Producing natural vanilla for the food and beverage industry is a time- and labour-intensive process.

Pollinating and harvesting the beans is largely conducted by hand in tropical climates increasingly impacted by climate change. Originating in Mexico and Guatemala, most vanilla beans are currently cultivated within 10-20 degrees of the equator – in Madagascar, Uganda, Indonesia, Papa New Guinea, Tanzania ,Mexico, Tahiti and more.

As a result, natural vanilla supply is far from stable, and when available, it comes with a hefty price tag. It is not unusual for a flavour house to sell 1kg of the ingredient for 250$-450$ US.

The ‘biggest problem’, according to entrepreneur Oren Zilberman, however, lies in the fact that the majority of ‘vanilla taste’ is in fact synthetic. And the majority of synthetic vanillin is produced from petrochemical raw materials.

To put this into context, around 2,300 tonnes of dried vanilla beans are produced every year. “It’s not a huge industry, because it’s so difficult to grow,” CEO Zilberman explained.

On the other hand, a significant 41,000 tonnes of synthetic alternative are produced annually. “Synthetic vanilla is much cheaper and more accessible than the natural ingredient.”

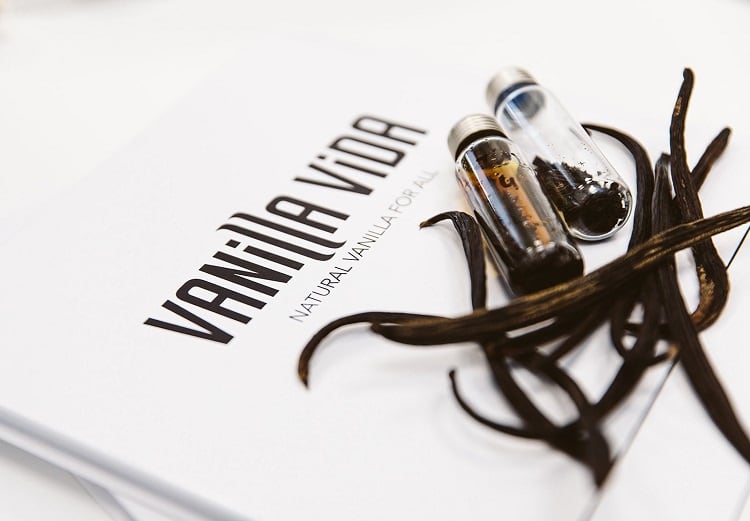

Together with co-founders Shlomo Kadosh (COO) and Raz Krizevski (CTO), Zilberman has founded a start-up that aims to fill the supply gap for natural vanilla with ‘the best product on the market’.

Smart farming in greenhouses

Vanilla Vida is an ‘A to Z’ solution, Zilberman told FoodNavigator. “We understand that to support our [F&B] customers, we need a stable supply chain – which is the biggest pain point in the market today due to climate change and difficulties associated with diseases.”

Rather than grow vanilla as it would naturally in tropical regions, Vanilla Vida is cultivating the crop in climate-controlled greenhouses in Israel. In doing so, the start-up is reducing common risks associated with conventional agricultural production.

Greenhouse-controlled cultivation allows for higher yearly yields. Whereas in the wild, vanilla flowers bloom once a year – with each flower requiring hand pollination within 12 hours of opening – Vanilla Vida’s solution enables ‘much shorter cycles’.

“You can do three seasons every two years, because your growing cycle is shorter. [In our greenhouses], you can do much more manipulation…and actually control the crop,” Zilberman explained.

“You are Mother Nature. You tell the crop when to bloom and when not to bloom.”

Pollination is another challenge in natural cultivation. In Vanilla Vida’s method, natural and robotic pollination processes are combined, which Zilberman said helps lower the cost of production.

The result is ‘better quality green vanilla beans’ that are then transformed into dry vanilla beans.

Better quality for a lower price

Concerning product quality, Vanilla Vida is convinced its product is best in market. “We have developed a technology and patent that allows us to support our customers that requires less vanilla bean for the same amount of extraction,” the CEO told this publication.

“We have much more contained aroma inside [our beans] compared to competitors in countries like Madagascar, Uganda, Indonesia and more.”

Indeed, Vanilla Vida claims its product contains twice the amount of vanillin – the primary component of the extract of the vanilla bean – than the market average.

The start-up also expects to significantly undercut current market leaders on price. This, Zilberman explained, is again linked to pollination. “One of the biggest problems in [conventional production] is that you need a lot of capital on a daily basis to solve the pollination issue.”

“Growing vanilla is not very difficult. The difficult part is the pollination and the harvest parts. If you solve the pollination [problem], you can reduce the cost of production to a place where we can actually compete in western countries like Israel, England and the US, with traditional [growing] countries in western countries.”

The idea of growing vanilla in greenhouses in not new, but trials to date have proved costly.

“Of course, you grow vanilla better in greenhouses, but the operation costs in greenhouses are very expensive. You can grow a lot of beans per square-foot, but if you don’t grow them very well, you can lose money at the end of the season,” explained the CEO.

“It’s a delicate balance going from a traditional, open field, tropical environment to a different location and growing in greenhouses. You have to pay a lot of electricity, water, heating and cooling, and provide the right temperature and humidity to support your crop.

“If you don’t do it 100% better than what happens in nature, you’re probably going to lose money.”

When working with vanilla in a greenhouse, Zilberman said ‘you have to be much better than you think’. “You need to take yourself to the edge and create a new way of growing it to support the operation costs that are very high for each acre that you grow in a greenhouse.”

Market disruption: ‘The time is now’

With growing consumer demand for clean label, ‘natural’ ingredients, Vanilla Vida believes its offering is poised to disrupt both the natural and synthetic vanillin market.

“We understand that the gap that already exists in the market is so big, and the potential to create a major player based on this gap is huge. This is why it’s the right time to disrupt the traditional [industry] and allow the world to consume more natural ingredients,” said Zilberman.

Disruption, for Vanilla Vida, doesn’t mean swapping out all synthetic vanillin for its own natural alternative. This is unrealistic, the CEO suggested, “because 95% of the [market] is synthetic material.”

However, the start-up does see potential to convert 25% of synthetic vanillin customers to natural. This would mean growing approximately six times more vanilla than is currently grown today.

In the future, Vanilla Vida plans to become the ‘biggest single player’ on the market. While it can’t compete with the approximate 80,000 vanilla farmers in Madagascar, for example, the start-up says it ‘doesn’t want to’. “We want to protect traditional cultivation.”

However, as one single player, Vanilla Vida aims to become the ‘largest growing and processing player of dried vanilla in the world’ within the next three to four years.

To do so, it hopes to partner with farmers in joint ventures. Via this model, farmers will license Vanilla Vida’s data, protocols and seedlings, and grow vanilla in their own greenhouses.

Flavour profiles

The start-up is targeting B2B flavour houses around the world, beginning with Europe and the US. Vanilla Vida has already run pilots with companies in these regions, in which it could demonstrate to flavour suppliers its variety of processing methods.

“We can generate the aroma of the vanilla to have a little more vanilla flavour, or a little bit of vanilla with chocolate flavour,” the CEO explained, stressing that ‘everything is natural’.

“They are the building blocks that build the aroma. But we know how to tell specific building blocks to generate more aroma of caramel, or generate more aroma of chocolate, or vinegar. And not only one specific aroma.”

Vanilla Vida has been a member of the Strauss Group’s The Kitchen Food Tech Hub since early 2020.

The start-up recently closed a pre-A funding round led by PeakBridge’s FoodSpark’s fund, which will be used to scale-up growing facilities, seedling production, and business development efforts.

Other investors include The Kitchen Hub, software and finance investor Michael Eisenberg, and one of Israel’s largest Kibbutz, Ma’agan Michael. The latter will partner with Vanilla Vida to build and operate vanilla growing facilities.

Vanilla Vida expects to kickstart its A round in the fourth quarter of 2021.