Sales in the alternative meat sector are estimated to reach $140 billion by 2029, according to Barclays. But for grand projections like this to be hit, the segment still needs to mutate from trending fad to full-blooded trend and move out of its fashionable niche to reach mass-market consumers. For all the technological advances that are improving the taste and variety of alternative meats, a cracking of the mainstream is something that is not yet to happen, believes Givaudan.

It exclusively revealed to FoodNavigator insights gained from its latest and largest ever 'plant attitude' consumer research. This investigated attitudes to meat substitutes, meat alternatives and fish alternatives among 2,500 consumers aged 18-60 in five European countries: the UK, Netherlands, Germany, France and Spain.

The research revealed that sustainability, animal welfare and health remain the key motives among people wishing to cut their meat consumption (39%, 37% and 31% respectively). But, interestingly, more consumers (31%) are choosing the category simply because they want to experience new tastes and flavours. That’s three times more than Givaudan’s previous research from 2018 and evidence of the category’s maturing. “This is the largest research in the history of Givaudan's 'plant attitude' consumer research,” said Lucas Huber, Category Manager Proteins EAME, Taste & Wellbeing. The fact more consumers are entering the category inspired not by health or ethics but seeking new taste experiences is “reassuring for us and helps understand we're going in the right direction”, he told us.

The research revealed further differences between age groups. “Health is a significantly stronger driver for the older bracket of consumers aged 45-60 years,” said Huber. “Another interesting fact is that we see the ‘animal welfare driver’ less applying for the youngest 18-24-year-old bracket,” he explained.

With regards how these products taste, older shoppers tend to be more unhappy about a lack of authenticity, disclosed Huber. Younger consumers complain the taste is too strong, and that products are less visually appealing. “The youngest generation also think these are not offering the convenience they want,” he added. This cohort often “don’t know how to cook them”.

Common people

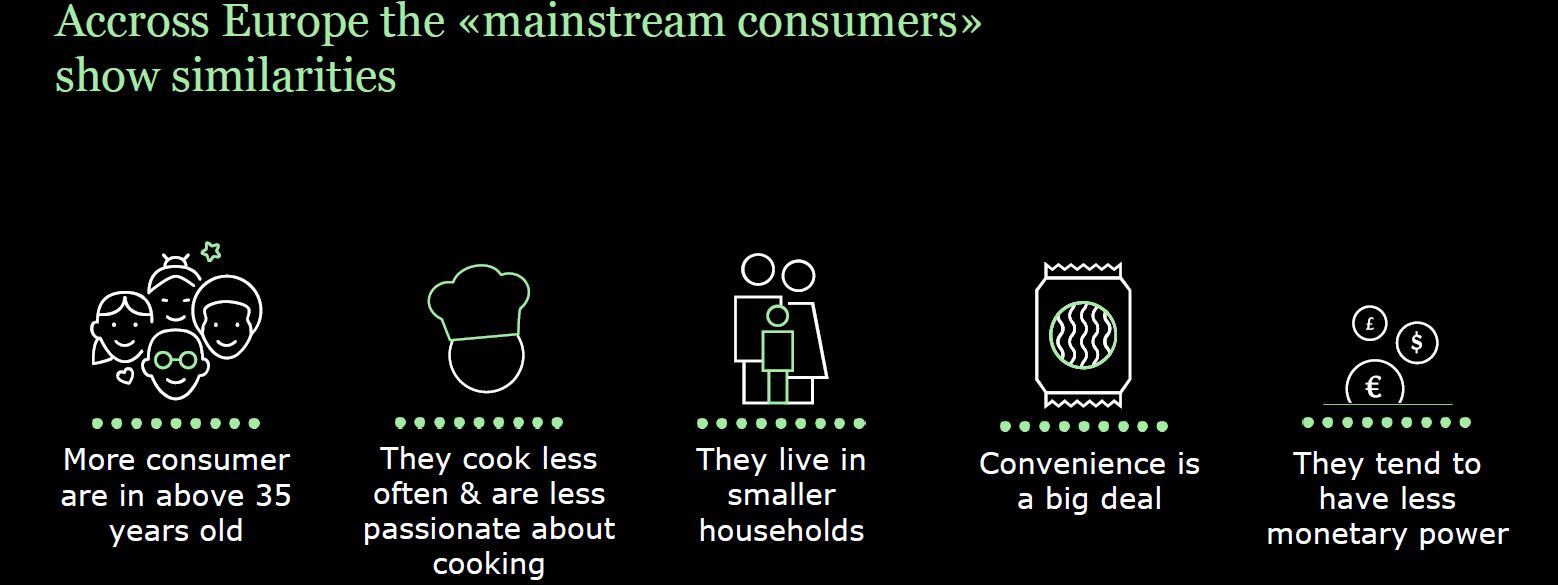

Via the research, Givaudan is probing how meat and fish analogues can attract and retain what it calls 'future mainstream consumers’. “We’re not fully convinced that the mainstream is already buying these products,” said Thomas Ullram, Innovation Director Savoury Europe at Givaudan Taste & Wellbeing Division. Most meat alternatives, he believes, continue to be bought by early adopters: those risk-takers and trendsetters who use new products before the mass market. These purchasers can have a strong influence on whether the latest launches can gain traction. But there are greater incentives for food manufacturers in the mainstream market, which “is where we believe these products sit”, said Ullram. However, currently only 38% of mainstream consumers are satisfied with existing analogues, according to the Givaudan research.

Mainstream consumers are not as forgiving as other cohorts, continued Ullram. But if they like a product, they are loyal and have strong repeat purchase. “There’s no second chance to make a first impression. But if you manage to get into the mainstream there are a lot of upsides. A convinced consumer will also influence other mainstream consumers.”

How can brands succeed in the mainstream?

What’s the key to attracting them? They need to be ‘holistically convinced’, said Ullram. “It’s not just about taste or the price. It’s a complete package between authentic taste, convenience, appearance and availability.” There’s no "one-size-fits-all" answer, added Huber. “Our research aimed to understand in more detail what ‘activators’ can make products more attractive for the mainstream consumer,” he explained.

Almost 40% of those polled said they would eat meat analogues ‘to try something new’. This leaves a door open for dishes and concepts to act as ‘conversation starters’ that can activate widespread adoption.

To this end, Givaudan has developed a vegan foie gras -- or faux gras -- by way of demonstrating to its customers how the meat alternative sector can produce polarizing and provocative dishes that can inspire NPD.

The faux gras combines pea proteins, coconut fat, masking tools and fattiness modulators to mimic the infamously rich, velvety texture and meaty, buttery flavour of the real thing. Givaudan’s creation boasts “a creaminess and extreme complexity of taste which is animalistic and specific,” stirred Huber. “It's a very authentic concept. If you bring that to a party or dinner with friends, it's something that has the potential to start a conversation and put a seed in peoples' minds about plant-based food and how exciting it can be.”