Ocado unveiled two investment in vertical farming this week in a bid to become what it described as “a leader in the newly emerging vertical farming industry”.

First, the company’s ventures arm has signed a three-way joint venture deal with 80 Acres Farms and Priva Holding.

80 Acres and Priva have been working together for over four years to design turnkey solutions to sell to vertical farming clients worldwide, with forecast revenues in 2019 of over $10m.

The new venture will be called Infinite Acres. Ocado will make a cash payment to Priva and 80 Acres to reflect the investments they have made to date.

Each company boasts a complementary area of expertise that the JV will leverage. Priva is an industrial horticultural systems provider based in the Netherlands, with products and solutions for climate control and process automation; 80 Acres is a vertical farming business with a “deep level” of plant science knowledge and operations management based in the US; and Ocado is a global technology provider with expertise in software and hardware systems, including robotics and automation, digital twinning and machine learning.

“With Priva’s and 80 Acres Farms’ extensive horticulture, engineering, operational, and food industry expertise, along with Ocado’s predictive analytics, automation and comprehensive system development, the partnership will provide its customers with everything from state-of-the-art facilities with uniquely developed crop recipes and the right unit economics, to an option for facility management with yield guarantees, product packaging, branding, marketing, and distribution,” Mike Zelkind, CEO of 80 Acres, explained.

The second investment from Ocado is the acquisition of a majority stake in Jones Food Company (JFC), the operator of Europe’s largest vertical farm, based in Scunthorpe, UK. Ocado will acquire 58% of JFC.

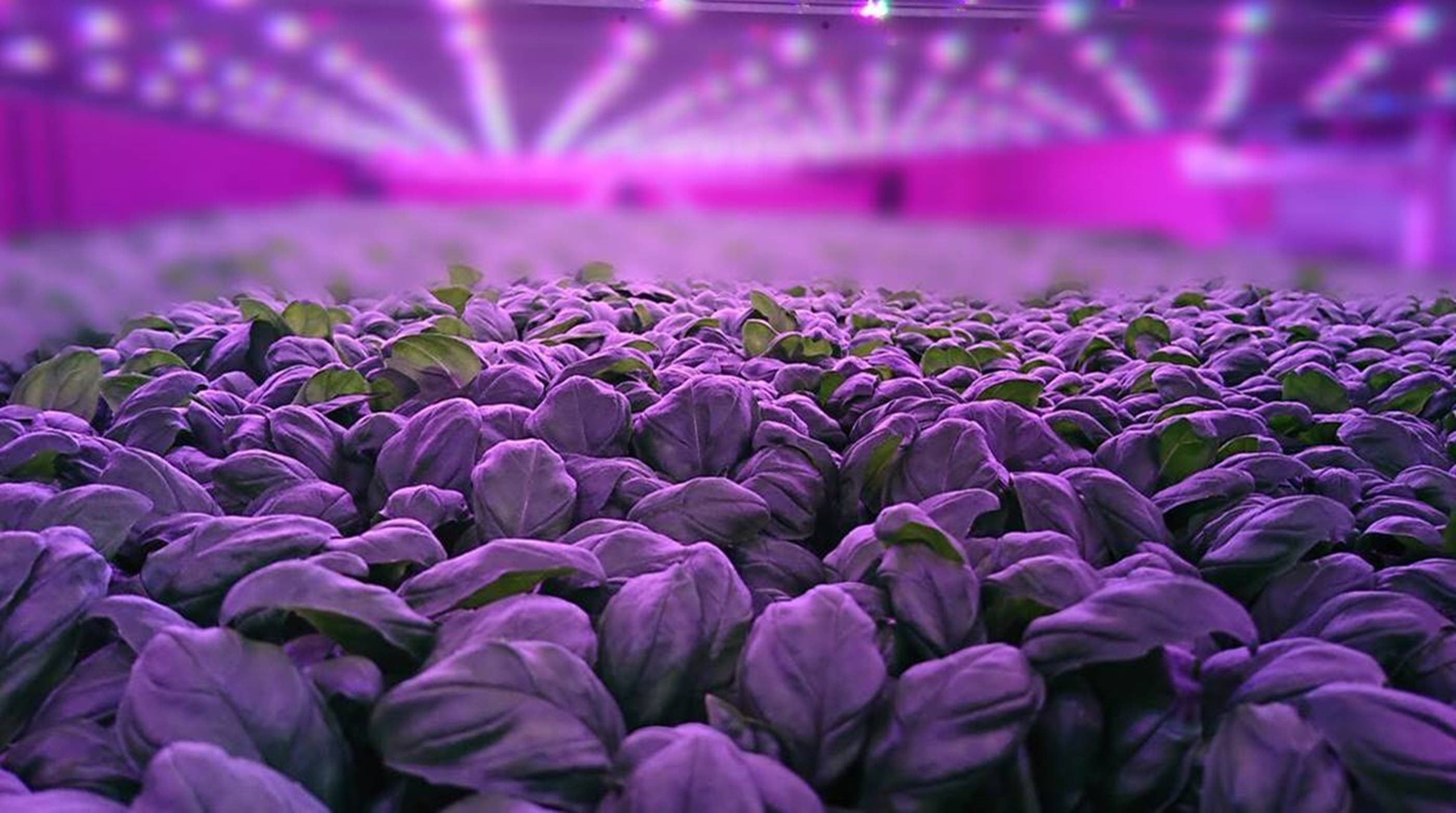

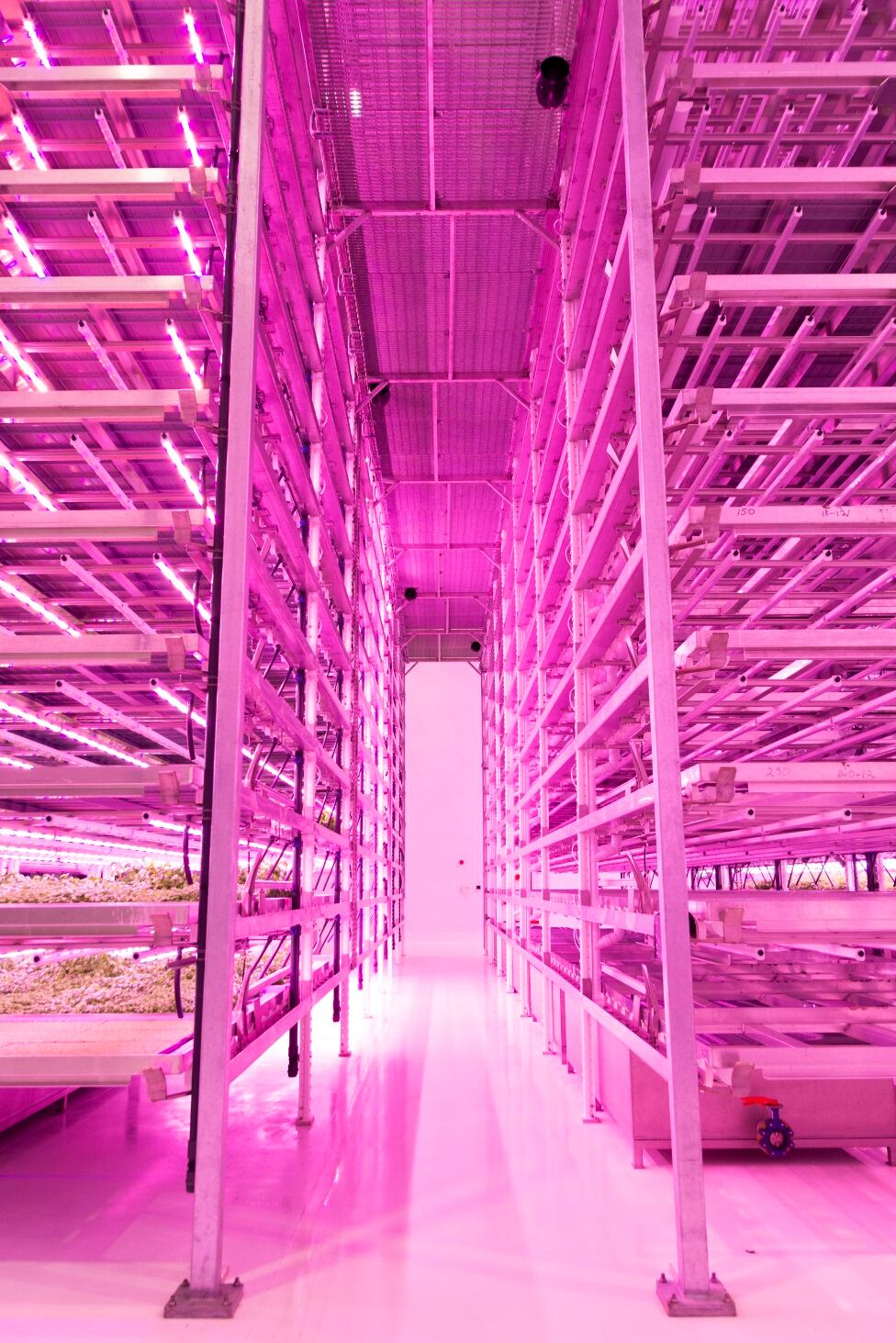

JFC’s facility is currently producing leafy greens and herbs for UK customers with capacity expected to grow to 420 tonnes per annum. With more than 5,000 square metres of production area and 12 kilometres of LED lights, JFC has the ability to produce consistent crop yields throughout the year and plans to expand crop types and production across the UK. JFC’s clean-room operations provide additional options to cultivate cosmetic and pharmaceutical-grade crops, Ocado noted.

Again, the investment will see Ocado leverage its knowledge of automation alongside JFC’s expertise in vertical farming, James Lloyd-Jones, CEO of JFC, suggested. “JFC is delighted that Ocado has chosen to partner and invest with us. We are certain that the combination of their world-leading logistics and automation systems coupled with our advanced growing technology will transform the way customers experience fresh produce - delivered fresh to their door a matter of hours from ordering.”

Together, Ocado’s planned equity investments in JFC and Infinite Acres will total £17 million.

Investments to complement the core

Ocado is one of the world's largest dedicated online grocery retailers, known for its robot operated fulfilment centres. It also operates Ocado Solutions, a division responsible for corporate partnerships, providing the Ocado Smart Platform as a service to retailers around the world. In February, Ocado announced the creation of an online grocery retail joint venture with Marks & Spencer, one of the UK's leading food and clothing retailers.

Since then, Ocado has stepped up investment activity in innovative companies with complementary areas of expertise. Last month, Ocado led an investment round in robotics start-up Karakuri. Karakuri’s unique IP combines robotics, machine learning, optics and sensors to automate the assembly of ready-to-eat meals in the fast, casual or food-to-go sectors.

At the time, Ocado said the investment in Karakuri gave it the opportunity to expand its value proposition in grocery, especially through Ocado Zoom, a new “immediacy offer”. The relationship also provides Ocado Solutions partners with innovative answers to the challenges of building a strong and profitable food delivery business.

Ocado CEO Tim Steiner commented: “Our investment in Karakuri, potentially a game-changer in the preparation of food-to-go, gives us the opportunity to bring the best of innovation to the benefit of our own customers as well as those of our partners."

In a similar vein, Ocado stressed that its latest round of investments will complement its core business: “The focus of our business remains fully on the task of delivering outstanding execution to our Ocado Solutions partners. Ocado also has a significant portfolio of technologies and know-how that can support new opportunities for customers and partners through investments in other verticals and related businesses; vertical farming is one of these markets.”

Why vertical farming?

Ocado is interested in developing its expertise in the vertical farming sector because it believes vertical farms offer an answer to two important trends.

Firstly, vertical farming is seen as a way to produce fresh produce more sustainably, using fewer land and water resources, producing less waste and without the need for pesticides. It also produces predictable yields of high-quality produce.

As Priva CEO Meiny Prins noted, these attributes align with “global sustainability needs” to feed a largely urban population of an estimated 10 billion people by 2050. “We can develop optimal environments in which plants and food crops experience the best way to grow indoors, using leading-edge technology and solutions which result in substantially lower energy and water use, as well as reducing food waste,” Prins claimed.

Secondly – and perhaps most interestingly for Ocado’s current business model – the company believes vertical farming can be part of a solution to deliver fresher, pesticide-free produce directly to consumers year-round.

Vertical farms can be placed much closer to customers, potentially co-located next to customer fulfilment centres (CFCs), supermarkets and other locations near population centres. Ocado said this would allow vegetables to be harvested hours before they are packed, metres from where they are shipped.

“We believe that our investments today in vertical farming will allow us to address fundamental consumer concerns on freshness and sustainability and build on new technologies that will revolutionise the way customers access fresh produce,” Ocado CEO Steiner explained.

“Our hope ultimately is to co-locate vertical farms within or next to our CFCs [Customer Fulfilment Centres] and Ocado Zoom’s micro-fulfilment centres so that we can offer the very freshest and most sustainable produce that could be delivered to a customer’s kitchen within an hour of it being picked.”