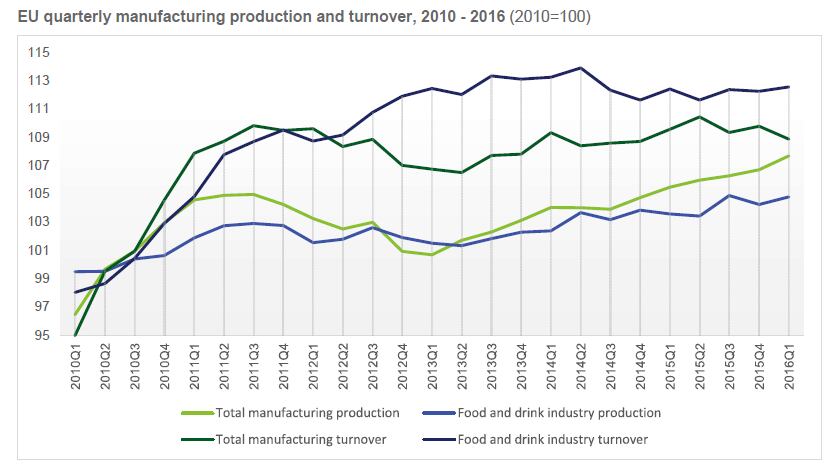

This was accompanied by an increase in turnover, up 0.3% on the previous quarter. The data also shows that Europe's food industry is outperforming the overall manufacturing sector as turnover for total manufacturing fell by 0.6%.

Overall, Europe's trade surplus for food and drink products reached €5.8 billion in the first quarter of 2016, with food and drink exports worth €22,801 million in Q1 2015 rising 2.2% to reach €23,303m in 2016.

The meat sector was the biggest winner with a 33% increase in its trade balance year-on-year, followed by 12% for chocolate and confectionery, while the trade balance for oils and fats fell by 8% for the same period.

Which countries are performing the best?

According to calculations by Eurostat Easy Comext, Ireland grew its food and drink production index by the biggest margin in the region, with a 6.1% increase from the previous quarter, although data was not available for some member states including the UK, Cyprus and Croatia.

Other countries which registered positive growth rates included Bulgaria (2.6%), Latvia (3%), and Greece (2.2%).

Other countries registered distinctly negative production trends. Austria saw its food and drink production fall by 8.2% while Portugal continued its downward trend, albeit at a lesser rate. In 2015 its production index fell by 19% between Q3 and Q4 2015, although this had dropped to -4.1% between Q4 2015 and Q1 2016.

Price changes

The prices of some main agricultural commodities also fell. Soft wheat prices fell by 14.2% while for dairy, whole milk powder fell by 19.1% to an average Q1 price of €1,878 per tonne. Skimmed milk powder saw its price fall by 19.2% in Europe and 27.6% worldwide.

Meanwhile for white sugar there was a 2.4% rise year-on-year in Europe compared with a 15.3% rise in world price, bringing the commodity to an average of €430 per tonne in the first quarter of 2016.

According to a previous FDE report, Europe's share of global food and drink exports fell in the decade spanning 2002 to 2012, dropping from 20.5% to 16.1%.