In its paper, ‘Food tech: technology and the food industry’, the Dutch banking group noted that technological advances mean that the influence of food tech is increasing.

This is being driven by the market pressures food makers are facing. ING senior economist Thijs Geijer said that food makers are being forced to look to new technologies to improve efficiency in the face of evolving retailer and consumer demands. On one hand, retailers require “larger volumes of food” at “low prices”. On the other, consumers are calling for action to be taken to improve the food sector’s health and sustainability footprint.

In this context, higher efficiency and labour productivity are essential to remaining competitive.

“Consumers and society expect healthier and more sustainable food while food manufacturers want to make production as efficient as possible,” explained Geijer. “The use of robots and data technology can serve both.”

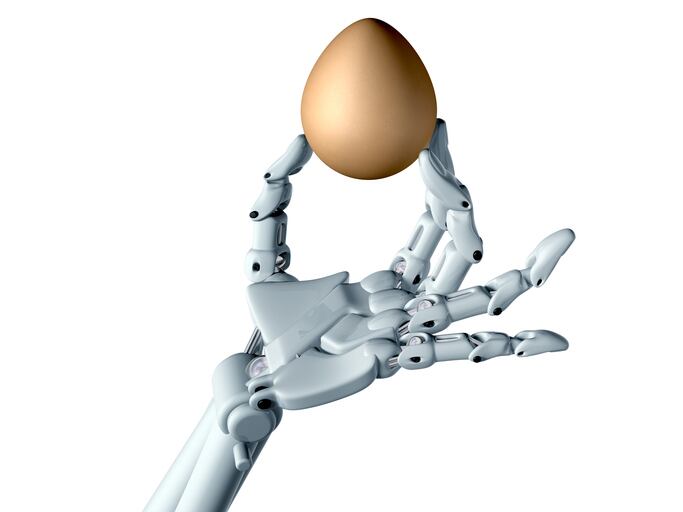

Growing uptake of robotics

Geijer flagged advances in robotic capabilities as a key enabler for this technological revolution. He pointed to advances in griper and image recognition technologies, which mean robots are now able to handle “delicate and diverse” products in challenging environments, including extreme temperatures.

Robotics can also be used to boost food safety and reduce contamination risks, ING noted.

The research revealed that the use of robotics by the European food industry has shot up, with sales of robots to the food sector growing by 50% over the last five years.

The number of robots in the European food industry is now well over 30,000, while the number of robots per 10,000 employees rose from 62 in 2013 to 84 in 2017. Germany is the largest market for food robots but robot density is relatively highest in Sweden, Denmark, the Netherlands and Italy.

Digitalisation delivers efficiency, transparency

While robots may boost efficiency in the long-term, the high initial investment and start-up costs required are acting as something of a break on uptake. Robotics and automation require tailor made solutions and low order size makes them big ticket items.

The introduction of digital technologies to a business is often a more affordable and therefore accessible option – and one that ING said delivers multiple benefits around both efficiency and traceability.

“Food manufacturers increasingly turn to data technology to make their planning processes more efficient and to predict supply from farms leading to a better match between supply and demand. Digitalisation of the supply chain also creates transparency from farm to fork, enabling consumers to trace the origin of an increasing number of food and beverages that end up in their shopping baskets.”

Changing face of the workplace

Geijer noted that these developments are poised to have a significant impact on the shape of the workforce in the European food sector. Robotisation and digitalisation serve to increase the complexity of production processes and this impacts the labour market, IGD noted.

Employees’ duties will evolve and the required level of education and training will increase, the report predicted. The adoption of food tech, therefore, require manufacturers to investment in capital goods and pay attention to training current staff and recruiting new staff.

“Some jobs will disappear, others will change and new jobs will be created. That’s why investment in technology should go hand in hand with investment in human capital,” Geijer suggested.

While managing this transition can be challenging – on both a business and societal front – Geijer nevertheless believes that these innovations will enable food makers to deliver better quality, safer food more sustainably and efficiently.

“Food production is increasingly in the hands of robots and data analysts, ensuring affordability and better quality of food,” he concluded.