Consumer concern over the safety and transparency of the food supply chain is reaching new peaks. Demand for high quality food, food integrity, safety guarantees and transparency is at an all time high. Retail customers are also placing new demands on their suppliers.

Operators in the food chain need to balance this against the need to supply affordable nutrition to shoppers. This means that operations have to be as efficient and lean as possible.

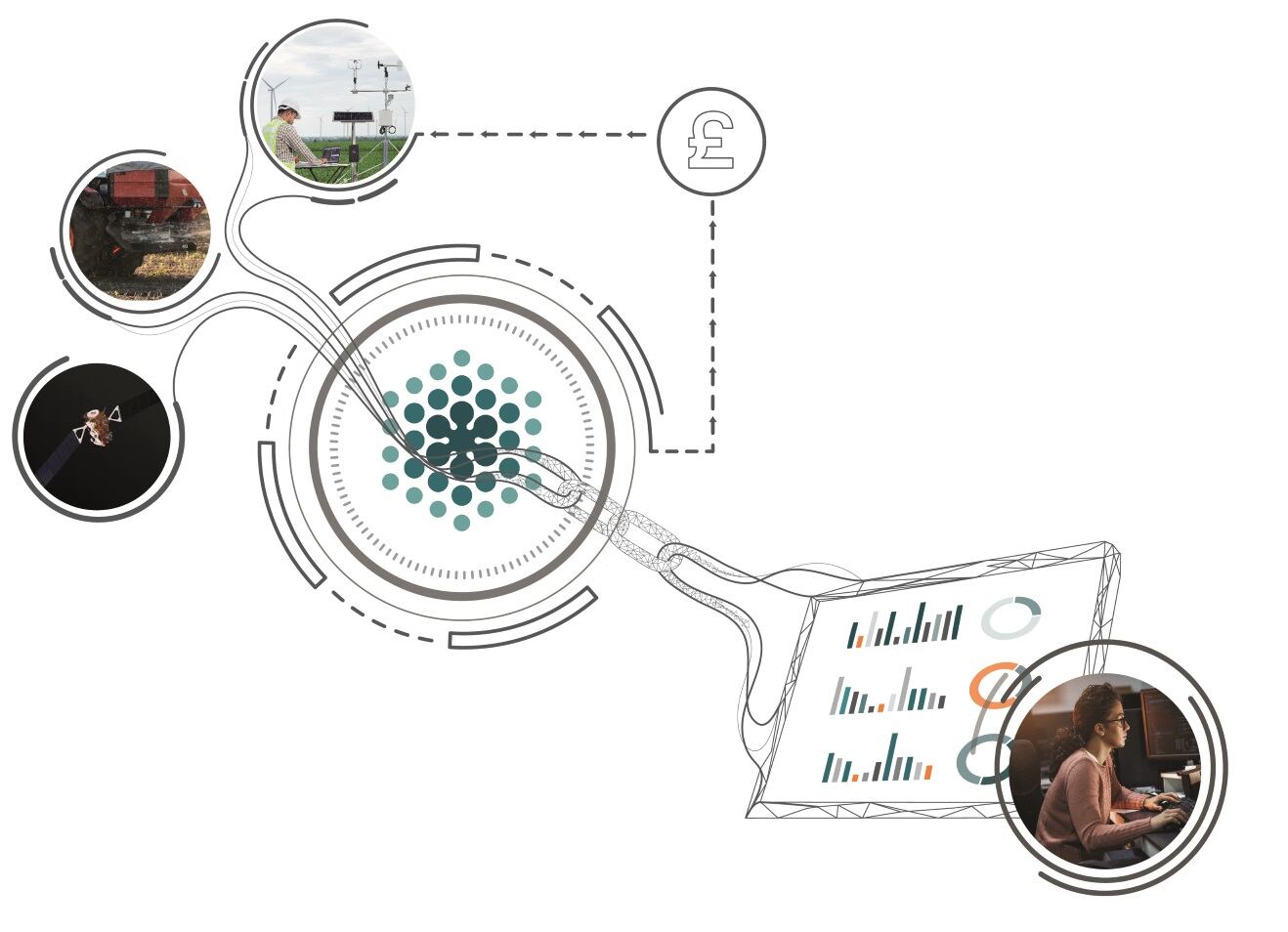

Food supply chains are reacting to these pressures by implementing systems that improve product quality and ensure safety. Many are leveraging technology to ensure that their actions are as transparent as possible.

“The food industry is under tremendous pressure to deliver safe, high-quality food at reasonable prices throughout the year. That’s a lot of responsibility and our food system does an incredible job with it,” John McPherson, who heads up global solutions at rfxcel, noted.

Nevertheless, the highly complex nature of the supply chain means that filling any gaps in the food and beverage supply chain can be a complex and challenging process. The key to success, according to McPherson, is data.

“To survive and thrive today, food industry sectors must modernise their data collection and analytical approach. Consumer demands for transparency, safety, and efficiency are driving the change. In order to meet these demands, supply chain data needs to be as complete and accurate as possible. This is actually true for all types of products, but food has the particular challenge of having a lot of key data happening in the field, on a boat or dock, or at different remote collection points. Similarly, the first actors in the global supply chains may lack resources or sophistication to digitise or record data.”

Currently, there are weak links in the data provided through much of the food and beverage supply chain. Complex interlocking structures of supply mean that it is difficult to trace exactly where a raw material has come from back to the farm or boat. And the nature of conditions at these points of origin means data collection technologies are not readily deployed, McPherson observed.

“Food supply chains are, by nature, difficult places to deploy technology. On the farm, ranch, or boat, where food originates, natural conditions and remote locations are far from the four-walled manufactured environments where other technologies are deployed, with electricity, connectivity, protection from the elements, and the ability to install permanent edge or line systems to track product movement.

“As a result, key data about product provenance, handling, and other food safety and traceability data is recorded after the fact. This can be prone to errors, and at best, help only in some kind of reactive action such as a recall investigation. In these cases, collecting the data is time- and labor-intensive and lacks validation.”

What is the answer? Mobile traceability technologies, the tech expert believes.

“By using mobile, organisations can capture data quickly and easily at those difficult places, closing the gaps and creating a digital record of the product.”

What is ‘mobile traceability’?

Exactly what ‘mobile’ traceability looks like is likely to change depending on the setting, access to infrastructure and other environmental conditions. However, McPherson suggested, a common definition can be developed. “Let’s say it is a combination of product-data pairing and expanding read-points.”

The development of mobile traceability capabilities has been enabled by a number of relatively recent technological advances. These include: the increased sophistication of mobile and smart devices; increased network connectivity (globally for remote data capture and in terms of bandwidth – the rollout of 5G for instance); and an increase in the types of devices capable of tagging a product through packaging. This last point ranges from improvements and lower costs of RFID chips, near-field communication (NFC) tags, or barcode print tech, McPherson elaborated.

“Improved camera capabilities on commercially and widely available mobile phones are allowing for rapid scanning with increased accuracy, making deployment more practical. Otherwise, workflows get slowed and adoption can stall,” he added.

Deploying new technologies in the field

Tech-enabled traceability can take the form of primary producers – farmers or fishermen – using smartphones or other devices to record real-time data. This can range from pre-harvest inspections, to harvests themselves and transportation details. Critically, the data produces a trackable path through the complexities of the supply chain until it reaches the processing stage.

“Mobile in the field allows for the digital transfer of custody no matter where it happens. In food production, that is critical data, because there can be several handoffs from the field to the first location that has the ability to set up installed systems, such as a processing plant. Even there, receiving docks can use mobile devices to record the transfer of custody in real time, increasing accountability and capturing key data when/where it happens and by whom,” the tech expert detailed.

“At the next level, product containers such as bins, clamshells, and bags — or even individual animals — can be tagged with a barcode for scanning, or via a passive tag that gets read at a stationary gate by Bluetooth or RFID. Handheld mobile devices for scanning means that different supply chains can be accommodated with limited disruption. Lettuce, berries, and shrimp are collected into different types of units; the ability to read all of them requires the flexibility mobile provides.”

Barriers to adoption: Cost and time

While these technologies afford the opportunity to shed light on any blind spots in the supply chain, adoption varies widely. Some companies already use mobile to track food products back to point of origin – others only have a post ship record ‘in an email or text message exchange’, McPherson observed.

“Mobile solutions have been on the market for years, but adoption is not widespread at the key upstream nodes where it can make a real difference. Handheld scanners in the distribution/manufacture environment are common, but not really what we are talking about here.”

Why has uptake been slow? “Key barriers to adoption are cost and time. A fisherman or farmer needs to see the value of adding a step to their workflow, where speed matters. It’s the same for transport and primary processing actors, which have been using paper-based methods for years and need proper incentives to adopt technology.”

Change is on the horizon, McPherson believes, signalling an uplift in the number of primary producers leveraging technological options.

“The newer combination of sensors and scanners will help drive this because adoption will be fast and virtually seamless. It will actually make the workflow faster, more efficient, and easier to manage.”

He continued: “Some brands are realising the value of allowing consumers to use mobile to engage with their products at or after the point of sale. Mobile traceability in this context means connecting that last node — the consumer — as the final read-point in the product journey, made possible by the ubiquitous computer in our pockets.

“This allows brands to provide proof of authenticity, quality, and purity, and connect the consumer to the farm. This basic engagement improves brand loyalty and is a valuable data point for modern companies with eyes on winning the future.”

The future of mobile traceability tech

Differing expectations about what mobile traceability tech will mean for the food chain can be seen throughout rfxcel’s customer base, according to McPherson.

“I often ask industry and supply chain leaders a simple question: In two years, do you think the amount of data you will be asked to provide to customers and consumers will go up or stay the same?”

The answers cover the spectrum of opinion, from early adopters that ‘already see the advantage of using mobile to digitize the entire supply chain to drive improvements and connect the consumer to the source’; to ‘followers’ waiting for more widespread adoption that they hope will drive down costs; to ‘laggards’ who will wait until their customers – the retailers – demand it. This last group, McPherson warns, is at risk of losing out. “Their competitors will win because they are driven by the data that mobile can help deliver,” he predicted.

He also stressed the consumer demand for increased engagement. “Modern consumers are driven by a many things, but no matter where in the world a company sells its products, authenticity, safety, and validity of brand claims are becoming more of a need than a ‘nice-to-have.’

“True end-to-end traceability is where the future value in adoption lies.”