Food & beverage trends: M&A activity points towards major shifts in consumer behaviour

On the face of it, the 57% volume increase in M&A (mergers and acquisitions) in the UK food and beverage industry in 2023 points towards a thriving trade, with companies competing for dominance by expanding their portfolio and consumer reach. However, taking a closer look, it’s clear that some areas of the industry are doing better than others, with larger companies capitalising on smaller companies’ inability to absorb increased production costs. In addition to this, the value of these contracts has been decreasing, with only 8% of transactions above £50m (€58.2m), falling well below the five-year historic average of 15%.

Across the industry, 75% of deals completed in 2023 had an estimated value of £10m or less, this is up from 69% of deals in 2022. Both 2022 and 2023 experienced a high volume of low-value deals compared to the five-year average between 2017-2021 (57%).

What’s hot and what’s not?

Beverages was the most active category in 2023, accounting for 28.4% of all M&A. It is also the clearest example of the shift we are seeing in the market as 80% of all deals had an estimated value below £10m.

A large number of these low-value transactions were for small beer producers. Furthermore, 25% of all beverage company acquisitions were beer producers being acquired out of administration. This follows in what is believed to be an oversaturated market in addition to an intense period of cost inflation.

Mark Lynch, partner at Oghma Partners, which provides advice on acquisitions, divestments and strategy to the European and UK food, beverage and packaging industry, said: “The key issues that impacted M&A in 2022 dragged over into the start of 2023 with inflationary cost pressures, the cost of living crisis and the increased cost of debt suppressing the higher value deals in the first half of the year (with the exception of the Glanbia Cheese acquisition).”

The trend of consumers, particularly younger consumers, away from alcohol and towards a healthier lifestyle, could also be partially responsible for the issues faced by beer producers as adult soft-drinks, health drinks such as smoothies and kombucha, and CBD drinks, continue to see a rise in consumer interest.

The next highest volume area for M&A was Grocery / Confectionery, accounting for 17.2% of all M&A. In contrast to the low-value deals within the beverage industry, this part of the sector included some notably high-profile, high-value deals.

In September 2023, British company Finsbury Food Group was acquired by asset management firm, DBAY Advisors, for an estimated £143.4m. November saw the acquisition of British brand, Hotel Chocolat by US confectionery giant, Mars, for an estimated £534m. The deal represented a 170% premium on Hotel Chocolat’s share price and was almost triple the average of the previous 60-day period. Mars has also committed to keeping Hotel Chocolat’s manufacturing within the UK thus protecting existing employee jobs.

Is the honeymoon over for the plant-based foods?

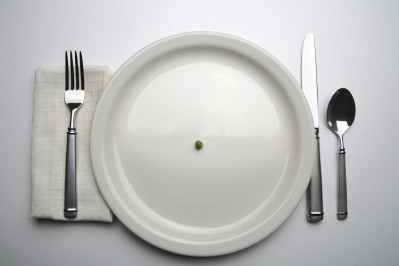

The last decade has seen the rise and rise of plant-based products, as an increasing number of people turned to flexitarian diets for health or sustainability reasons. The industry was quick to respond with many new plant-based food producers launching to meet this new demand. In addition to this, existing producers launched new plant-based lines to capitalise on the trend and avoid losing their customers to their new competitors. However, 2023 showed the first clear signs that this upwards trend is slowing as consumers turn away from plant-based options.

“UK plant-based companies have particularly struggled in 2023, with three notable businesses being acquired out of administration. In June, Vegan Food Group (formerly known as VFC) acquired Meatless Farm, in July VBites acquired Plant and Bean, and in December it was announced VBites had gone into administration,” Lynch told this publication.

”It hasn’t just been the smaller players struggling, in August Beyond Meat sales had fallen by almost a third over the previous three months, Heck announced in May it was slashing its range of meat-free products from ten to two, Pret a Manger has closed half of its vegetarian and vegan only outlets, Nestlé axed its Garden Gourmet plant-based vegan brand in the UK and LoveSeitan collapsed in August.”

Commenting on the decision to pull Garden Gourmet products from the UK and Ireland, a spokesperson for Nestlé said, “the UK plant-based market is very crowded and competitive and despite the investment we’d put behind the brand, we learnt that establishing and scaling a new brand in retail would require more investment over a longer period of time than originally anticipated. We therefore took the decision to remove Garden Gourmet from Retail in the UK and Ireland last year as we wanted to focus our investment and resources on strengthening our Core portfolio, rather than the significant investment required in new brands. Garden Gourmet products are still part of our UK and Irish out-of-home offering through our Nestlé Professional business.”

What’s fuelling the current move away from plant-based?

A plant-based diet can be incredibly healthy, incorporating plenty of fruits, vegetables, nuts and grains. However, many people have also been including ultra-processed meat-free products into their diets to supplement meat itself. Recent studies into the potential health impacts of ultra-processed foods have led to increased media attention on the subject, and raised concerns amongst consumers.

As reported in FoodNavigator earlier this week, consumers are paying more attention to what’s on their plate, including when it comes to plant-based meat.

In addition to this, the cost-of-living crisis has forced many consumers away from meat-free products which are typically higher in price.

“We suspect that the meat-free shake out will continue this year,” suggested Lynch. “However, fewer players with greater scale should be able to provide a focused marketing effort to help re-engage the consumer and retailers in due course. The long-term factors that drove excitement in the sector in the first place are unlikely to go away, those businesses and brands that survive this shakeout will emerge the winners over the longer term in our view.”

This sentiment was echoed by a Nestlé spokesperson who said, “We’ve continued to innovate, most recently in the fish alternative space but also promoting veg-forward options. Our belief in the category and more plant-based diets going forward remains strong.”

What can we expect from the food & beverage industry in 2024?

Overall, the outlook for the food and beverage industry in 2024 is positive. Economic recovery, leading to a lowering of inflation, will make financial operations for manufacturers more manageable. This strengthening of the economy, coupled with the improvement within the debt funding environment, will also likely help to encourage an increase in high-value M&A in 2024.