Prior to the outbreak of coronavirus, industry observed an influx of food entrepreneurs launching start-ups and challenger brands across Europe.

When COVID-19 hit, however, these businesses were faced with fewer opportunities for retail listings, and near non-existent foodservice and food-to-go channels within which to market their products.

Struggling with cash flow, SMEs with agile and responsive mindsets have been able to ‘turn the odds in their favour’, and flourish amid a global pandemic, according to strategy director at brand consultancy eatbigfish, Nick Geoghegan.

So how can challenger brands ‘pivot’ to meet new consumer needs? Is strategic agility the secret to surviving a downturn? FoodNavigator spoke with industry experts this week to find out.

What is a challenger brand?

For Geoghegan, challenger brands are not defined by their product, nor by their size. Rather, being a challenger brand is ‘about a state of mind’, he told delegates during FoodNavigator’s Start-ups, New Business Development and Funding webinar – part of its global Unlocking Innovation series.

“A challenger is someone who has a desire to change something despite the odds. They see something in the category that they don’t agree with and they want to make right.”

Dutch chocolate bar business Tony’s Chocolonely is one such example. The brand – which is ‘going gangbusters’, according to eatbigfish’s strategy chief – uses its ingredients, packaging, and the way it formulates its products, to draw attention to inequality in the cocoa supply chain. “While they are a fun and vibrant challenger brand, they have a clear sense of what they are trying to challenge in this space.”

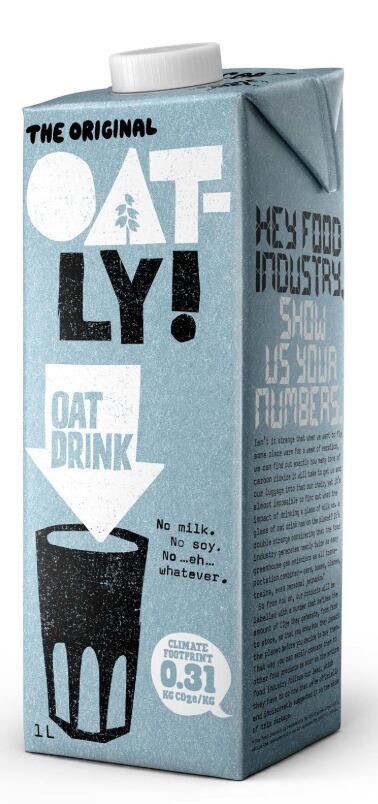

Another well known example is Swedish vegan brand Oatly, which generated around $200m last year, with plans to double that by 2021. Rather than focus on the benefits of drinking oat milk (the brand’s star product) the business aims to challenge the way consumers think about the dairy category, Geoghegan explained.

By using slogans such as ‘It’s like milk but made for humans’, Oatly makes consumers question why they are drinking cow’s milk. “It’s seems like a very weird and outlandish thing to do, when you put it like that. [The brand] is challenging your preconceptions around the category.”

COVID challenges

In Europe, the coronavirus outbreak disrupted distribution channels for many an early-stage start-up and challenger brand. To survive lockdown restrictions, SMEs have had to transform such challenges into opportunities.

Start-ups hit the hardest by the pandemic were those focused on foodservice, explained head of ProVeg International’s Incubator, Albrecht Wolfmeyer during the panel discussion. “Start-ups have [encountered] cost problems when they focus on foodservice, because [this channel] has basically closed down for a long time. Restaurants and all out of home markets basically stopped working.

“So they had to take a pivot and rethink their strategy, and reduced their fixed costs just to survive,” he told delegates.

Other complications were linked to supply chain partners, who were facing their own challenges during lockdown, and retail. “Retail is a big problem [for food brands] because negotiating a deal at the time the crisis hit probably would have been stalled. They wouldn’t have taken in your product when the crisis hit the market.”

Thea Alexander, co-founder of challenger brand network Young Foodies, agrees. “Anything ‘to go’ has struggled. There are…different factors that determine whether a start-up has flown through COVID and seen it as an opportunity to cut through the market faster, or whether they’ve been…taken off their primary course.”

Pivoting to meet new consumer needs

Alexander has observed a number of brands up-close pivot in response to these challenges. Within the Young Foodies network, start-ups are ‘shifting to respond to where the consumers are’, she explained. So where previously consumers were communicating with consumers out of the home, now they are building loyal customers bases directly, and ‘creating interesting touchpoints that they would not otherwise have done’.

One such example is a tea brand within the Young Foodies community. They have ‘done really well’ with their online business, which Alexander said has ‘absolutely boomed’. “They have also put on tea tasting sessions to build that loyalty with their consumers, and use Instagram, TikTok and other online channels to build a deeper connection.

“When the world resumes, not only will they get their distribution back in the out-of-home, but they will have really deepened their

connection with their core consumer base.”

Niccolo Manzoni, co-founder and managing director of venture capital firm Five Seasons Ventures, has noticed strategic changes among early-stage start-ups as they respond to the crisis.

“Early-stage companies have been able to respond to consumer needs even faster by changing their messaging, launching new products, and changing their product formulation to respond more closely to what consumers are looking for during COVID,” he explained.

And what were they looking for? A mix of food security (which drove unprecedented growth in the food delivery sector) and health, said Manzoni. “[Some supplement companies] have changed their positioning and messaging more towards ‘immunity’, which is clearly something consumers were looking at.”

Leveraging the ‘challenger’ advantage

This is where challenger brands can leverage their operational structures and agile mindsets to their advantage, said eatbigfish’s Geoghegan.

Incumbent brands have ‘big processes’ and ‘great ways to capitalise on the market’, he told delegates. They form ‘best practices’ designed to ‘double down on growth’ and aim to seize a position in the market that creates dominance.

“Yet when a crisis comes around, things stop working, and it’s really hard to suddenly drop all the things you were working on before, overnight.

“For a challenger, having that ability to quickly manoeuvre and say ‘I’m ready to find the growth wherever that pops up’ is an important part of how they succeed. That ability for a challenger to be responsive, to recognise the market needs and to be able to one from one thing to another is super important.”

The free webinar can be listened to on-demand here.