What’s the new research?

The Business Benchmark on Farm Animal Welfare (BBFAW) assessed 150 food companies in 23 countries, including 63 manufacturers and producers, as well as retailers, wholesalers, restaurants and bars.

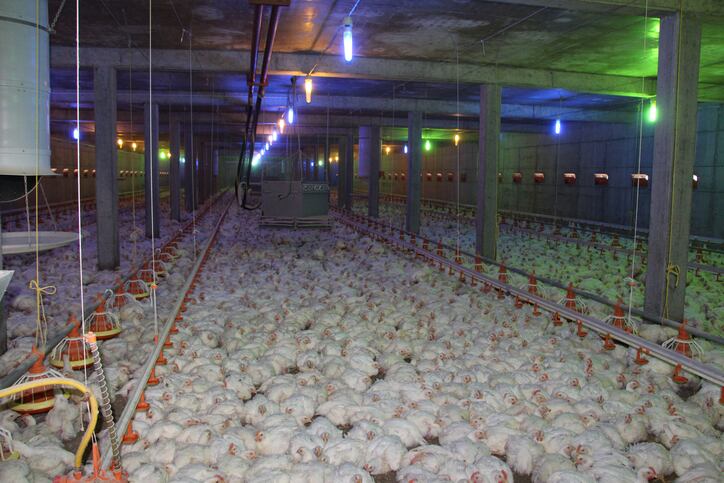

Firms were assessed on their approach to managing farm animal welfare in four areas: management commitment and policy, governance and policy implementation, leadership and innovation, and performance reporting and impact. This year, the scores were more heavily weighted towards reporting and impact – for example, the proportion of animals in their supply chain that are free from confinement and pre-slaughter stunned, and whether animals arrive within specified maximum journey times.

So, how did manufacturers do?

Not bad. Meat processor Cranswick and fresh food supplier Noble Foods were two of only five companies (from 150) to feature in tier 1 of the benchmark (reserved for those that have taken a “leadership position” on the issue).

Noble actually dropped down a level last year, but jumped back up thanks to better performance reporting for laying hens and dairy cows in its supply chain (it makes Gü desserts). The company’s position on the responsible use of antimicrobial medicine also helped: Noble doesn’t permit the routine prophylactic use of antimicrobials, but acknowledges that “controlled intervention may be required”.

Several other manufacturers also managed to move up a rung, including Groupe Danone and Vion Food Group (up to tier 2). Kraft Heinz managed to jump from tier 5 to tier 3 – progress that was largely attributed to it publishing updated animal welfare policies, as well as more detailed reporting on management controls and improvement targets. Globally, Kraft Heinz is switching to using only cage-free eggs across all its operations by 2025, whilst in Europe its goal is to achieve 100% free range by 2020. The company has also committed to source all its pork globally from suppliers that do not use sow stalls.

How about the other big firms in there?

Unilever and Cargill remained in tier 2, while 2 Sisters Food Group, Nestlé and Premier Foods remained in Tier 3.

Dean Foods and General Mills went backwards, however, dropping from tier 4 to tier 5.

Other laggards in food manufacturing included Mars and Müller, which both still languish in tier 6, with “no evidence” that animal welfare is on their business agenda. Those that have recognised it as an issue but done little about it, include Associated British Foods, Campbell Soup Company, General Mills and Lactalis.

Are businesses taking this seriously, then?

Most of them, yes. The fact that 17 companies achieved tier 1 or 2 status and 63 are now in 3 or 4 “tell us that farm animal welfare continues to be recognised as a strategic opportunity by a significant number of global food companies”, the full report reads.

There is also evidence that leadership and improved management practices are starting to become “institutionalised” – perhaps not surprising given increased consumer focus on animal welfare. Of the 150 companies covered by the Benchmark, 64 (43%) now have explicit board or senior management oversight of farm animal welfare, and 106 (71%) have published formal improvement objectives for farm animal welfare. This is way up on 2012, for example, when the figures were 22% and 26% respectively.

BBFAW noted there had been consistent year-on-year improvement (this is the seventh time the analysis has been run). For example, 53% of companies now have explicit board or senior management oversight of farm animal welfare. UK companies achieved a significantly higher overall average score (61%), compared to companies in Europe (34%) and North America (28%).

What’s the picture globally?

Look at the results from all 150 companies and it quickly becomes clear how much more there is to be done. The overall score was 32% (manufacturers and producers managed 31%), which was lower than last year’s 37% due to the change in scoring mentioned above and all the new companies assessed (negative publicity can often deliver a kick). Still, adjusting for all that and the score is still only around 40%.

Indeed, better processes have not necessarily led to better performance. For example, just over half of companies report on the proportion of animals that are free from close confinement – a key issue for most manufacturers assessed – yet only one in four provide any information on the proportion of animals that are stunned prior to slaughter, whilst only one in five companies reports on live animal transport times. This could well appease the average consumer but it isn’t enough.

“While we are seeing a gradual improvement in the proportion of companies reporting animal welfare performance data, the quality of performance reporting – in terms of consistency, comparability and coverage – is still not fit for purpose,” the authors note.

Is pressure mounting?

Yes, but it’s left food businesses a bit stuck. Whilst 85% of the companies surveyed by BBFAW said customer interest was the primary driver for higher standards in their supply chains, some 82% said that customers and clients still weren’t willing to pay the price for higher animal welfare. Some will see the business opportunity of course, whilst others will have noted that failure to act isn’t just a reputational risk anymore. Investors also want to know that food companies are effectively managing the business risks and opportunities.

“Investors need to have confidence that companies are delivering the outcomes that they aspire to, in terms of improved farm animal welfare and in terms of better business risk management,” said Dr Rory Sullivan, one of the report’s authors. “The Benchmark exposes the gap between policies and performance, highlighting those companies whose governance processes work effectively and those that are not fit for purpose in a world where farm animal welfare is an increasingly important driver of business value.”

The full benchmark report is available here.