The aim was to use these insights to define key opportunities for dairy producers and retailers to drive growth.

The research was conducted in conjunction with Kubi Kalloo and included a quantitative survey of more than 2,000 shoppers as well as interviews with experts and Bord Bia stakeholders.

The study identified the main drivers and roadblocks affecting purchasing decisions across different consumer demographics and highlighted opportunities across the core categories of milk, butter, yogurt and cheese, among other insights.

Affordability remains a major concern

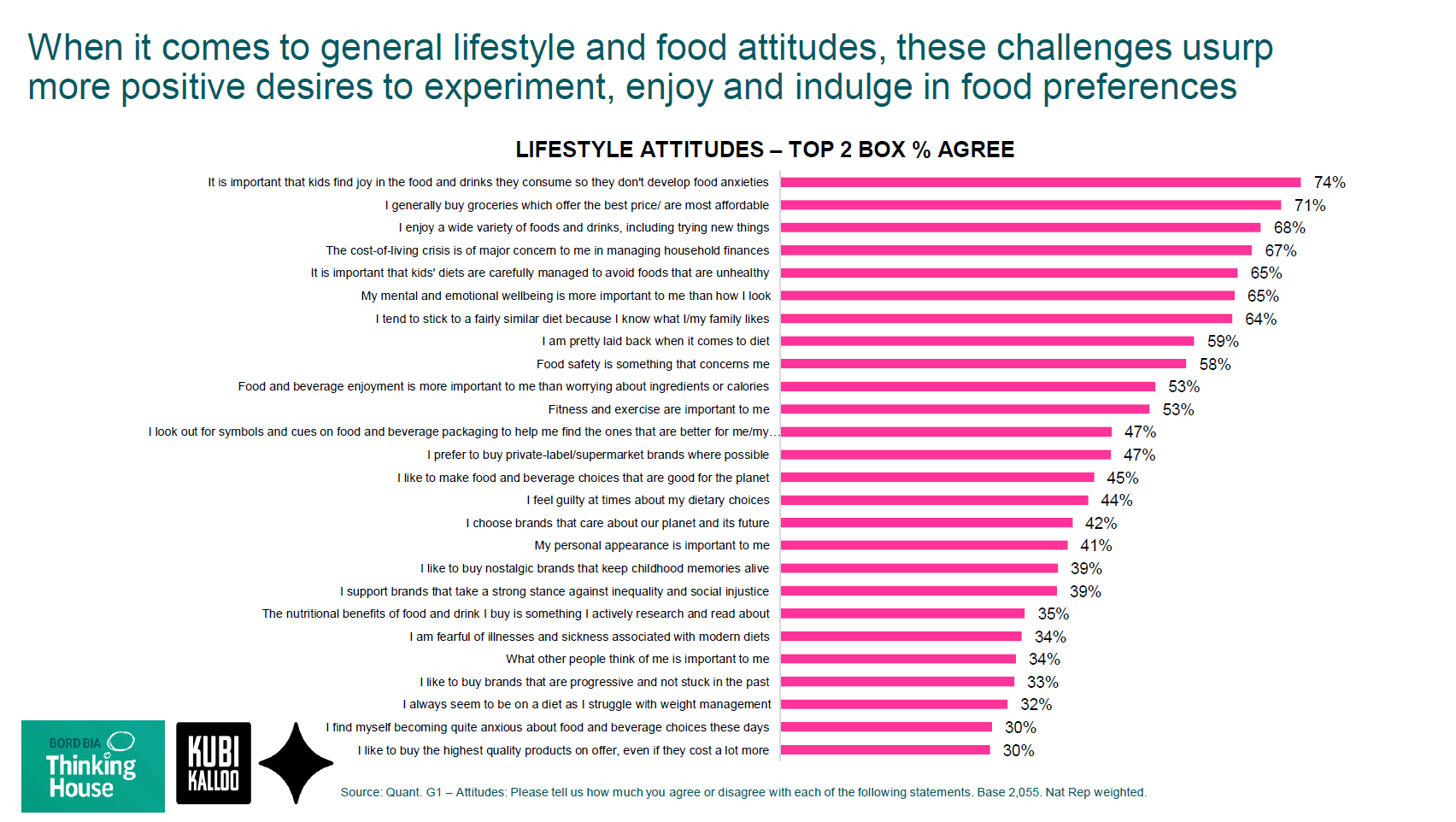

In the quantitative survey part of the research, shoppers were asked to rank statements related to food quality, affordability, enjoyment, health, environmental and social responsibility to determine the factors that influence purchasing decisions.

Here, statements linked to health and wellbeing (e.g. ‘It is important that kids find joy in the food and drinks they consume so they don't develop food anxieties’) and affordability (‘I generally buy groceries which offer the best price/ are most affordable’) received the greatest level of agreement from respondents.

Statements about positive sensory experiences (‘Food and beverage enjoyment is more important to me than worrying about ingredients or calories’, 53%) and environmental sustainability were next in terms of importance, while statements regarding food quality claims and nutritional benefits (‘I like to buy the highest quality products on offer, even if they cost a lot more’, 30%; ‘The nutritional benefits of food and drink I buy is something I actively research and read about’, 35%) came lowest in the ranking.

“These lifestyle attitudes were measured at a total food and drink level and factors around affordability/price unsurprisingly came out high given the current environment, whilst taste always ranks highly,” Estelle Alley, UK Dairy Category Manager at Bord Bia, told us.

“We have seen sustainability lower down on consumer’s priorities of late, but expect this to come firmly back on the agenda longer term.”

“When it comes to dairy, we see that claims centred around animal welfare, sustainability and quality related all featured in the top tier for consumers, reinforcing their importance for dairy shoppers,” Alley added.

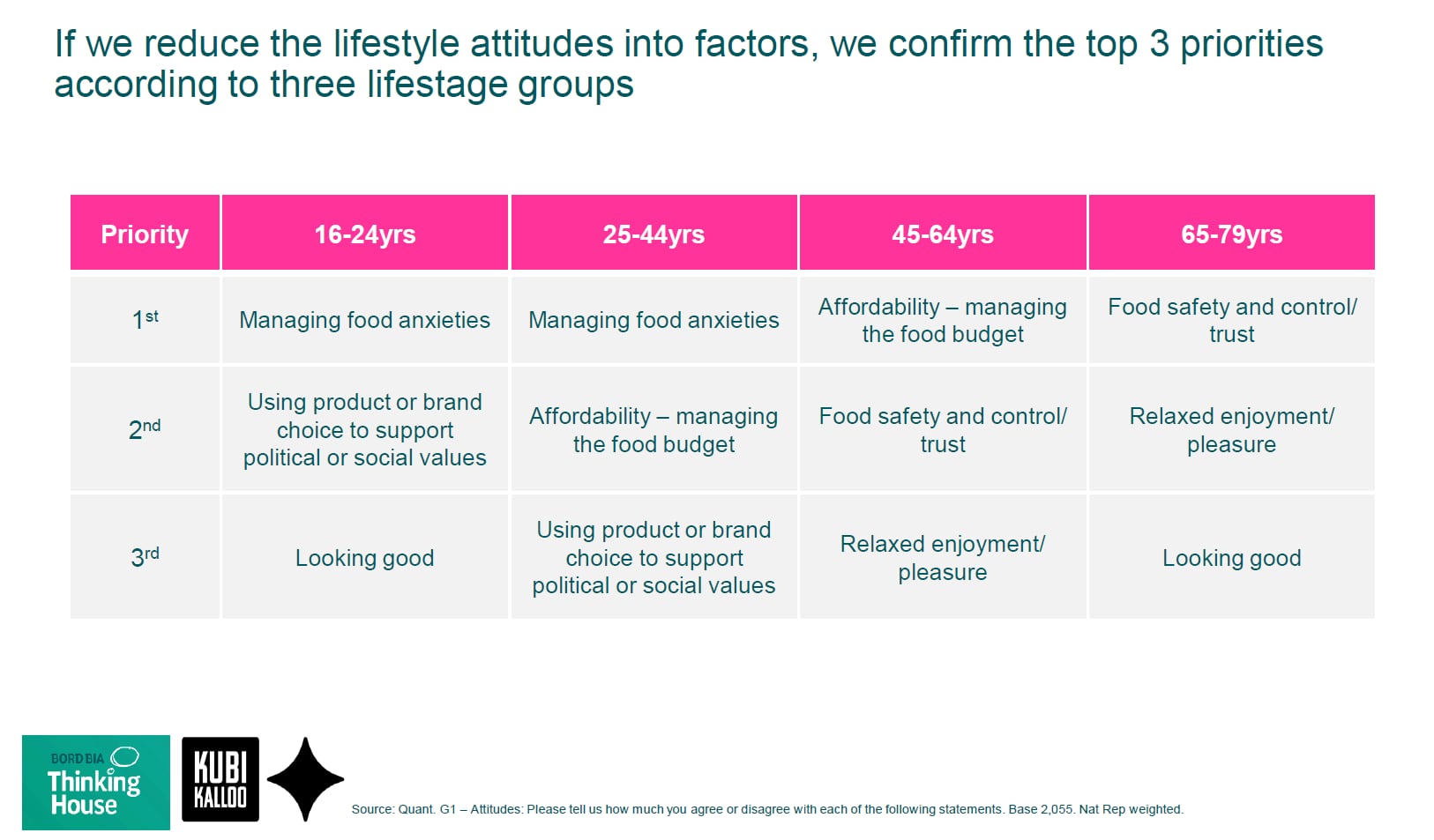

Consumers from different demographics also had different priorities dictating their food choices, the research revealed. For those aged 16 to 44, managing food anxieties was the single most important factor, while ‘affordability’ and ‘food safety’ was what mattered most to 45-64 year-olds and those aged 65 and over, respectively.

The youngest cohort (16-24yo) had the strongest attitudes towards supporting political and social values through product and brand choices, and this was also an important motivation for 25 to 44 year-olds, albeit not more so than affordability.

Signs of changing perceptions

“The vast majority of UK shoppers remain strong advocates of dairy,” the researchers reported. “They see it as an entrenched, welcome and growing part of their everyday life.”

Most consumers agreed with statements that dairy is a key part of a healthy and balanced diet (76%) and that it is a delicious part of everyday life (75%) – but there were also signs that this ‘perception of goodness’ could be changing.

In the study positive sentiment outweigh the negative. Whilst low levels of anti-dairy sentiment exist amongst consumers, one area of concern was to do with the perceived lack of innovation in dairy and products being ‘generally boring’ according to those polled. Other ‘anti-dairy’ sentiments included the perception of dairy farmers being responsible for the climate crisis; the growing importance of plant-based alternatives to some consumers, and the notion that dairy products are not vital in an adult diet.

Positive sentiments – which were linked with dairy’s familiarity, taste and origin (e.g. grass-fed dairy tasting better and consumers preferring to buy products that come from family farms) – dominated and were more prevalent among older demographics.

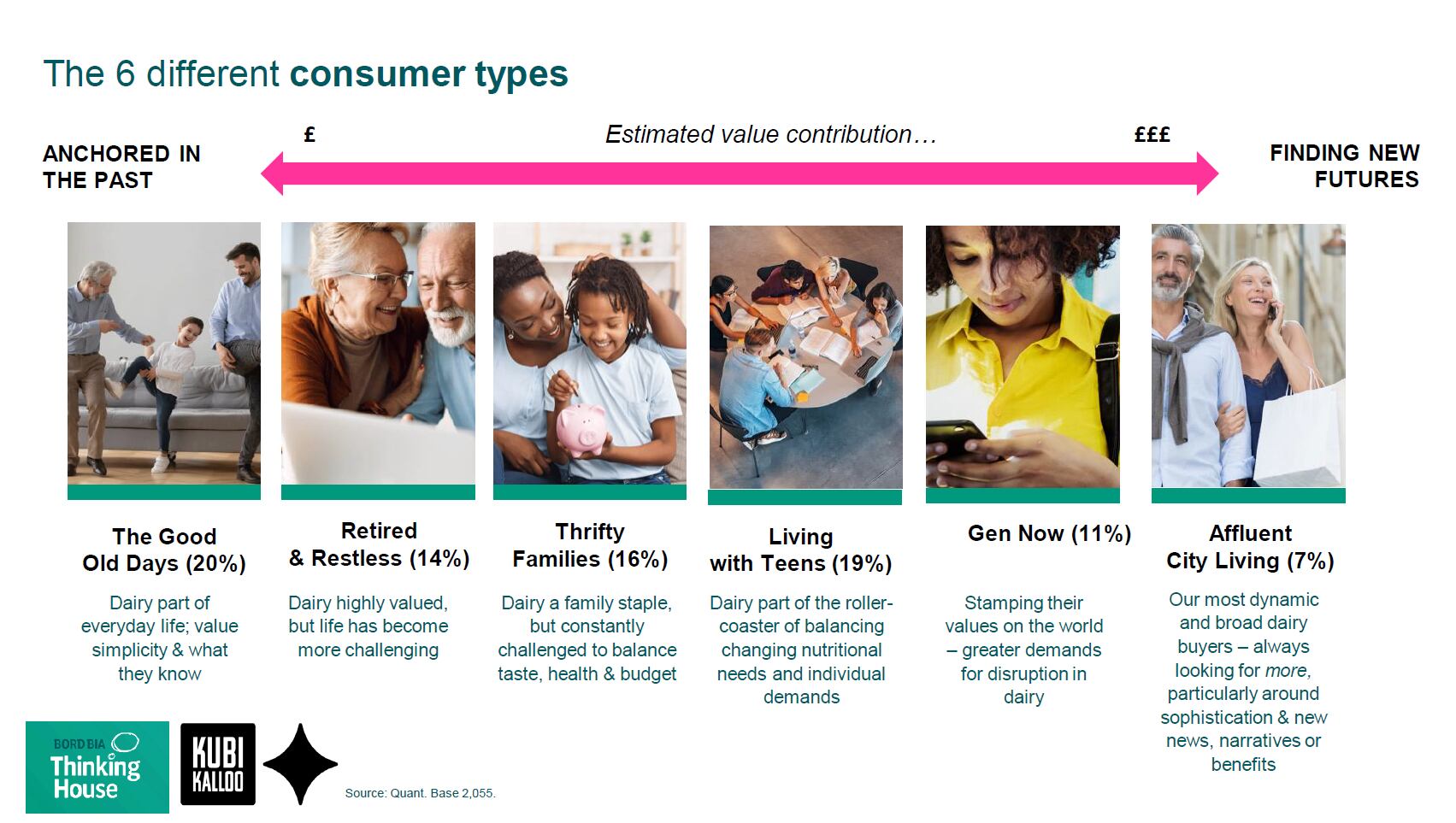

The researchers then identified six diverse consumer types – those that value dairy but face different nutritional, social and budgetary challenges (four separate groups, comprising 69% of all respondents), and those more likely to seek new categories and experiences, i.e. ‘Gen Now’ (11%) and ‘Affluent City Living’ (7%).

“The Gen Now cohort of consumers are more likely to be embracing flexitarian diets, experimenting with dairy alternatives and looking for more excitement within the category,” Alley told us.

“At the same time, they are still frequent buyers from most dairy sub-categories and see the natural benefits of traditional dairy. We also see significant interest amongst this cohort within each of the four future worlds of dairy the research identified, indicating opportunity across many areas dairy can operate within, from the traditional/natural to the more exciting/progressive.”

In need of education

The research also identified consumer knowledge gaps, particularly around the importance of the gut microbiome and farming practices such as micro-farming and regenerative agriculture, highlighting the need for more education in some more technical fields where formal definitions (in the case of regenerative ag) are not yet available.

“Whilst we have seen growth in consumer interest around areas such as regenerative practices, the gut biome, and micro farming, there is still low level of understanding on these topics,” Alley explained.

“Claims centred around animal welfare, sustainability and nature are easier to understand and connect with. However, we see significant opportunity to move between the four future worlds which we identified and speak to a wide range of benefits and claims.”

Opportunities for innovation in dairy, but also in alternatives

Breaking consumer perceptions down across the four categories of milk, cheese, butter and yogurt, the researchers highlights opportunities for both dairy producers and those in the business of dairy alternatives.

In cheese - a product associated with pleasure and indulgence according to the research - less than 1% of the consumers polled said they exclusively bought plant-based alternatives, highlighting the functional and sensory gaps in plant-based cheese. Turning to sub-categories, claimed product purchase behaviors reveal that grated cheese, alongside low-fat or low-calorie cheese and block parmesan are experiencing growth, while continental, camembert and goats’ cheese are stagnating. The vast majority of consumers (98%) meanwhile see cheese as a post-dinner/late evening snack, which presents an opportunity for marketers to ‘push cheese into the every-day without breaching the barrier of indulgence’, the report says.

Unlike cheese, yogurt is the category least defined by occasion, with 1 in 5 consumers stating there was no definitive occasions to enjoy it. Here, Greek; low-sugar, and flavored kids’ yogurt are all experiencing a resurgence, while fruit-on-the-bottom yogurt, cereal yogurt pots and organic yogurt are at the opposite end of the spectrum. There’s an opportunity for plant-based alternatives too, as 30% of those polled stated that plant-based alternatives ‘are becoming increasingly important’ in their lives.

When it comes to branded products, butter is still the most brand-focused category, with 1 in 4 respondents stating they mostly buy branded. Whereas in milk, just 12% of shoppers choose branded milk. The challenge for milk producers is to leverage their product’s health and sensory ‘goodness’ in a world that is looking for excitement and integrity, according to the research.

In terms of product categories, plant-based creamers, lactose-free milk and fresh semi-skimmed milk are enjoying a positive momentum, unlike buttermilk, single cream and milkshakes.