Two months ago, FoodNavigator reported on the unprecedented demand for home-delivered recipe boxes due to the coronavirus pandemic. At the time, a number of businesses revealed spikes in new orders, seemingly overnight.

Almost the entire hospitality industry had recently shuttered and government guidance was advising against frequent trips to the supermarket. As a result, an increasing number of people were investigating food delivery options.

Recipe boxes (or meal kits as they are known in the US) were one such option. This sector is still considered one of the few winners amid the COVID-19 crisis.

But what happens when lockdown ends, restaurants re-open, and supermarkets can once again operate without the complications of social distancing measures? Will the recipe box sector be able to maintain its momentum? Philip Koh, co-founder and director of strategy at London-based brand design agency Without, suggests that recipe boxes are ‘unlikely to become the norm’.

‘The meal kit model is unsustainable’

To start with, the recipe box model itself, is unsustainable, said Koh. The reason for this is three-fold.

Firstly, current levels of interest and demand are driven by necessity. “The lockdown has restricted consumers’ food choices – [whether it be] eating out, takeaways, grab-and-go on the move, or simply in flexible access to shops.”

Indeed, such ‘necessity’ has seen demand soar. Back in March, Mindful Chef – which is known for being one of the healthier options available – reported an unprecedented increase in sales since the coronavirus outbreak – up +425% in new recipe box customers week-on-week.

East-London headquartered Pasta Evangelists, which delivers fresh pasta recipe boxes nationwide, saw demand quadruple. Gousto similarly observed a spike in demand, as did organic vegetable box delivery company Riverford – which recorded its highest ever number of deliveries outside of Christmas.

“As restrictions lift, these incentives will ease, and need for meal kits will naturally drop,” said Koh.

Secondly, the model is unsustainable in terms of consumers’ available time, he told this publication. “Everyone has a lot of time on their hands at the moment, and little opportunity to spend it outside of the home.”

This, according to Koh, is why we’re seeing a boom in scratch cooking. Indeed, data from Google Trends reveals that UK searches for cinnamon roll, hot cross bun and sourdough recipes have spiked, alongside banana bread, soda bread and flatbread. A nationwide shortage of flour and yeast supports such findings.

“As the lockdown is lifted, we will see more competition for leisure time, and we’d expect to see a drop off in regularity of cooking at home,” the director of strategy continued.

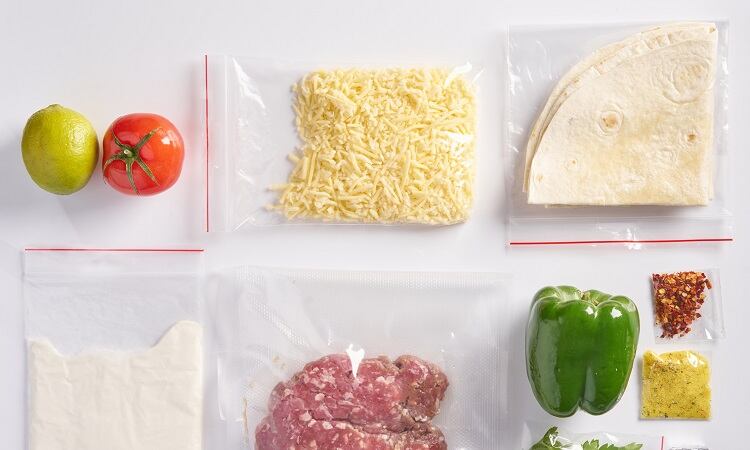

And thirdly, the packaging required to keep recipe box ingredients fresh is a ‘huge problem’. Meal kits use a large amount of packaging, and consumers are wise to the impact, which is increasingly becoming a ‘turnoff’, Koh explained.

“With even mainstream supermarkets like Waitrose moving into packaging-free products, meal kit brands will need to find a sustainable solution. A 2019 survey by INCPEN found 53% of consumers say they have become more concerned about packaging in the past year, with 38% of respondents believing food packaging was a bigger climate change issue than food waste.”

Some meal kit companies are, however, already making headway in responding to consumer demand for more sustainable packaging. UK recipe box company Gousto, for example, has already achieved a 50% reduction in plastic use, and plans to make all its packaging reusable, recyclable or compostable by the end of 2022.

Consumer behaviour in ‘new normal’

To determine what role recipe box services will play amid the post-lockdown ‘new normal’, depends largely on how the coronavirus pandemic has altered consumer behaviour in the long-term.

According to Koh, it is too early to say how consumer behaviour will change. Yet the co-founder suggests ‘it’s never by as much as we imagine’. Indeed, a Kantar survey published in March revealed 86% of respondents intended to eat out the moment lockdown was lifted, which, as Koh pointed out, has been backed up by anecdotal evidence from countries ahead of the curve.

Rather, the strategy expert suspects that meal kits could become ‘part of the mix’ in consumers’ baskets. Perhaps one night in the week could become ‘meal kit night’, in a similar vein to ‘Meat-free Mondays’. “But it’s unlikely to become the norm – it’s too much of a commitment, and consumers are too fickle and spontaneous for that.”

In the short-term, it is possible that the sector continues to maintain its revenue stream. It’s for the sector’s long-term sustainability that Koh has doubts.

“There are various studies around habit-forming, with a range from 21 to 66 days, so demand for meal kits may remain buoyant beyond the end of the lockdown,” he said. “And there’s bound to be residual fear surrounding visiting supermarkets and restaurants, especially if there’s as second outbreak, so consumer sentiment may continue to be favourable to meal kits in the short- to medium-term.”

However, the long-term pressure will be downwards, Koh continued. “It’s clear from other markets that customer churn is significant (a Second Measure study in the US estimated that 50% of HelloFresh customers cancel in the first month, 85% by month six and 90% by month 12).”

Therefore, meal kit brands should regard this period as an opportunity to reach a ‘captive’ and ‘receptive’ audience. A time to introduce themselves and hopefully to convince and convert.

“When ‘the dust settles’, it’s going to be that much harder to encourage trials from new subscribers, and a significant number of recent subscribers will be in the ‘churn zone’. It’ll be all the more important to hold on to the subscribers that they do have.”

So why haven’t recipe box companies succeeded in revolutionising the way we eat?

Given Koh’s long-term predictions, one may wonder: why haven’t meal kit businesses completely disrupted the food sector?

“Because, fundamentally, there’s nothing revolutionary about the proposition,” Without’s co-founder responded. “In the words of one Forbes analyst, ‘Consumers already have access to meal kits – they're called grocery stores.’ And he went on to predict that by 2025, over half of all meal-kit companies would shutter.”

The act of delivering groceries, albeit in nicely prepared and portioned packs, makes life that little bit more convenient, but ultimately doesn’t change lives, he argued. For Koh, a pack of M&S stir-fry veg with stir-in sauce from Ocado delivers exactly the same benefit.

Where meal kits differ is in doing the thinking for consumers, Koh told this publication. “You don’t have to decide what to eat for dinner if it’s already waiting for you. You don’t have to watch what you eat if it is already calorie counted and portioned controlled for you. You don’t have to worry about allergies if ingredients have already been excluded for you. You don’t have to worry about your carbon footprint if the ingredients are all local and organic.

“It’s these more focused and purpose-led propositions that will have impact.”

For Koh, the brands that have the best chance of succeeding are those that offer a ‘purpose beyond convenience’. That may be a functional diet (for weight loss or muscle gain, etc.), specialist meals (vegan, gluten-free, etc.) or brands with a strong philosophy (organic, local producers, etc.)

Whether it be Riverford Organics with responsible sourcing, Mindful Chef with healthy balanced meals, allplants for planet-conscious vegans, or Natural Fitness Food for physical-goal-based diets, “each of these brands has a specific purpose that chimes with the values of their customers.

“Shared purpose builds the most loyal and engaged communities”.

How to ensure post-COVID success?

Looking at the current state of the hospitality and food-to-go sectors, it is easy to see how lockdown has provided opportunities for recipe box firms. Yet Koh warns players to ‘embrace this strange hiatus wisely’.

“They may have consumers’ exclusive attention for a limited time. Function and convenience are today’s mandatories. Investing in and communicating a broader purpose will secure tomorrow.” – Philip Koh, director of strategy, Without

For Koh, it is about ‘long-term thinking’ and ‘providing lifetime value’:

Brands need to find their unique purpose and articulate it: “They need to build a community, a strong and direct relationship with customers, with shared values, motivations, and interests. And once they have their community, they need to be generous, with knowledge, with service, with moments of surprise.”

Plan for a long-term relationship with customers: “What journey should the customer go on? How should their view of the brand develop and deepen over time? What hero moments and touchpoints will strengthen the relationship? What experience does the brand provide that will keep people coming back? How can the brand extend the experience (from special event accessories, to Spotify soundtracks)?”

Plan for a long-term operational model: “How do we reduce packaging waste in a way that will make consumers feel it’s a sustainable choice, and make operations more efficient? Can we consider a more intimate relationship, for example helping customers to build up a larder of staples (e.g. large multi-use bottles of own-branded sauces) that reduce the need for ongoing packaging and delivery, and serve as an ever present reminder of the brand in the heart of the kitchen?”