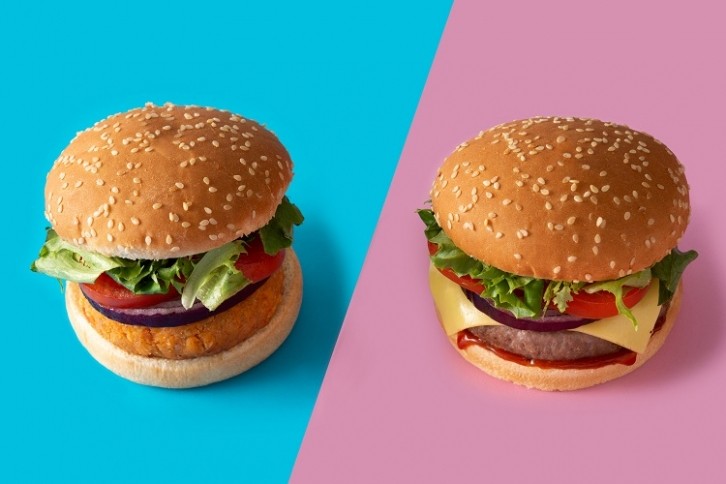

No, consumers aren’t shunning plant-based meat for the real thing

The cost-of-living crisis is contributing to the plant-based slowdown. As consumers tighten the purse strings, they’re less likely to splash out on plant-based meat alternatives – which often come with premium price tags.

So what are they eating instead? When consumers are trying to cut costs, are they throwing cheaper meat-based products in the shopping basket instead? That’s not what retail insights suggest in the UK.

Swapping bacon for ‘facon’? Not necessarily

The last ten years have seen the plant-based meat market surge, in both product volume and sales. In the UK, this trend aligns with consumers cutting down on meat consumption for predominantly health and environmental reasons.

But that upwards trajectory started to slow around 2021. There’s been ‘pullback’ from meat-free as an alternatives category, explained Nathan Ward, business unit director at data and insights consultancy Kantar.

The trend is not specific to the UK alone. Globally, plant-based meat players – even category pioneers such as Beyond Meat – have been suffering.

That is not to say that amid cost-of-living pressures consumers are swapping out plant-based meat for meat. Kantar’s consumer data suggest that consumers are continuing to remove meat from their diets, they’re just going about it a different way.

The plant-based meat market is generally almost as expensive, if not as expensive as meat products, Ward told us during FoodNavigator’s recent Positive Nutrition Digital Summit. “Consumers are seeing that and putting different things into their [basket].

“A great example of this would be consumers dropping meat from a pasta dish and just using a sauce or adding cheese to that dish. They’re moving away from having a meat alternative with it and having a more meat-free meal that doesn’t…contravene quality.”

Ward continued: “We are seeing people eat differently, and the cost-of-living crisis has been a big driver.”

Is flexitarianism increasing or decreasing? Insights differ

To a certain extent, this is what Tesco has observed. “Plant-based food fans are diversifying in their taste for all things veggie with a move into scratch cooking,” noted the UK’s biggest retailer earlier this month.

“The move follows a slight dip last year after the initial novelty of the biggest food trend this century saw dabblers and the merely curious drop off.”

Tesco believes the ‘rising popularity’ of the flexitarian diet – otherwise described as a semi-vegetarian diet – has had an impact on the plant-based food trend. Volume demand for tofu and tempeh (both high protein soy-based products that can substitute, but don’t mimic, meat) is up by around 20%, claims the retailer, and a recent survey conducted by OnePoll suggests 47% of people are eating more vegetables than they did five years ago.

Of those consumers, most (82%) said they do so to be healthier, 22% said it was to save money, and 25% to reduce their environmental impact.

But if those who eat more vegetables identify as flexitarians, it would suggest the diet trend is increasing. That’s not what Kantar’s Ward has observed.

People’s diets aren’t changing as much as they were, he told us. “People that were describing themselves on our [Kantar Worldpanel] as flexitarian have reduced a little in the last two years. They’ve dropped back to the levels we saw in 2019.”

At the same time, the number of vegans and vegetarians remains strong – accounting for around 8% of the UK population.

The future of plant-based dissected

Although Tesco has observed a rise in scratch cooking with vegetables and other meat-free ingredients, it has also noticed renewed interest in the plant-based meat category. Meat-free whole cuts in particular appear to be selling well.

According to the retailer, volume demand for fish alternatives is up by 100% over the last three months year-on-year, plant-based steaks and chicken breasts by 20% and meat-free burgers by 10%.

“Customers are starting to understand the versatility of plant-based ingredients and whole cuts, and are creating a wide variety of meals such as tofu stir-fries, meat-free curries using chicken alternatives or beans and pulses, and classic steak and chips using plant-based steaks,” said Tesco’s plant-based food buyer Cate May.

It’s likely that plant-based diversification will continue. Kantar has observed a broader trend towards plant-based – in all forms – and expects that to grow over time. As concerns of ultra-processing persist, manufacturers are likely to experiment within plant-based – but without turning to alternatives and processed products, the business unit director suggested, “because I think there is a fear of processing coming through as well.”

Kantar also expects environmental sustainability to continue to play a role in purchase behaviour. Although this dipped early in the cost-of-living crisis, ‘early shoots of recovery’ have been observed. “We’ve noted that people have actually sprung back to where they were in 2021 and beyond in terms of their views on sustainability.

“We’re seeing these things become more important to them, and forecast that will continue.”

Missed any of FoodNavigator’s Positive Nutrition Digital Summit 2024? Don’t worry, you can still access all of our sessions and handouts, which will be available on-demand for the next 90 days. Click here to register for free.