Allianz Global Corporate & Specialty (AGCS) said the average cost of a ‘significant’ recall is $12m with the ‘ripple effect’ meaning events can cost billions. A ‘significant’ event refers to product recall claims equal to or greater than €5m.

The firm analysed 67 insurance industry product recall claims from 28 countries across 12 sectors between 2012 and the first half of 2017. The automotive industry is the most impacted by recalls.

Cost for food and beverage

Food and beverage accounts for 16% of analyzed losses with the average cost of a significant product recall claim almost $9.5m (€8m).

Undeclared allergens (including mislabeling) and pathogens are a major issue as is contamination from glass, plastic and metal. Malicious tampering and even extortion incidents pose an increasing threat as well as food fraud.

Recalls for ethical and reputational reasons are also rising, such as child or slave labor in the supply chain or where food such as halal or vegan has been mislabeled or counterfeited.

Christof Bentele, head of Global Crisis Management at AGCS, said impact is a company having to recall or withdraw a product so incurring expenses and loss of profits.

“On the loss of profits side that happens by way of consumers not continuing to buy the product due to an accidental contamination,” he told FoodQualityNews.

“Impact clearly is financial and reputational on the firm and this is what we cover with our insurance. Impact meaning how much financial loss did the company incur which they wanted to get reimbursed via Allianz. If you look at the evolution of accidental contamination and malicious tampering of products with the introduction of more consumer safety regulations around the world you do have an increase of governmental interference as a recall or plant closure.”

Recall timelines depend on factors such as the product, market, the problem and how popular it is.

“From an insurance perspective we have limits, we will cover all of your incidents, your recalls, up to a certain amount of months or years,” said Bentele.

“We usually work with 12 months from the date that the revenues are declining. That is a significance difference from the loss because usually the loss of profit does not kick in the same day, it kicks in later when the public is aware.”

Bentele said its statistics show an increase in clients, not necessarily in recalls.

“When we look at our statistics of insured clients the number is definitely going up dramatically so more clients are buying financial protection for these types of things, therefore we see more of what is happening,” he said.

“The number of clients is growing, the number of recalls is growing does that mean more recalls in the food and beverage industry? Not necessarily, it means we have more incidents that reach us as an insurance company. The statistics of the overall food industry are pretty clear they say we have a stable number of incidents.

“From an insurance perspective we see more incidents, we see incidents being larger, we see supply chain having a bigger impact – the deeper the supply chain of a product the more costly a recall including the loss of profits, therefore for us as an insurance company, the bigger the loss.”

Increasing awareness in Asia

Products from Asia account for the majority of recalls in the US and Europe, reflecting the eastwards shift in global supply chains and historically weaker quality controls in some countries but increasing safety regulation and consumer awareness is ensuring recall activity is rising in the continent.

Incidents have gone up around the world but primarily in the US in terms of number and size of recalls while Europe is comparatively stable, said Bentele.

“More and more manufacturing has moved over to Asia therefore you see more things happening, we see on the insurance side a lot of European and American companies having issues and having to recall a product due to manufacturing in China,” he said.

“As the regulatory environment changes you will see that we will find more issues, for the insurance industry to have more losses and we are preparing for that, it does not mean we are reducing our appetite.

“You need to work with clients educating them how we are able to help on the financial side. Many times this works by way of self-insured retentions, how much will the company carry in terms of a loss scenario on their own. How much are you happy to say I am going to pay myself before the insurance kicks in and reducing the premium.”

Planning in peace times with SGS and red24

AGCS works with SGS to use genome sequencing and DNA testing and red24, a risk and crisis management specialist.

Bentele said it helps with pre-incident management measures to be implemented in a company.

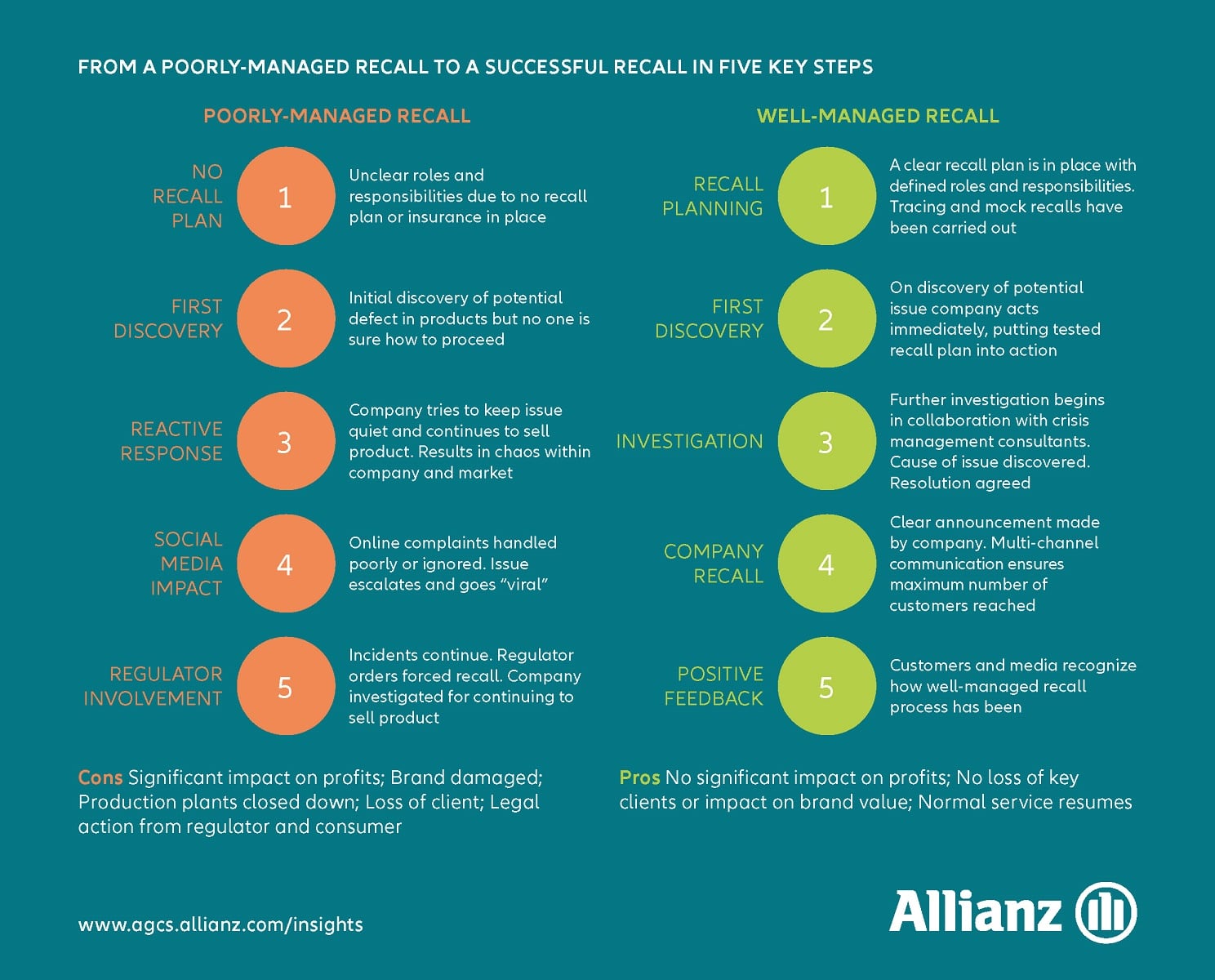

“We offer consulting companies who are experts in helping our clients to improve measurements such as the recall plan or crisis management plan or HACCP procedure; they are able to give guidance on how other clients operate. It always helps making a safer environment, a better product and what may happen if something goes wrong,” he said.

“We financially support the use of these services prior to an incident - so in peace times - and many of our clients use these services. Where people work or there is a process a product goes through things go wrong. That is why you buy insurance and prepare.

“If something goes wrong, we provide these consultants on a 24/7 basis so the client can access them and get support and advice on how to deal with authorities in the country where we have a problem as it might not be your home country.

“The food and beverage industry is investing in all geographies because they want to continue to grow. New markets bring opportunity but they also bring dangers and sometimes when you have an incident in those markets it can be a big challenge which is why they need to use the consultants.”

Bentele said its capital helps make sure the impacted company is able to continue to operate.

“Many times if you look at the lower end in terms of size of a company, so if you talk about a $100-$150m company, a $25m dollar loss is a massive loss, it eats the profit. The smaller the company the more important it is to buy insurance because it basically makes sure you can continue operating,” he said.

“With big companies the trouble is when something goes wrong the impact can be enormous. Everybody knows the product around the world so the impact is bigger than if you are a smaller company with a product that might not be known globally.”

Figures show companies it is not talking ‘about peanuts’, said Bentele.

“We are talking about a number that makes a difference. We wanted to say it is not like we have hundreds of incidents and they are all in the $1m-$2m area. We see losses way bigger and go beyond what a company is prepared to take as their own risk on their bottom line,” he said.

“Clients should be aware that when there is a significant impact you should do something about it or if you don’t want to do something about it you should at least know so your decision is an educated decision.”

Social media is great and not so great

Social media is having a major impact on the market, said Bentele.

“Social media is great for marketing purposes and when you want to recall a product to get hold of your consumers but it is not so great when you think about the type of information that is being disseminated, totally unfiltered and sometimes false,” he said.

“It is a major issue in all industries especially in food and beverage because it is an emotional product. Not only is the experience when you buy the product an emotional experience: ‘I’ve got my favourite cereal or beer’ but when something is wrong you are equally emotional: ‘I’m never going to buy this ever again’.

“In the food and beverage industry consumers react whether the information is right or wrong and that leads to an incident and we as an insurance company have to respond to this rather complicated issue when there is nothing wrong with the product.

“A solution is adverse publicity coverage: we would cover for such an incident provided the information in the public suggests our client had an incident of a magnitude where a consumer would have been hurt. It is difficult for insurance companies as it is a subjective risk and insurance works with objective risk where you can clearly identify what is wrong.”

Bentele added it has often come across old cases being brought up again.

“That happens quite often that things have been pulled out by the media…every time a company has an incident the media basically do their work and dig in the history to see if the company had this problem before, they find something and it is all over the press, that is the natural life circle of a product recall.”