Stiff competition from online operators is shaking up the brick and mortar retail model. In an effort to meet more demanding consumer expectations, offline players are adopting new technologies and convenience-driven systems.

“The store is not dead – but will need to be reinvented to remain relevant for the future,” according to data insight firm Edge by Ascential.

The brand and retail-focused analyst predicts that as growth in physical outlets continues to slow, a transformation towards ‘the store of the future’ will boost efficiencies, and ultimately, market share.

“We believe [the store of the future] will need to be fundamentally underpinned by technology,” said author of the firm’s Store of the Future report and Edge by Ascential analyst, Ioli Macridi.

“We think that data will be used in order to inform, very specifically, where each item needs to be placed; what type of route consumers should take in the store; how the store should be allocated; what types of services should be [offered] based on the location of the store; and what consumers in [specific] areas want to see in-store.”

Edge by Ascential’s vision also includes robotics and automation with no queuing or checkouts. And at the report launch this morning (11 July), the company’s senior director of product & content, Xian Wang, was quick to point out that a ‘no check-out’ policy should not mean offloading the cashier’s work to consumers.

“There have been some cases where retailers ask consumers to scan [the products] themselves, put it in the basket, and pay for it. But actually, that is just reallocating [the burden], and the shopper is more wise that that.”

Defining the ‘store of the future’

Retailers should focus on four key elements – as identified by Edge by Ascential – to transition into the store of the future, suggested Macridi.

The leading characteristic is curation – in order to build a differentiated proposition for consumers. “Are you really looking at the latest trends so that the products in-store reflect what the shopper wants to see?” Macridi asked delegates. “Are you looking at the different types of ingredients that are being used in the products themselves, are you looking at digital native brands that fit with your general store proposition?”

The analyst highlighted that ‘curation’ should be the ‘number one’ step for reinventing retail stores. “If you’re not making sure that your store has the trendiest [items], the products are environmentally friendly…then your store will not be a profitable solution in the future.”

Experiential is another key characteristic of future brick and mortar outlets. Designed to help shoppers connect with a brand or a retailer, enhanced experiences could include events, education, value-adding services, or ‘shop-in-shops’ – whereby a brand take space in another retailer’s store.

“How can [retailers] add services that can really enhance the experience, how can they add things like cooking classes or [ways for consumers to] learn things in-store?” Macridi continued.

The social element of future retail stores will also be key, according to the insight firm. Shoppers can be encouraged to interact in meeting hub areas and by being prompted to engage with social media in-store.

“Is there a foodservice area where people can interact, socialise, and have a meal? Are there classes where people can interact with the local community, are there charity activities that the retailer is bringing to the store?” asked Macridi.

Making the shopping experience frictionless is another crucial aspect – and one that is increasing in importance as time-poor shoppers opt for convenience. System examples including click & collect, seamless online to offline (O2O) integration, and checkout-less stores. “What types of technologies are you using in-store to interact with the shopper and to make the payment process easier or faster?” Macridi asked delegates.

These four elements will ‘elevate your store’, but they need to be executed in a sustainable and cost effective way, the company stressed. “Are you using automation to lower your costs elsewhere so that you can improve other parts of the store?

“This is the key element underpinning all of these operations.”

Benchmark study puts Carrefour on top

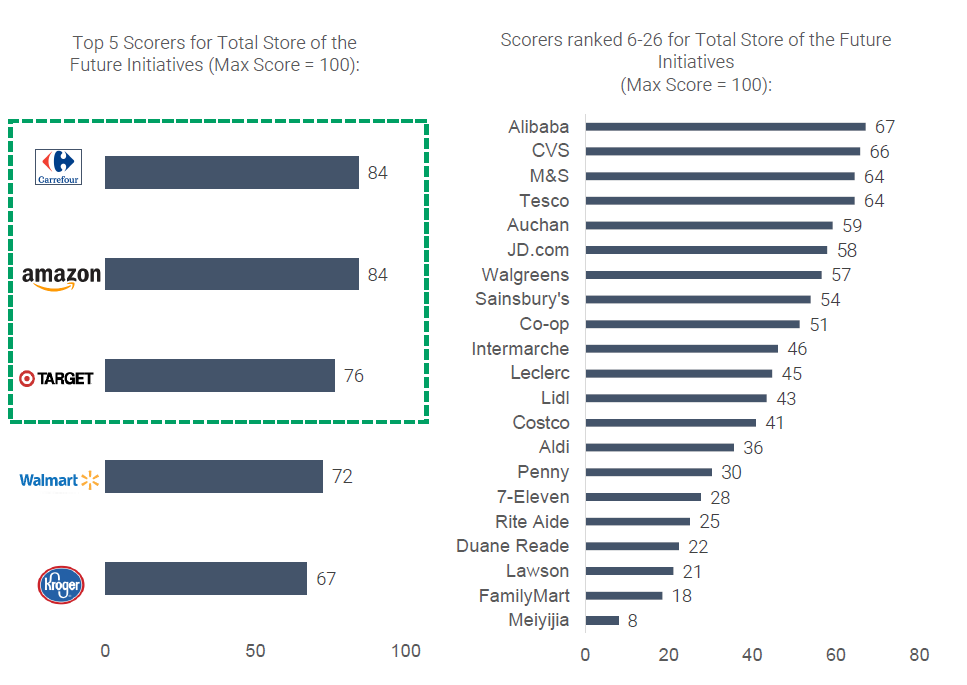

Based on these four pillars, Edge by Ascential conducted a global benchmarking study to evaluate retailers based on their ‘store of the future journey’.

Analysts looked at which elements the major retailers had implemented and if they were successful. “We also looked at how they were doing as a general operation in terms of [innovation]”, said Macridi.

French supermarket Carrefour scored the highest, thanks to its range of ‘store of the future’ initiatives. These include ‘experimential’ projects such as shop-in-shops partnership with FnacDarty in France, and with Gome in China; social elements with its ‘Art For Food’ programme and in-store cafes; its ‘curated’ products covering private label free-from brands, Carrefour baby range, and Carrefour Selection. In terms of being ‘frictionless’, Carrefour offers a delivery and drive through service, and ‘Carrefour Pay’.

“Carrefour came out on top, and the reason for that is that they have a very comprehensive strategy. They have really tried to undergo a process where products go through a vetting process. It creates a good experience for shoppers,” said Macridi.

“They have experimented with a lot of technology in-store, they have a lot of partnerships with shop-in-shops, all the things that make shoppers come back.”

Amazon came in behind Carrefour, thanks to not only its Amazon Go checkout-less locations, but also its Whole Foods stores. The e-commerce giant purchased Whole Foods in 2017.

“The combination of these two formats has made them a retailer that can really do both – a well-built experience…and a social experience. But also one that is very much powered by technology,” said Macridi.

Other food-focused companies to achieve a top-30 ranking include Kroger, Marks and Spencer, Tesco, Sainsbury’s, Auchun, Co-op, Intermarché, Costco, Aldi, and 7-Eleven.

‘Discounters are the ones to watch out for’

The analysts predicted discount supermarket Aldi to significantly increase market share in the coming years, despite not selling food products online.

“I think that one of the reasons why retailers like Aldi…are successful is because although it’s not apparent at first sight, it sort of replicates the e-commerce experience, in that we can find the cheapest product of the highest quality,” said Macridi.

“Consumers are very price-focused right now and the reason [Aldi] is doing so well is because [consumers] can find that lowest mark…much easier than if they were going to 10 different stores.

“They are really a ‘no-frills, get your stuff and go home’ [store].”

Aldi in particular has been clever with its private label offerings in the US, noted Wang. The discounter sells own-label products under the Trader Joes brand, which has garnered an international following. “They’ve done a really nice job on that front.”

And in terms of adopting new technologies, while the supermarket is not building capacity itself, “they are being smart about partnering. Discounters are the ones to watch out for, because if they bring their in-store…online through some of those partnerships, they can be a really viable, really interesting opportunity going forward as well.”