Global cheese market growth – key trends and forecast summary

- Global cheese market valued at $105.5bn, reaching $178.5bn by 2035

- Growth accelerating to 4–5% CAGR, up from historical 3–3.5%

- Fast food expansion in Asia and Middle East boosts mozzarella demand

- Premium, plant-based and functional cheeses driving consumer interest

- Europe and North America lead per-capita value, private label rising

The global cheese market is thriving. It holds a value of $105.5bn (€89.32bn) and is projected to hit $178.5bn by 2035, according to analytics group Future Market Insights.

“The global cheese market has established itself as one of the most resilient and steadily expanding segments of the broader dairy industry,” says Nandini Roy Choudhury, principal consultant for food and beverage at Future Market Insights.

What’s more, market growth is actually speeding up - growing at a CAGR of roughly 4-5%, up from the long-term historical trend of around 3-3.5%

And this growth is not limited to any one region. It’s a combination of mature demand in Western countries and strong, sustained expansion in emerging markets.

What’s driving growth in the cheese market?

Future Market Insights’ latest report on the global cheese market reveals the significance of foodservice and quick-service restaurants in supporting growth. Pizza chains, burger outlets, and bakery-café formats continue to expand aggressively in Asia and the Middle East. Cheese – especially mozzarella, processed slices, and cream cheese – forms the cornerstone of these menus.

“In many Asian cities, the ‘pizza moment’ that swept across the US and Europe decades ago is only now scaling, leading to outsized consumption growth,” explains Choudhury.

In Europe and North America, growth is found to be slower but value expansion is strong.

“Both regions already have very high per-capita consumption, but the rise of speciality cheeses, PDO/PGI certified products, and indulgent formats such as triple-cream or aged varieties is helping sustain momentum,” says Choudhury.

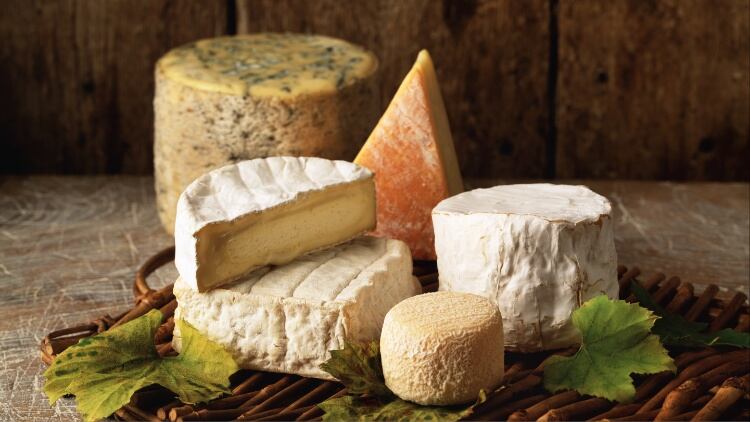

Premiumisation is also fuelling growth here, with brands increasingly highlighting natural and artisanal cheeses.

The outlook also highlights the interplay between private label and branded products.

Private label cheese sales, particularly in North America and Europe, are capturing greater household share, as price sensitivity rises. In the US, private label already accounts for around two-fifths of cheese sales, and European retailers are pushing further into premium private-label ranges to protect margins while retaining shoppers during inflationary periods.

Elsewhere, Latin America presents a diverse picture. Brazil, Mexico, and Argentina dominate consumption, but each market behaves differently.

“Brazil has strong domestic cheese traditions and growing demand for mozzarella and cheddar due to pizza and burger culture,” says Choudhury. “Argentina, with its deep dairy roots, balances domestic production with exports, and Mexico is increasingly influenced by US dietary patterns and quick-service restaurants penetration.”

The broader region faces challenges of economic volatility and currency fluctuations, but structural drivers such as a young population, a growing middle class, and urbanisation are creating opportunities for both domestic producers and global entrants. Latin America is also seeing greater interest in specialty cheeses, especially among affluent consumers.

Plant-based is booming

The plant-based cheese category, though small by comparison to dairy cheese ($3–3.5bn), is growing at double-digit rates.

And, while its trajectory has slowed since 2022, it remains one of the fastest-growing sub-segments.

“Innovations in fermentation, microbial rennet, and cashew-based formulations are gradually improving sensory quality, and health- and sustainability-conscious shoppers continue to experiment,” says Choudhury. “Traditional dairy companies such as Bel Group and Danone are either launching or reshaping their alt-cheese portfolios, signaling long-term commitment despite short-term rationalisations.”

Functional cheeses

Another factor driving growth is the rise of functional and health-orientated cheeses.

Lactose-free cheese has grown rapidly, particularly in Europe and North America, as awareness of lactose intolerance expands. Reduced-sodium and low-fat cheese formats are also gaining shelf space, catering to older consumers and those monitoring cardiovascular health. At the same time, high-protein and organic labels are being leveraged to position cheese as part of the health-and-wellness lifestyle.

For parents, fortified cheese sticks and snacks marketed as calcium-rich options for children are gaining popularity. This aligns with broader snacking trends and the push for convenient, portion-controlled formats. Functional positioning is becoming a differentiator that allows both established brands and private labels to carve out space in crowded aisles.

Challenges impacting cheese market

Despite its growing success, the sector is facing significant challenges. Volatile milk prices, high energy costs, and labour shortages weigh heavily on producer cost structures.

However, some of the larger dairy companies have responded with capacity expansions, designed around automation and energy efficiency. Arla’s €59.4m cream-cheese expansion in Denmark is just one of the many examples of this.

Similarly, mergers and acquisitions, such as Lactalis’s pending acquisition of Fonterra’s consumer dairy businesses, highlight the push for global scale.

Cheesemakers have also been hit by the rising health and wellness movement, with consumers questioning fat and salt content. Though savvy brands are focussing on the benefits.

“On one hand, concerns about fat, salt, and calorie content temper demand,” says Choudhury. “But on the other, cheese is being rebranded as a protein-rich, nutrient-dense product that can play an integral role in modern diets.”

The future of cheese production

The resilient demand in mature economies and rising demand in emerging markets makes cheese one of the strongest growth stories in the global dairy industry.

This creates opportunities across the spectrum – from low-cost, high-volume processed cheese for quick-service restaurants, to premium niche products sold through speciality retail and direct-to-consumer channels.

With innovation, investment, and strategic positioning, producers are well-placed to navigate challenges and seize the opportunities ahead in this $178.5bn global growth story.