At a press briefing yesterday, Mondelez said that chocolate is the leading confectionery segment in France and is worth €2.9bn ($3.8bn), up 2.7% from 2011 to 2012.

Volumes stand at around 250,000 metric tons per annum and the chocolate spend per consumer has increased €10 ($13) compared to five years ago.

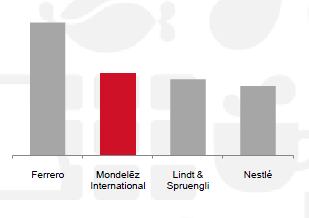

Mondelez is the number two chocolate firm in France with a 16.5% stake, behind market leader Ferrero.

The firm is level with Mars globally in chocolate, but is the leader in Europe with a 21% share.

Innovations account for 96% of French choc growth

The Kraft Foods spin-off recorded 4% growth in chocolate in the French market in 2012, 96% of which came from 12 innovations.

The company highlighted the launch of filled tablets of Cote D’Or such as those containing nougat. The company’s Choco Bakery platform, which mergers biscuit and chocolate brands is also proving a success. Milka Lu and Milka Tuc have created a new market segment, claimed the company.

It also reported that share bags of Milka with Snax and Crispello were attracting consumers who had never bought the Milka brand before.

One reason, new products are doing so well may be owing to troubled economy. Mondelez said that people eat at home during a crisis and seek small pleasures. During these periods, consumers are very open to innovation, it said.

French penchant for dark and premium choc

The company added that French chocolate market was very different to other European markets – the French love chocolate and will pay for quality.

31% of the French chocolate market is premium compared to just 19% in Europe. 25% of French consumers buy only dark chocolate while 65% buy dark and milk.

Tablets are the leading segment in chocolate confectionery in France with a 36% share, ahead of seasonal products which hold a 31% stake. The smallest segment, which includes single serve chocolate and countlines accounts for 33%, but is growing faster than the other categories.

However, French consumers are not particularly brand loyal and two thirds of consumers will consume around three brands.