Is this the plant-based meat future? Summary

- Beyond, formerly Beyond Meat, expands from plant-based meat toward protein focused drinks

- Experts view shift as diversification, not collapse of plant based sector

- Consumer interest declines as concerns grow around affordability and processing

- Data shows only nine percent choose plant alternatives over traditional meats

- Hybrid meat rises offering familiar taste with reduced environmental impact

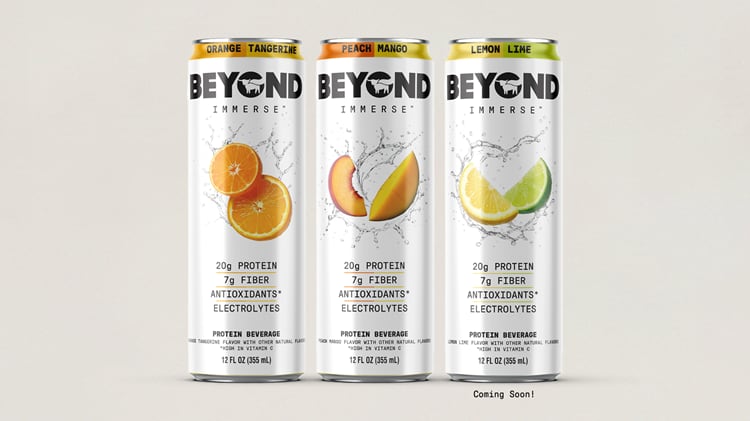

Beyond, the company formerly known as Beyond Meat, is now selling drinks.

It announced last week that it plans to release a new range of protein-rich, wellness-focused functional drinks, tying it into the functional drinks boom of the past few years.

Once one of the flagship brands of the plant-based trend, Beyond Meat is now consistently seeing revenue decline and falling sales.

The overall category has also seen decline for quite some time. But is this diversification an omen for the sector, a sign that it’s well and truly run out of steam? Or is it an isolated event that says more about Beyond and the functional drinks boom than the plant-based trend in general?

What Beyond’s diversification says about plant-based meat

In terms of Beyond’s own history, the expansion to protein drinks is the latest and most drastic step in an already existing effort to reposition itself.

Last year, the brand dropped ‘meat’ from its name to be simply Beyond. Furthermore, it announced a new ‘Beyond Ground’ product, which would focus on being high in protein rather than mimicking meat explicitly.

The release of Beyond’s protein drinks further aligns with this strategy.

The decline in the plant-based category as a whole is certainly linked to this trajectory. But, says Lauren May, a researcher at the Future of Food Institute, it is “maybe less an indicator of declining interest in plant-based meat specifically, and more an attempt to capitalise on the wider consumer demand for protein across categories“.

The move does not, necessarily, indicate a definitive end to plant-based meat, suggests Marija Banovic, associate professor of consumer behaviour at Aarhus University. It should be interpreted “as a form of portfolio diversification rather than as definitive evidence of a structural decline in plant-based meat”.

While the familiar headwinds against plant-based, such as affordability and scepticism around ultra-processed foods, remain, Beyond’s product release does not indicate a major departure, instead falling into the high-protein trend, as well as the company’s already existing willingness to diversify.

Beyond did not immediately respond to a request for comment.

Could plant-based recover?

While the end isn’t necessarily nigh, plant-based meat has certainly seen better days. According to consumer research platform Circana, 40% of European consumers are opting for healthier meat, fish or poultry, compared with just 9% going for plant-based alternatives. But what could stall the plant-based meat decline? What could save the category?

There is one thing that won’t: a narrow focus on sustainability. “A sustainability-first narrative alone is not sufficient to shift consumer behaviour, particularly at a time when health concerns around ultra-processed foods are increasingly influential,” says Future of Food Institute’s May.

“To regain momentum, plant-based meat companies will need to convincingly demonstrate that their products are not only sustainable, but also natural and healthy.”

Indeed, high levels of processing have played a key role in turning consumers away from plant-based meat.

Narratives around sustainability “remain salient”, according to Aarhus University’s Banovic, particularly for younger consumers. But they must be paired with innovation in developing products with a clear nutritional benefit and reduced processing.

The rise of hybrid meat

As plant-based meat declines, hybrid meat has increased in popularity. Hybrid, which is part plant-based meat and part the real thing, aims to give consumers the taste and texture of real meat but with a lower carbon footprint. Ingredients companies such as Roquette and Beneo are confident that the trend is on its way up.

Hybrid meat products “address two persistent barriers associated with fully plant-based alternatives, namely sensory acceptance and familiarity,” says Branovic.

Hybrid meat products, she says, appeal to consumers who want to make incremental contributions to sustainability without sacrificing familiar taste and texture.

Not everyone agrees that hybrid is the next big thing, however. “In theory, hybrid products could be positioned as the best of both worlds: the taste and texture of meat combined with higher fibre content and improved sustainability,” says Future of Food Institute’s s May.

“In practice, however, current consumer perceptions suggest the opposite. Many appear to view hybrid products as the worst of both worlds, offering compromises on taste as well as on sustainability and ethical considerations.”

She suggests instead that manufacturers could add plant-based foods to meat products by stealth. “Think of your grandma’s meatballs. She would add chopped onions, to make them taste better. Also, because onions are cheaper than meat, she could make more meatballs.”

While the plant-based sector isn’t over, it’s changing. Whether brands try their hands at hybrid, or diversify into entirely new categories, the future is far from certain.