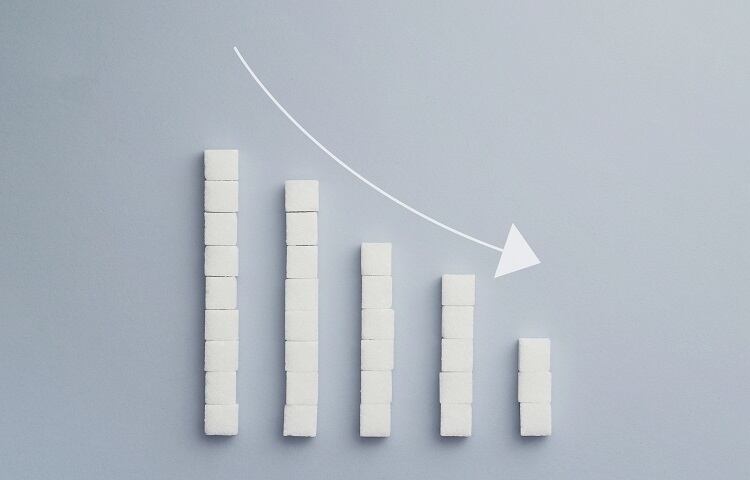

Over two years have passed since the UK introduced its Soft Drinks Industry Levy (SDIL), which taxes beverage manufacturers according to their products’ sugar content.

First implemented 5 April 2018, the levy charges in two tiers: a lower rate of 18p per litre for beverages containing 5g sugar per 100ml or more; and a higher rate of 24p for those with 8g sugar or more.

Initial results have proved positive. The tax raised £153.8m within its first seven months, from April to November 2018. In July 2019, the UK Government reported the ‘hugely successful’ SDIL had removed the equivalent of 45,000 tonnes of sugar from soft drinks.

In January this year, an Oxford University study found that the total amount of sugar sold in soft drinks in the UK had dropped by 29% between 2015-2018.

Mixed reviews

Given these findings, the tax has largely been praised by academics and obesity experts.

Dr Maria Bryant, Associate Professor of Diet and Obesity at the University of Leeds, and Chair of the Association for the Study of Obesity (ASO), for example, said that of all the activities highlighted in the UK Childhood Obesity Plan, ‘this is probably the one that has been of greatest benefit’.

“The key reason for this is likely to be the fact that it was mandated and that industry were told that increased taxes would apply,” she told this publication. “Revenue for this has been less than anticipated because of reformulation, but this is an overall benefit.

“More work needs to be done to confirm ring-fencing of income for school sports; however, I understand that targets have been met to provide school breakfast using £10m annual revenue.”

The self-proclaimed ‘glass half full’ Paul Gately, Professor of Exercise and Obesity at Leeds Beckett University, however, describes the SDIL as a ‘minor success’. It didn’t go far enough, he told delegates at the Westminster forum on children’s food and nutrition in England last week.

“It should have been set at twice the level. We know that from the modelling from Oxford [University]. To have a really, really big population impact, it should have been set at twice the level.”

When asked whether the SDIL rate was appropriately set, or whether the Government should have been more ambitious, the University of Leeds’ Dr Bryant said that while she no expert in taxing systems, “these amounts have clearly been seen as substantial in order for industries to take action on reformulation and marketing offers.

“I guess we need to monitor this and it may be possible to further reduce the amount of sugar over time”, she added, referencing the UK salt reduction programme’s ever reducing targets.

Up next: sugary milk drinks?

Both fruit juice and sweetened milk are currently excluded from the sugar tax.

When Prime Minister Theresa May was in power, the Government suggested the levy may well be extended to milk drinks. Yet her successor, Boris Johnson, has not been so convinced. In the weeks prior to taking the head job, Johnson described such levies as ‘nanny state’ style measures, and promised to review their effectiveness.

Dr Bryant agrees whole heartedly that manufacturers of sugary milk drinks should be taxed according to their products’ sugar content. “The lack of taxation for sugary milky drinks definitely needs more thought,” she told this publication.

“This was due to be considered in 2020. I hope that it is not overly delayed by our current [coronavirus pandemic] situation. Sugar in infant foods is also something that has been considered and definitely needs more thought. In order for these to be a success, mandated policies with levies are needed.”

At the Westminster event last week, Maggie Rae, President of the Faculty of Public Health, concurred with this last point, suggesting that the UK’s challenge lies not in developing interventions, but in ‘getting people to stick to interventions’.

“I think it’s important that we have got a sugar tax, but it’s just not enough,” she told delegates attending the forum online. “I think there needs to be a much bigger and better commitment to all the legislative powers that we could use to really try and tackle this problem.”