Food tech is expensive business. The research and development funding required to cultivate meat from cells, develop dairy in a lab, or mimic textural profiles with 3D printing tech, should not be underestimated.

In cultivated meat alone, global investment topped $1.36bn (€1.28bn) in 2021 according to the Good Food Institute (GFI), with the industry’s investor base growing by 62% to 458 unique investors.

But macroeconomic factors ranging from increased inflation to reduced trade in 2022 are continuing to impact the investment environment in 2023. “The current investment environment is not very favourable,” said Noga Sela Shalev, CEO of northern Israeli food tech incubator Fresh Start. “It’s a huge challenge”.

The challenge is not insurmountable, however, suggested the food tech expert at the OurCrowd Global Investor Summit in Jerusalem last week. Climate change and food insecurity are very real issues that need addressing. “I do believe there will be investors around and there is money to be poured into this space,” we were told. Indeed, Israel has observed a 26% increase in food tech deals over this last year.

What is required, suggested Sela Shalev, is a ‘slightly different’ approach to fundraising. How can food tech start-ups putting their best foot forward?

Turning growth into profitability

“It is definitely a challenging period for investment,” agrees DouxMatok CEO Ari Melamud. At the same time, it is such an ‘exciting’ time to be part of the food industry, he told delegates at the OurCrowd summit.

“It is going through what is probably the biggest revolution ever. We have basically been eating the same food for thousands of years, but this is changing. What is going to be on our plates and on our childrens' plates 10-15 years from now is just amazing.”

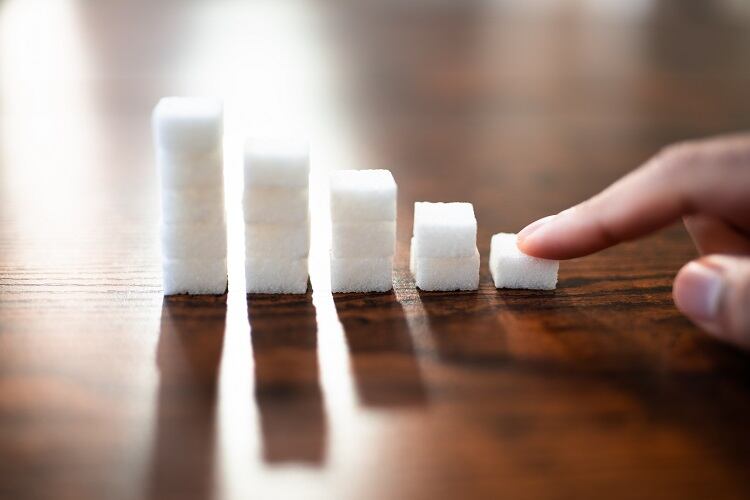

The Israeli company is rethinking sugar reduction with patented technology based on real cane sugar. In essence, the sugar technology wraps sucrose molecules around silica particles to form structures that are perceived to be sweeter than conventional sugar. By replacing sugar with DouxMatok’s product Incredo Sugar, the company believes a 30-50% sugar reduction can be made without impacting flavour.

DouxMatok has observed a recent shift within the funding realm – one that Melamud believes will set start-ups in good stead for increased investment.

“Up until about one year ago, [food tech] companies were [predominantly] focused on growth. They were measured valuation-wise on growth. But one of the biggest challenges we have in the industry is how we can turn growth into profitability.”

The DouxMatok CEO believes that food tech start-ups with the ‘right’ go-to-market strategy are the ones that ‘should be taken seriously’. These businesses, he stressed, can show investors – ‘in a credible way’ – that profitability is a realistic achievement within a set timeframe. “That is the key element of getting direct valuations,” he said.

As to how DouxMatok’s is approaching profitability, the company is heavily focused on commercial partnerships, having signed deals with a number of food majors. Now that the company has established a presence in the US, DouxMatok is launching into Europe.

Another investment hurdle may lie in the fall – and in some cases, plummeting – of direct valuations in recent times. Food tech start-ups are likely not valuated as highly today as they were prior to 2022. But Melamud welcomes these ‘corrections’, judging them to be ‘very healthy’.

“Good companies will continue to grow, will show profitability and will create value. Those that do not, will not.”

Buy the KPIs, not the ‘story’ of a start-up

Maolac, another Israeli innovator, agrees that commercial partnerships offer investors at least a good ‘entry point’ into judging their credibility.

Founded by Maya Ashkenazi, Maolac has developed a discovery platform based on an AI-powered algorithm. Leveraging this technology, the start-up finds bioequivalent proteins from upcycled bovine colostrum to that found in human milk. Maolac is not focused on identifying proteins with the bioequivalent nutritional value, but those presenting with biofunctional elements to help improve immunisation, congestion, cognition, sight and bone development.

Ashkenazi urged investors to focus on concrete deliverables, rather than getting swept up in a start-up’s ‘story’. “This is a wakeup call to investors to not just look at the story, not just look at the team, but also look at the company’s [track record] in achieving their KPIs [key performance indicators].”

If a company has a history of meeting KPI deadlines, and progress to a go-to-market stage where they are ‘not just selling a story’, the Maolac founder suggested funding opportunities should be investigated.

Maolac itself is fast-approaching that go-to-market stage, having achieved scalability and Self Affirmed GRAS for US market entry. The start-up expects to commercialise this year and is already working with ‘several’ food companies, including dairy companies in Israel and Spain.

Is it ALL about making money?

Maolac also urged investors to be realistic in their exit timelines. Some investors, explained Ashkenazi, expect that investment in a food tech company should result in an exit within ‘a year or two’.

“No, this is not the situation,” she stressed, highlighting the differences between a longer food tech game, compared to the shorter term conventional software start-up. “We want to create food for our children’s plates…we are not creating a programme, we are not creating a new game or application.

“We create history, and in order to do that, you need to evaluate the company on its KPIs and capability to scale up.”

The reality is that not all food tech start-ups will be able to hit their KPIs or achieve scalability. “That’s ok,” said the Maolac founder. “It’s a fair game [and if they don’t], they’re not supposed to be here.”

Going one step further, co-founder and CEO of plant-based start-up Plantish Ofek Ron said food tech companies are not driven by ‘making money’, but by ‘making impact’.

The Israeli start-up is leveraging 3D printing technology to mimic the taste and texture of a conventional fish filet, with plants. The technology allows for each plant-based ingredient to be placed in the exact same place as its conventional counterpart, Ron explained. By layering the muscle tissue, fat component, and connective tissue in the right way, Plantish claims to be developing the ‘next generation’ of plant-based products.

“We are not here to make money. If we were here to make money, we would start a software company,” reiterated the Plantish CEO. “We’re here to make a difference, to make an impact.

“Investors who are counting [down] need to know that this is a marathon. The market will go up and down a few times before they see any money.”

But if investors want to do something meaningful with their money, Ron believes food tech is the right path. “It doesn’t matter if the market is up, medium, or down. You should do whatever you can to make sure that we have a future.”