Trends and tech are changing the face of the food industry. The buzz around food tech has reached fever pitch as the world wakes up to the need to feed more people using fewer resources.

Start-ups, who are willing to take risks and experiment with new ideas, play an important role. According to Alastair Cooper, who manages ADM Capital’s Cibus Fund, consolidation in the corporate world – particularly in agri-food – has placed the role of start-ups in research and development centre stage.

“At the corporate level, especially in big agri, there is consolidation going on,” he told the audience assembled at Dutch Hall. “The R&D [investment] at a corporate level is much lower than ever before. R&D is now reliant on start-ups.”

London Food Tech Week, a self-styled ‘food festival’, aims to provide a platform that brings together its 1,900-strong start-up community with big brands and investors.

So what trends stood out? Here are FoodNavigator's top picks.

#1: Plant-based powers up

Fuelled by concerns about the sustainability of meat production and health implications of over-consumption, demand for plant-based proteins has sky-rocketed in recent years.

More and more consumers adopt flexitarian, vegetarian and vegan diets. How we eat has become associated with identity and emerging food tribes. Nevertheless, the biggest opportunity for the plant-based food sector lies not with vegetarians or vegans but with the growing number of ‘meat-reducers’ who still enjoy animal proteins but want to diversify their diets.

Plant-based products that can deliver on the taste, texture and experience of eating meat represent something of a ‘gateway’ product for this mainstream consumer demand. “The first series of innovators [in plant-based] are looking at how we can eat more plant-based food without stopping eating – and experiencing – meat,” Nadia El Hadery, Founder of event organiser Y-Food, explained.

“We are seeing it happen across the spectrum all over the world,” she said.

Technology is allowing plant protein products to mimic the look, taste and texture of meat, Nova Meat’s Giuseppe Scionti explained. The start-up founder has developed a tech that allows the group to 3D print plant-based protein burgers. This, he claimed, mixes “the best” elements of taste, texture and nutrition.

One challenge facing the plant-based sector is scaling up, Jim Laird, CEO and founder of 3F Bio suggested. 3F Bio has developed a “simple process” to produce Mycoprotein – the protein that is used in the Quorn brand – but make it at scale “a bit cheaper”.

“Fermentation is a disruptive technology to make protein sustainable,” he said. “It also has to be about affordability.”

#2: Personalised experiences

Personalisation was also tipped as a top trend that will be shaped by technological developments.

Personalisation is a broad catch-all phrase, ranging from supplements designed to meet your metabolic rate, to pro- and prebiotics that suit your mocrobiome, to personalised flavour combinations and personalised shopping experiences.

As twins, Lisa and Alana Macfarlane (AKA ‘Love Island’ DJs The Mac Twins) were surprised to learn about the impact personalisation could have on their diet. As part of some twin research carried out in the UK, they found that as identical twins they share 100% of the same DNA but only 30% of the same microbiome. This prompted them to set up thegutstuff.com, Lisa explained. “We have a product range and a book coming out.”

Melissa Snover created what she described as “the world’s first” vegan gummy, Goody Good Stuff, which was sold to Cloetta in 2015. When she launched the brand, she was “frustrated” because even though she had developed eight flavours it was “nowhere near enough to please every customer”.

Her next project was to establish a 3D confectionery printing company. “I wanted to create something that could let the customer come out of the store with exactly what they wanted. 3D printing was the best solution.”

Katjes Magic Candy Factory now has 150 machines in 24 markets. However, Snover found that demand for personalised confectionery was largely ‘novelty’ – things like confectionery selfies. Fourteen to 15 months ago she started to ask “how can we use all the IP we have amassed to make a difference in the market every day?”

The answer she struck upon was Nourished, which will offer a personalised nutrition gummy 'pod' that is vegan, plastic-free, sugar-free and contains seven active ingredients “best suited to your needs and lifestyle”. Supplements will be delivered to the consumer’s door – and the makeup of the nutrition pod can be altered as the consumers needs evolve. The business will launch this August.

“We are using 3D printing to disrupt the health and wellness market,” Snover said.

#3: New types of production

Tech doesn’t just have the potential to change what we eat – it is also reinventing how we produce it.

Filling the supply and demand imbalance created by urbanisation, rising incomes and changing diets is an important principle underscoring ADM Capital’s Cibus Fund’s investment thesis, fund manager Cooper said.

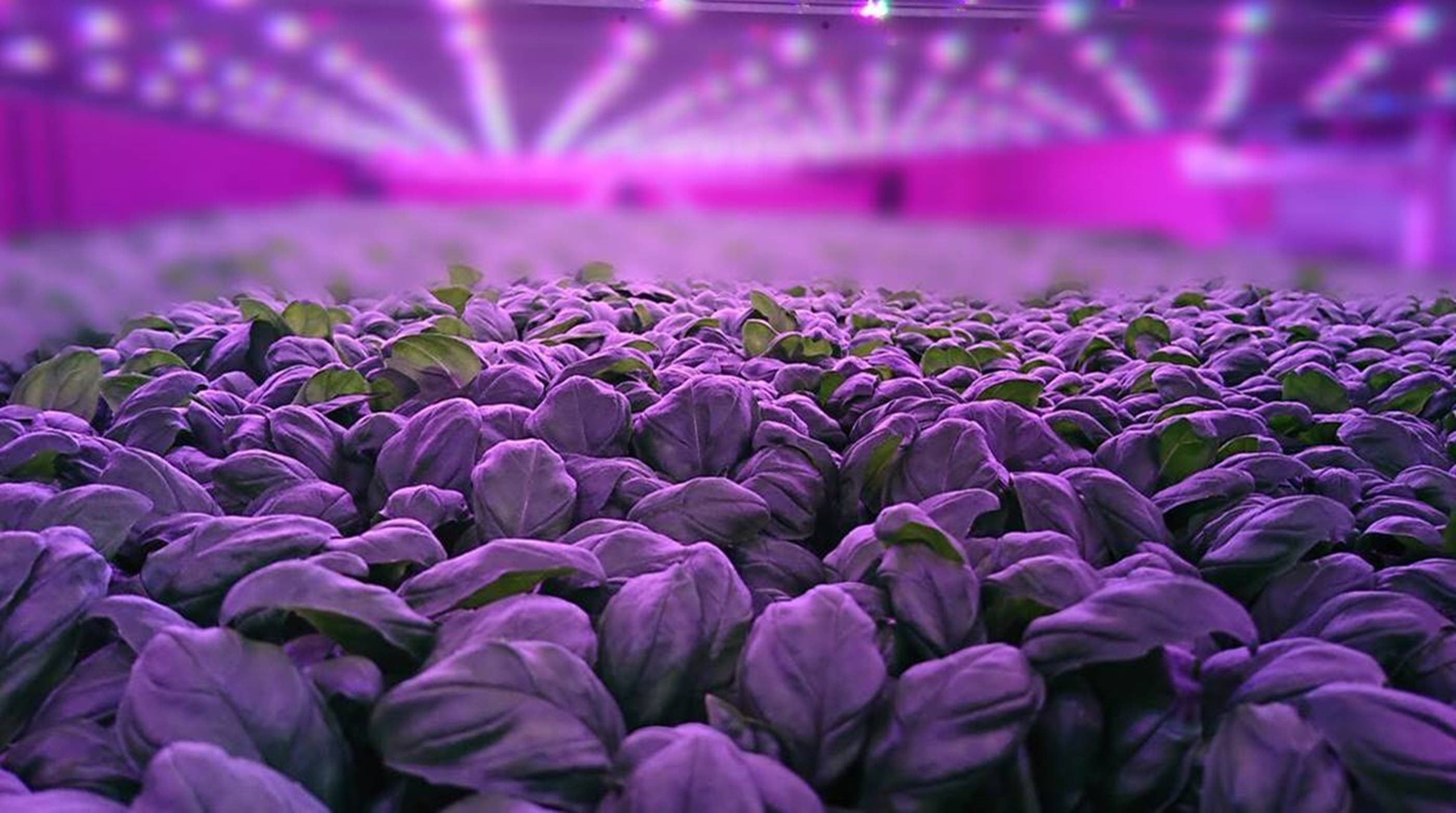

This concept is what motivated Cibus to invest in vertical farming group Aerofarms in 2017.

The US company operates nine farms, including a 70,000 square foot vertical farm in a converted steel mill in Newark, New Jersey. It sells products under its own retail brand, Dream Greens, and plans to expand domestically by opening new physical farms and internationally by selling its tech to third party producers.

Aerofarms is not only bringing horticulture closer to urban consumers. According to Cooper, Aerofarms does not view itself as an agricultural business: “Aerofarms is a technology company. It believes it has more data on plants than any other company in the world.”

The group is able to leverage this data to “optimise the environment” in order to grow plants with specific nutritional profiles – vegetables Cooper described as “nutraceutical crops”.

“What excites us is the tech driven opportunity – but also one that is focusing on healthier and better for you [products],” he concluded.

Alongside horticulture, aquaculture is an area Cooper believes could be disrupted by vertical farming concepts. Here, he suggested, companies will be able to bring fresh, nutritionally superior fish to consumers in big urban centres.

Molecular science opens the door to even more futuristic production. US start-up Atom has already produced the world’s first “molecular coffee”, made without coffee beans. Meanwhile, Endless West has created molecular spirits that “skip the ageing process”.

“Molecular is going to be a big thing,” Y-Food’s El Hadery predicted.

#4: Doing more with less

Feeding the growing population on the Earth’s finite resources will require us to do more with less.

According to the FAO, around one-third of the food produced globally is wasted. In the developed world, the greatest amount of food waste occurs in consumer’s homes. Food tech innovators are working on solutions that will empower people to address the issue.

Solveiga Pakštaitė founded Mimica to achieve just that. The company has developed Mimica Touch, a bio-reactive expiry date label changes texture to tell you exactly when food spoils in order to reduce food waste and improve food safety.

Already, the start-up is working with Arla on a milk label and has seen “strong” interest from across the sector, Pakštaitė said.

Food waste and by-products from manufacturing processes are also finding novel new applications. For example, Chip(s) Board is now working with French fry giant McCain in the UK to turn potato waste into a biodegradable plastic, co-founder Rob Nocoll revealed.

“Our plastics can now be made using a whole host of agricultural waste,” he added.

Hordur Kristinsson, chief science and innovation officer at Matis, an Icelandic government owned food and biotech research institute, explained that start-ups in the country are finding novel uses for waste in the seafood sector.

At a seminar dedicated to the blue economy, he noted that Icelandic companies have emerged that produce supplements from trimmings. Fish skins are being used to produce an alternative leather and collagen products. Meanwhile, fish intestines – not approved for use in food in the EU – are being used to develop enzymes, with products as unlikely as a mouth spray that shortens the length of a cold hitting the market.