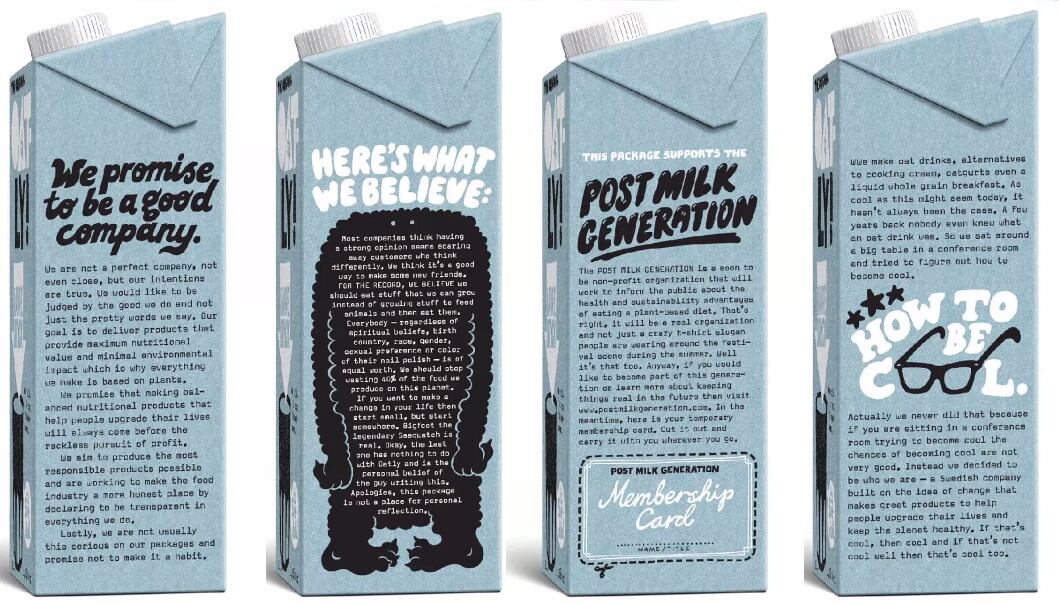

To realise his mission, Petersson restructured the company and removed the marketing department. Instead, the CEO put creatives at the centre of the business.

Known within Oatly as the ODMC ('Oatly’s Department of Mind Control’, the creative department decides on business strategies and creative angles, which is then delivered by the rest of the team.

“It is slightly chaotic,” admitted Paran, “but at the same time, it has some great benefits.

“It almost feels like the inmates are running the asylum…but we work in ongoing discussions, and it is less hierarchical.”

The structure lends itself to fluid, project-based work, the country manager elaborated. “It means that we are very agile, very quick to market, and we don’t have a lot of red tape and processes involved, which enables us to deliver initiatives quick.”

Rebranding, risk taking, consumer support

Under Petersson’s leadership, Oatly was achieving single-digit growth, and according to Paran, ‘doing ok’.

It was at this time, that in 2015, the company took a risk when it underwent a complete redesign – including a logo change, whereby ‘Oatly’ was broken into two lines, and a hyphen was added, as well as an exclamation mark. “The pack changed unrecognisably to what it was before,” Paran recalled.

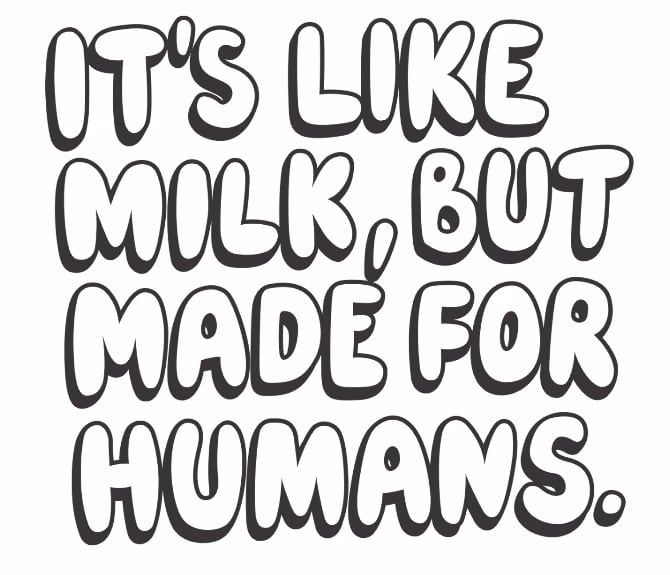

One year on, and sticking to the top right hand quadrant of his strategy graph, Petersson decided to ‘go up against the dairy industry’ in Sweden. His creative team developed the now well-known campaign ‘It’s like milk, but made for humans’.

“We did get sued for it. We got taken to court and we lost. And we lost a lot of money. It was a difficult time,” Paran told delegates.

Yet staying true to the ‘good’ and ‘f**king fearless’ quadrant, Oatly ‘doubled down’, published the case on its website as well as in advertising in morning newspapers. According to the country manager, “a lot of people actually thought that a gigantic Swedish dairy industry suing a small, independent Swedish company was pretty silly. And the support for the brand grew exponentially within Sweden.”

At this point, Oatly decided to go global. In the UK alone, revenue has increased from $6m in 2016 to an expected $70m in 2020, and the business has changed tact to concentrate on foodservice – which has since helped boost grocery sales.

Oatly also reused the ‘It’s like milk, but made for humans’ campaign in the UK to generate discussions amongst consumers – something it had been banned from doing in the Nordics.

A loyal consumer base has also been nurtured by investment in the company’s consumer relations department, which Paran said ‘engages in proper discussions’ with shoppers. “It’s not about just writing stock answers back to them [via social media]…discussions can range from love to hate, from silly topics to highly sensitive and very challenging areas.”

That Blackstone investment

Customer loyalty – and Oatly’s consumer relations team – were put to the test recently, when the challenger brand took investment from controversial private equity firm Blackstone. The world’s largest private equity company now has a 7% share in Oatly.

Blackstone’s name, however, had been muddied by alleged ties with deforestation in the Amazon, which prompted Oatly fans and activists to take to social media last month to denounce and boycott the Swedish brand.

At Bread & Jam, Paran addressed the elephant in the room. “The question isn’t whether [Blackstone] is ethical or unethical. That’s for people to decide… The main question is why did we go with Blackstone and not go with a green fund, or something that was perceived to be…more ethical?”

Oatly’s response is that to truly change the food system, new ‘clean’ or ‘good’ companies aren’t going to ‘miraculously’ replace the old ones. “The easiest way to change the worst industries is to upgrade them. In order to do so, big businesses need to be given the opportunity to make that shift.

FoodNavigator followed up with Paran, to investigate whether Oatly fans did indeed boycott the brand, following the Blackstone investment.

“We haven’t seen any significant drop in sales within our data reads (grocery) nor account losses,” Paran told this publication. “We are tracking it ongoing. Foodservice is harder to track, but again, we had out strongest month last month and it looks like October will also be a record month.”

The future of Oatly

So what does the next phase look like for the Malmö-headquartered firm? The business is doubling down on sustainable growth, the country manager told delegates, which remains one of its biggest challenges.

While its Dutch factory in Landskrona uses 100% renewed energy, the business also uses contract packagers. As these sites are not under Oatly management, Paran acknowledged it needs to work with these partners to help deliver more sustainable oat-based products.

And as Oatly expands, so does demand for the raw material. The company sources its oats from the Nordics and producing its range in the Netherlands. Will this structure expand moving forward? “Hopefully there will be some exciting news in the coming weeks,” Paran told delegates.

Evaluating the company’s climate impact, and encouraging others to do the same, has also become a key objective for the challenger brand. In 2018, Oatly began declaring its climate impact on its packaging, which Paran said helps consumers make better, more informed purchase decisions.

“The more companies that join us in this the easier it will be for consumers to compare the impact of different products,” he said. “It’s absolutely crucial that the food industry…be more transparent.”

And looking beyond the oat drink itself, to logistics and distribution, Oatly is also exploring more sustainable transport options. “We are working on electrifying our fleet,” revealed Paran. The project is underway in Sweden, where Oatly has partnered with tech company Einride.

By optimising software and coordinating drivers, vehicles, routes, and charging, Einride says it can drive 24 tonnes of goods an average of 120km without charging. For each Oatly shift, the logistics firm drives with three drivers in four different trucks. This means that one truck is always on charge.

“We’ve started this off, we’re looking to see how we can apply that across other markets,” said Paran, “so again, watch this space.”