Gone are the days when snacks were just an inbetween meal fix. Now, they’re being positioned as tiny, edible therapists.

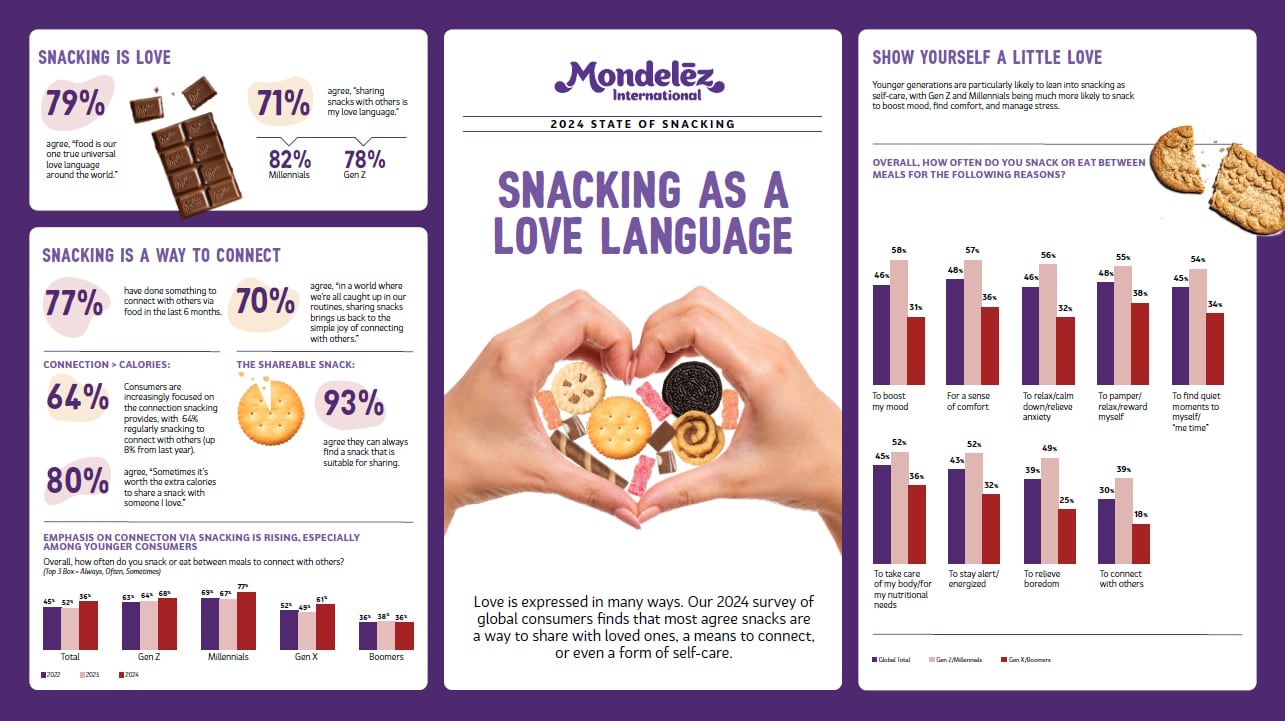

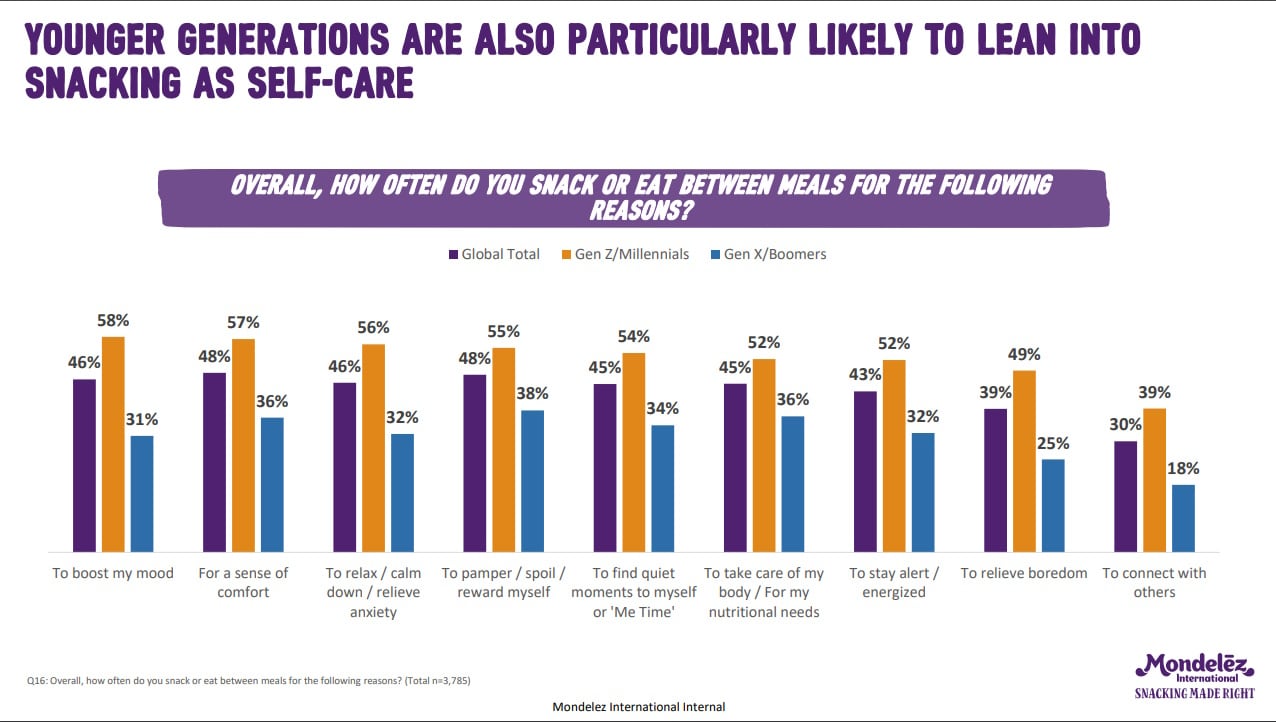

Mondelez International’s 2024 State of Snacking report shows 71% of global consumers say sharing snacks is their ‘love language’ – that’s an 8% jump from 2023 and a 15% increase since 2021. This trend is even more pronounced among younger consumers, especially Millennials and Gen Z. For 73% of this demographic, a favourite snack has the power to turn their mood around instantly.

Snacking isn’t just about self-care, though – it’s about connection. 64% of the nearly 4,000 adults surveyed by The Harris Poll (on behalf of Mondelez) regularly snack to bond with others, an 8% increase from last year. That number climbs to 68% among Gen Z and Millennials, showing how snacking has become a social ritual just as much as a personal indulgence.

But let’s be real – does handing someone a cookie really count as an act of emotional depth, or is this just a ramped up strategy by Mondelez to sell more Oreos? By branding it as ‘self-care’, Mondelez’s report is selling the idea that those cookies and chocolates are tiny, edible acts of self-love.

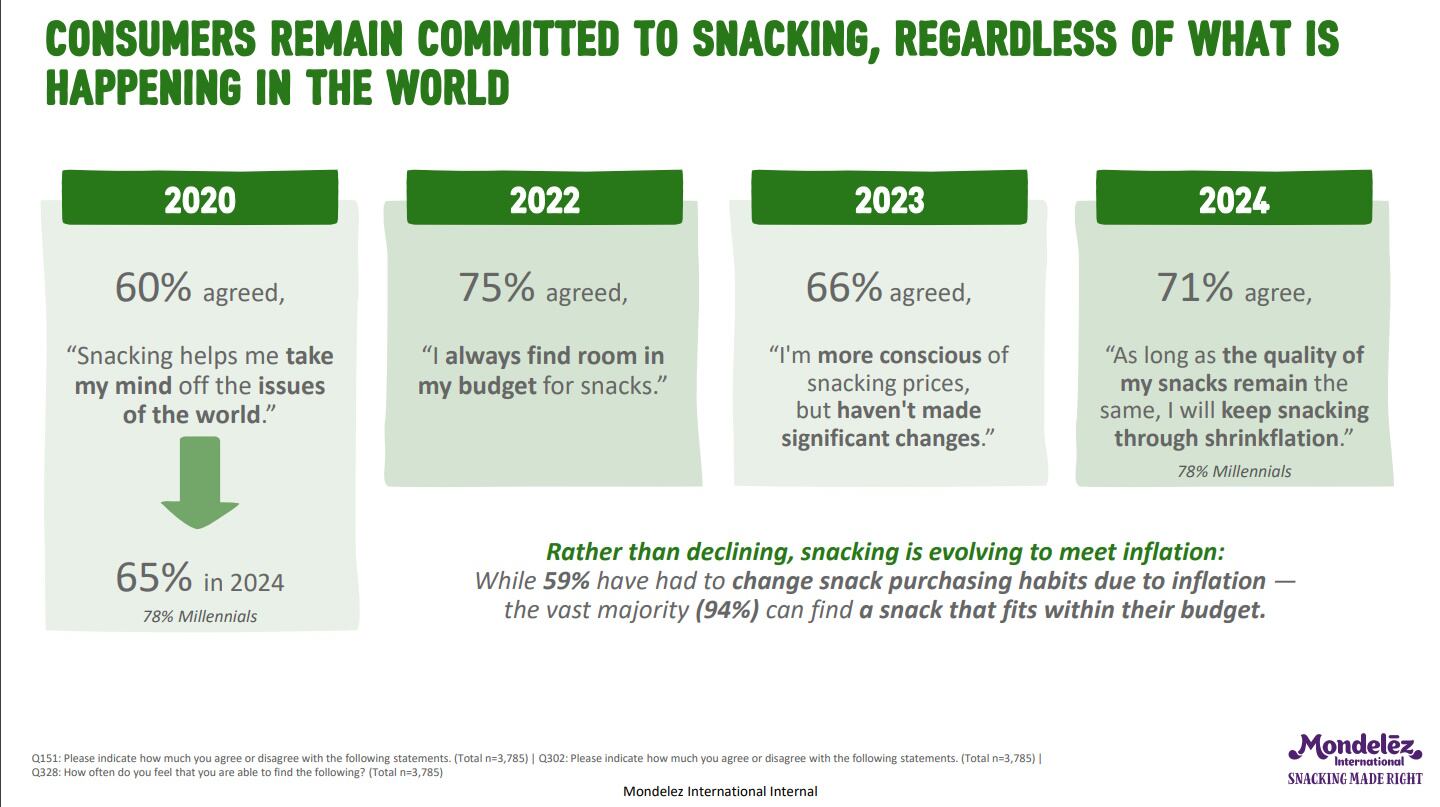

It’s a strategic move, and a smart one, crafted to capitalise on a trend that is not slowing down anytime soon. The report finds 65% of global consumers say they’re snacking more than they did a year ago, rising to 78% among Millennials and Gen Z. Plus, 81% snack to escape daily stress, up from 77% in 2023. More than ever, snacks aren’t just fuel – they’re a moment of relief in an otherwise chaotic world.

The rise of all-day snacking

The numbers don’t lie: 91% of global consumers have at least one snack per day, with 61% having two or more. What’s even more telling? 62% say they prefer grazing on small snacks throughout the day instead of eating three big meals, up from 58% in 2022. And if you zoom in on Millennials and Gen Z, 71% say they’d rather snack all day than stick to a rigid meal schedule.

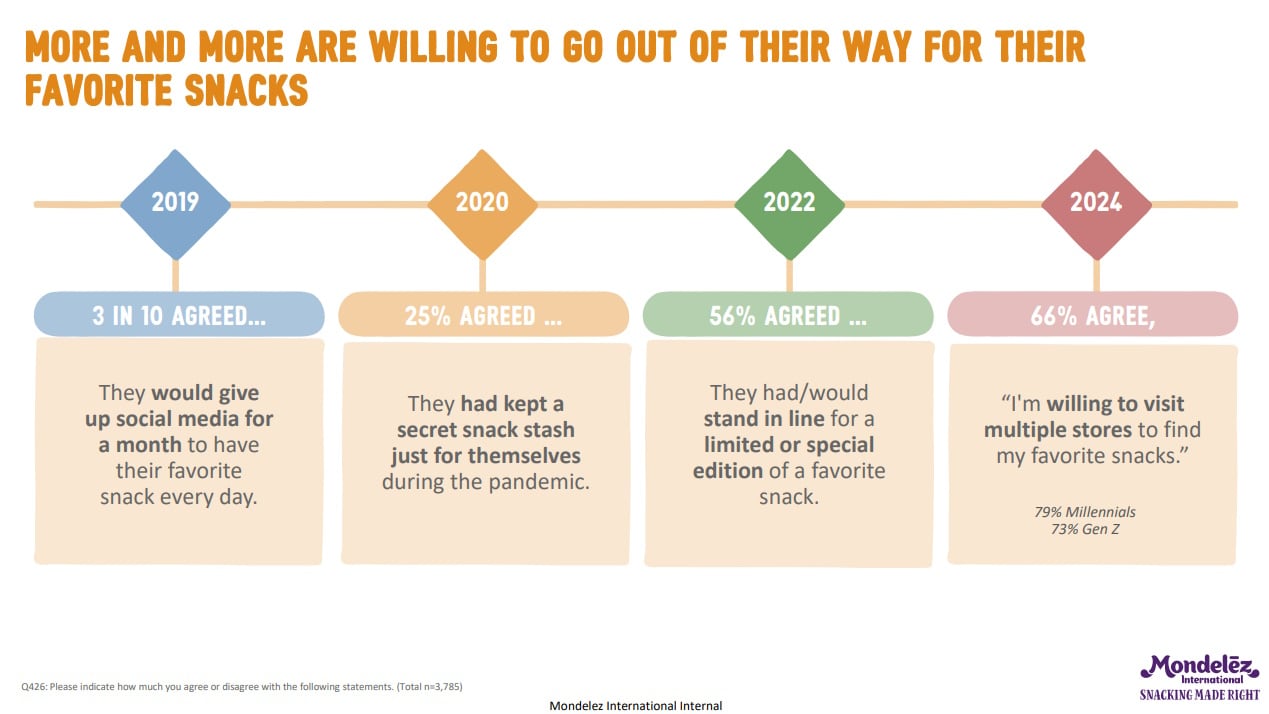

The snacks industry has jumped on this trend, with switched-on manufacturers ensuring that whatever your emotional state – stressed, happy, bored, tired – there’s a snack for that. The report also found 75% of consumers get excited about discovering new snacks, and 67% consider themselves adventurous snackers.

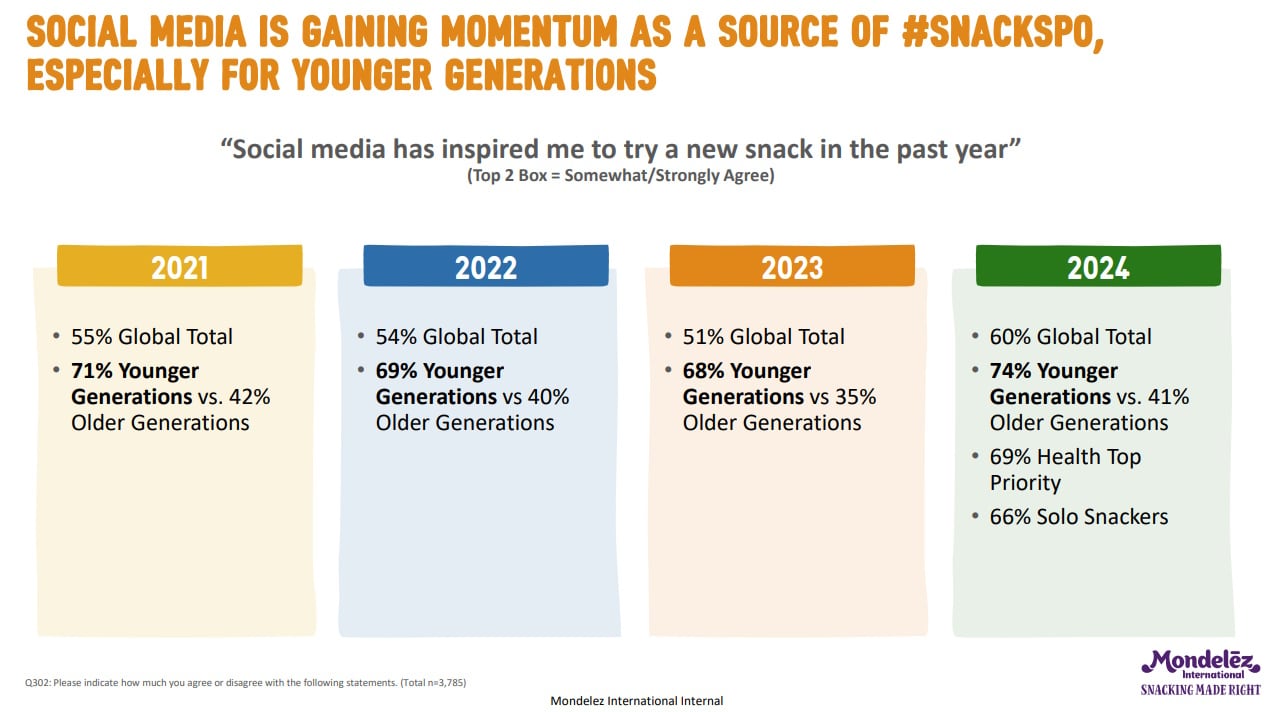

Social media is a big driver of this, with 60% of consumers saying they’ve been inspired to try a new snack because of online trends. Influencers showcasing exotic snack flavours and limited edition treats have only amplified the cultural significance of snacking.

The psychology of snacking is also shifting. Once seen as a way to satisfy hunger between meals, it’s now perceived as an experience in itself. Consumers are seeking out snacks that provide an emotional boost, whether through nostalgic flavours, unique textures, or satisfying indulgence.

The rise of premium snacking – where consumers prioritise high-quality ingredients, artisanal production, and even sustainable sourcing – is another indicator that snacks have moved beyond just convenience.

Although accessibility is still a huge factor. 78% of consumers say they prioritise ease when choosing a snack, up 5% from 2022. And the snacking sector is keeping up: with more meal-replacement snacks hitting the shelves. In fact, 41% of consumers are now opting for protein-packed or fortified snacks instead of traditional meals, particularly in urban markets where fast-paced lifestyles demand grab-and-go options.

Striking a balance

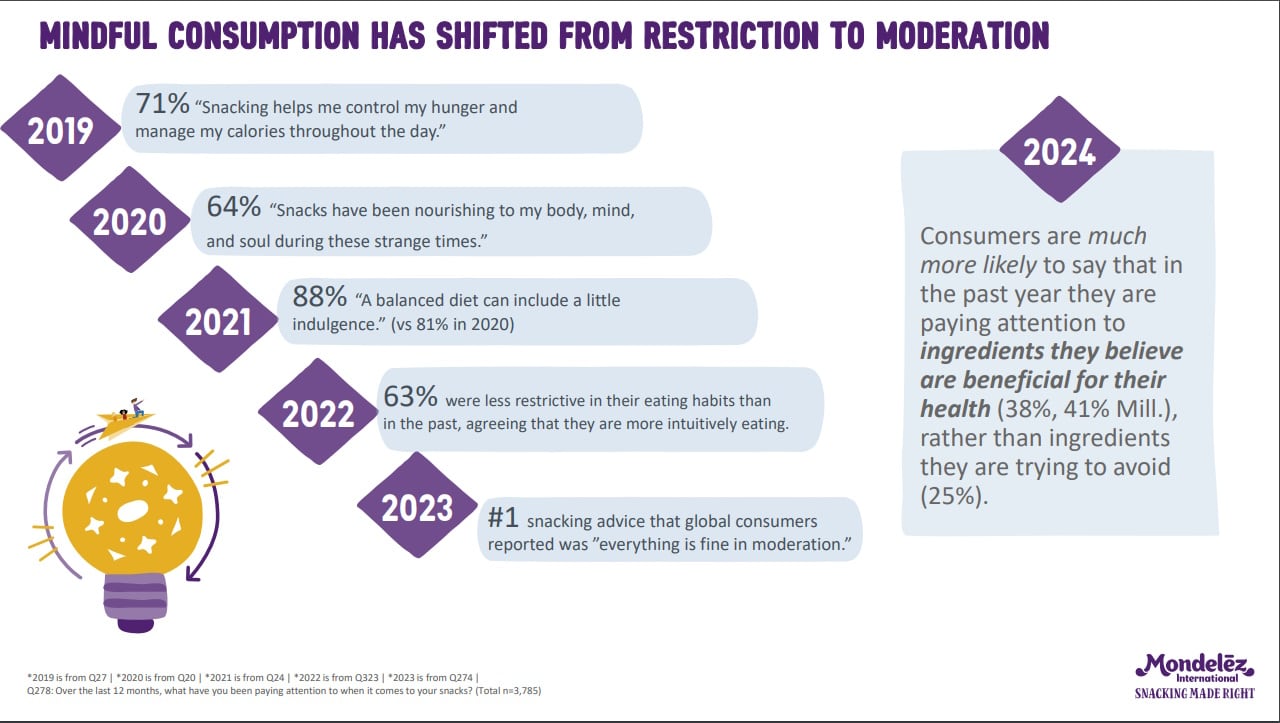

Snacking today is a balancing act between indulgence and mindful consumption. The concept of ‘permissible indulgence’ is on the rise, with 76% of consumers saying they just want to enjoy their snacks without worrying about ingredients or calories. This trend reflects a shift toward food freedom, but it also raises the question: are we genuinely embracing mindful eating, or are we simply justifying eating more?

The report highlights that 96% of consumers practice mindful snacking, with 81% focusing on the sensory experience of what they eat, up from 75% in 2022. While this suggests greater awareness, it doesn’t mean consumers are cutting back. 76% still say they want to enjoy indulgent snacks without guilt, proving that pleasure remains a key motivator.

At the same time, health-conscious snacking is gaining traction. 32% of North Americans eat at least one healthy snack per day, while 28% of Europeans do the same. Globally, 74% of consumers prioritise snacks with high-quality nutrition, a 6% rise since 2021. People are actively choosing protein-packed, fibre-rich, and vitamin-enhanced snacks, steering clear of artificial flavours and preservatives.

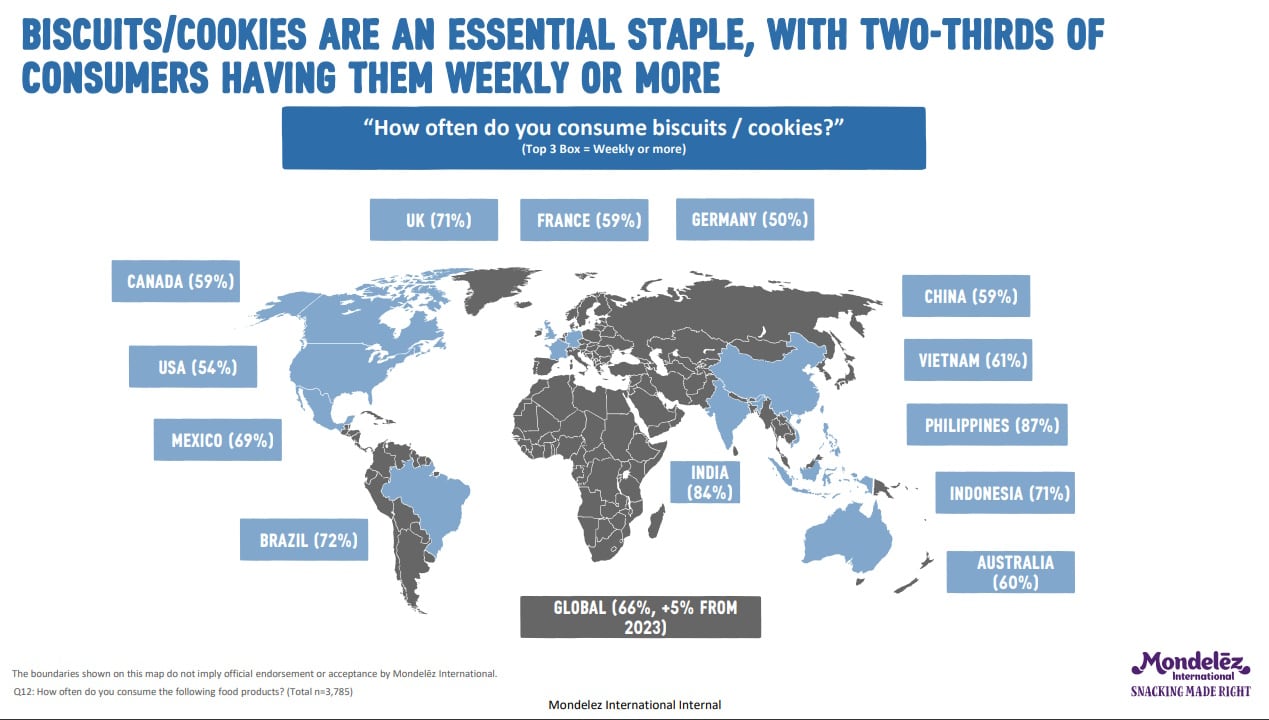

The reality is, classic comfort foods aren’t going anywhere. 73% of consumers say they “can’t imagine a world without chocolate”, up 6% since 2019. And cookie, cracker, and biscuit consumption has climbed 5% in the past year alone, showing that while consumers want healthier options, they’re not willing to give up their favourite treats.

With 87% of consumers agreeing that “life is more fun with a bit of indulgence”, brand owners like Mondelez are seizing the opportunity to redefine snacking. Instead of positioning it as an unhealthy habit, they’re shaping it into a lifestyle – one where balance, enjoyment, and a little bit of indulgence are all part of the equation.

The TikTok effect

If you’ve ever tried a new snack just because you saw it on TikTok or Instagram, you’re in good company. The report shows 60% of consumers have picked up a snack based on social media recommendations, a 9% increase from last year.

Viral food trends and influencer endorsements are making snack discovery more exciting than ever.

And people are loving the adventure: 75% say they get a thrill out of finding new snacks, while 67% consider themselves ‘adventurous snackers’, up 8% from 2023. Gen Z, again, is leading the charge, actively hunting for limited edition snacks, exotic flavours, and innovative textures that offer something different from the usual grocery store options.

Social media engagement is growing fast, too. Brand interaction on snack-related content has jumped 12% over the past year, and 41% of consumers say they trust online reviews and recommendations when choosing snacks. Simply put, the digital landscape is reshaping how consumers discover and buy snacks: and brands are paying attention.

What’s next?

The industry is already responding to changing consumer expectations with innovation and sustainability efforts. The report finds 80% of consumers want snacks that align with their values, like sustainability, clean ingredients, and eco-friendly packaging. As a result, plant-based, organic, and responsibly sourced snacks are hitting the market at record speed.

Technology is also stepping up its role.

AI-powered personalisation is changing the game, with companies using data to offer custom snack recommendations based on individual preferences.

Whether it’s an app that tracks your mood and suggests a snack or a direct-to-consumer service that curates a personalised snack box, the future of snacking is getting smarter and more tailored.

Another big trend? Mood-enhancing and functional snacks. Ingredients like adaptogens, probiotics, and nootropics are showing up in more products, promising benefits beyond basic nutrition. With consumers looking for foods that support mental clarity, digestion, and energy, functional snacking is on track to grow 7.2% annually over the next five years.

A booming industry with no signs of slowing down

Snacking isn’t just a trend – it’s a lifestyle. The industry is expected to grow 6.5% annually, fuelled by the demand for convenience, personalisation, and better-for-you options. Premium and specialty snacks are leading the way, as 45% of consumers say they’re willing to pay more for unique flavours and high-quality ingredients, up from 39% in 2022.

Mondelez isn’t just watching the trend: the Chicago-headquartered conglomerate is part of a movement in shaping it. From pushing shareable treats to marketing snacks as the perfect solo self-care moment, the Oreo maker is ensuring that snacks aren’t just part of our diets, but part of our emotional coping mechanisms. The report even alludes at a future where snacking continues to evolve, with brands experimenting with mood-enhancing ingredients and functional snacks that claim to boost mental wellbeing.

At the end of the day, there’s nothing wrong with enjoying a snack. In fact, the evolving snacking landscape presents an exciting opportunity for brands to offer more innovative, high-quality, and better-for-you options. As consumer preferences shift toward mindful indulgence, sustainability, and personalisation, the snacking sector is poised for continued growth, ensuring that there is something for everyone – whether for comfort, connection, or pure enjoyment. The future of snacking looks tastier than ever.

Watch for more

In future articles, Bakery&Snacks will dive deeper into Mondelez International’s State of Snacking report, breaking it down by section to provide valuable insights for snack producers looking to tap into these trends.