Griffith Foods was founded 103 years ago in Chicago with the mission of making better meat products. Animal protein has ‘traditionally’ been one of the company’s ‘strongest growth segments’, European chief Wim van Roekel reflected. “It was the foundation of Griffith Foods 103 years ago.”

Today, while this remains an important segment for the group, the ingredient manufacturer also wants to leverage its R&D expertise to support the transition towards more plant-based diets. “The protein transition is such an important move for us because it connects our sustainability goals to an important customer group for us,” van Roekel told FoodNavigator.

Plant-based potential: ‘We are putting limitations on ourselves’

According to van Roekel’s assessment, the current state of the plant-based sector can be characterised as ‘phase 1A’. Phase 1 saw products introduced that mimicked animal-based proteins but ‘weren’t really appealing’ in terms of taste and texture execution. Phase 1A has witnessed the quality of these analogue products greatly improve.

But currently, van Roekel believes the industry is failing to appeal to flexitarian consumers who ‘really like animal protein’. The shoppers among us who want to cut our meat consumption for health and sustainability purposes ‘don’t want to eat something that looks like a steak but isn’t a steak’, he contended. The food industry expert said that this – as well as the ‘not so good products’ that characterised the first phase of development in plant-based – has resulted low repeat purchase and high product churn on shelf.

Rather, today’s shoppers are ‘looking for different experiences’ that don’t necessarily need to look like fish, chicken or beef. And if the food industry can deliver innovation that ‘thinks outside the box’ it will unlock ‘endless opportunities’ to play with flavour and texture in ‘completely different formats’, van Roekel suggested.

This transformation won’t happen overnight, van Roekel continued, noting that Griffith Foods’ long-term investment horizon and strategic focus mean it is well placed to help deliver the next phase of plant-based innovation.

“It is a long-term play. Our base is defined by how quickly our customers and the market is going to move. But we believe we have a role to play to make the industry more sustainable. Are we going to change the nugget of tomorrow next week? No, we can’t. But we can provide our insights, our technologies, our application knowledge to support the transformation.”

Ultra-processed foods and the importance of sourcing stories

Meat analogues' often long ingredient lists are one of the reasons why van Roekel expects a plant-forward approach to centre plate innovation to shine.

“Think different: think centre of plate transformation, think health and nutrition, think different tastes and textures. Those are great opportunities,” he advised.

The European food sector has witnessed a backlash against foods that are considered ultra processed and which – in the mind of the consumer at least – are often linked to questionable nutrition credentials. This shift is reflected in Griffith’s innovation agenda, we were told.

“There are some components that we are incorporating in our propositions to move away from ultra processed foods. We are striving to incorporate sustainably manufactured natural ingredients. That’s an ambitious statement because it forces you to trace back all the way into the value chain.”

Griffith has sustainable sourcing and traceability initiatives spanning ingredients like chilis from India and black pepper from Vietnam. This sees the company collaborating with growers and processors in sourcing countries ‘all with the objective to move away from ultra processed and allow consumers to understand what’s being put in their food products’.

According to van Roekel, there are further strong investment cases for building more sustainable supply chains. “If you are serious about building a sustainable business model you will get an economic benefit. But this is about timing. If you expect an economic benefit next year, then that’s not going to happen. But ultimately the economic benefit will come and customers are aware of that. This is about the short-term gain or the long-term gain for the benefit of the planet and the people that live on the planet.

“The entire industry is transforming in that sense. A couple of years ago there were ‘organic’ or ‘sustainable’ [product propositions’. These were themes where people were concerned about the price point related with it. You see that changing now.”

Evolving expectations for nutritious products

Griffith sees increased demand for nutritional products – ‘taking out the baddies and introducing ingredients that have a positive impact on human health,’ van Roekel continued.

“We are using more and more fully natural ingredients with full traceability through our sustainable sourcing programme in these propositions,” the businessman noted.

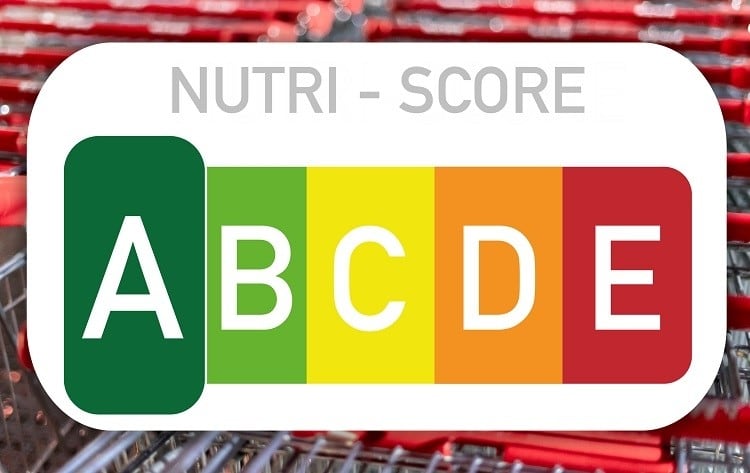

Europe and the UK has seen a shift in the regulatory environment around food, in particular with the upcoming introduction of HFSS regulations in the UK and the widespread adoption of Nutri-Score front-of-pack labelling throughout the EU. This is hastening a shift in the packaged foods industry towards reformulation.

“We have seen a change in the regulatory environment, it is closing in on the food industry. It is more and more explicit. It is more and more visible. Consumers are more educated, they have a much better understanding of what it means to them.

“That call to action to our customers is real now. They need to change. It is no longer nice to have. It is really a regulatory driven compliance issue. That is a great opportunity for us as a company and for our customers because our core is product development. We have a really good understanding of ingredients in the food matrix of the customer products.”

In order to capitalise, Griffith is ‘proactively’ communicating how it can boost the Nutri-Score rating of products to its customers. The message: “This is what we can do to help you improve your label while the product still tastes as great as it did before.”

Reformulation and fortification for functional foods

In the near-term, van Roekel believes reformulation to reduce salt, sugar and fat is a key priority for European food manufacturers. However, he also sees growing opportunity to add in macronutrients and micronutrients with positive health associations.

“In Europe, short term the focus is about fat reductions, salt reductions and sugar reductions… Longer term vitamin E could be one of them, fibre enhancement is one of them, a number of vitamin combinations for specific consumer groups provided through snack or protein products are in scope.”

Griffith has developed product propositions that reflect these priorities, including its Vegetable Based Never Fry Coating System, which it claims is a healthier alternative to frying that reduces fat by 30% compared to using fryers. This incorporates beetroot and spinach so it is a ‘colourful experience’ that is also vitamin enriched. The group has also offers a high fibre coating for breaded products fortified with quinoa and other grains, as well as sodium reduced sauces and vegan mayonnaise.

“I believe the opportunity for our industry is to design and develop delicious and nutritious products. If we can deliver nutritional products through products that are fun to eat, that is a great benefit. You could eat a carrot and an apple but there are some consumer groups for whom that is not appealing,” van Roekel observed.

“Going forward we will continue to focus on more targeted nutrition – specific solutions for specific consumer groups – and there again we combine our great sourcing capabilities with our product development knowledge to create products that have nutritional benefits.

“We will also make our bets on where we see the biggest needs and the biggest efficiencies and design out products accordingly.”

Register for Positive Nutrition 2022 now

For a deep-dive into the latest developments in reformulation and fortification register now for our free broadcast event, Positive Nutrition 2022.

Tomorrow, FoodNavigator will be asking an expert panel how the industry can deliver positive nutritional outcomes while maintaining clean label credentials. Hear from experts including Kantar, Cereal Partners Worldwide, Nomad Foods and more...

You can also view our previous sessions looking at innovation in the plant-based space and the link between gut health and immunit on demand by clicking here.