Belgium-based Verlinvest is the investment company of the family behind brewing giant Anheuser-Busch InBev. Created over 25 years ago, today Verlinvest has 28 brands in its portfolio and has in excess of $4bn in funds under management.

Its most famous -- or more accurately, infamous -- brand is Oatly (currently worth more than $14bn since listing on the US Nasdaq stock exchange last month), in which it owned a 55.9% stake within a joint venture prior to the IPO.

Verlinvest’s head of European food and beverage, Ben Black, told FoodNavigator the group is looking at long-term growth opportunities offered by those trends offering ‘more ethical, sustainable and healthy alternatives’.

“We believe those three consumer shifts will be pervasive,” he told us, adding that the investment vehicle’s focus is on brands seeking to drive mainstream consumption towards more ethical alternatives that serve the needs of a new generation.

“We are very focussed on what the consumer wants, and those three trends and long-term consumer shifts are important for us because we’re in an incredibly interesting period of time where the large majority of brands that exist today have been built in the 20th century for the 20th century consumer, and that consumer has different needs. What we’re looking for is brands for the 21st century that serve the 21st century consumer. That consumer is younger and has a very different expectation of what they want from brands within food and beverage.”

He believes more people want to buy green and ethical products and are prepared to pay more for them, and he’s bullish on the prospects for socially-minded entrepreneurs and brands successfully capitalising on and driving these trends.

“I’m hugely confident because that’s where I see the growth coming from. Brands that have those aspects are growing faster than the ones that haven’t,” he told us. “What you’re seeing is the larger FMCG strategics beginning to reorient themselves around those trends as well.” A very clear example is Unilever’s commitment to purpose-led brands. The FMCG giant is “an oil tanker of an organisation within food, but they are shifting the whole business towards this. I’m not looking for the oil tanker, but the speed boat that’s built around these values.”

Trend 1: Personalised nutrition

The first area where nimble start-ups are busy making waves concerns personalised nutrition. “We’re very interested in looking at options which help people understand their uniqueness and their own nutritional needs,” noted Black. “We’ve not yet seen personalised nutrition be adopted by the mass market so we’re very excited by brands that can help people understand their own specificities and be guided about what kinds of foods they should be eating to lead a healthier lifestyle.”

Personalised services typically command a higher price tag for shoppers. But consumers are prepared to pay premium where they feel added value, according to Black. “If they're getting genuine benefit from personalised nutrition, I would feel confident that they would pay a premium to non-personalised nutrition.”

Trend 2: Plastic-free hydration

According to Verlinvest, the hydration trend promises to solve two prescient issues: the problem of the dramatic rise in the production of throwaway plastics that are failing to be contained, controlled, reused and recycled, and people’s desire to stay healthy. “We’ve been a very long-term backer of hydration trends and now we’re seeing a new generation of brands coming through who remove plastic. Plastic-free hydration takes away the need to shift water around the world that takes away the need for single use plastics,” explained Black.

Whilst not in the Verlinvest portfolio, one such brand that falls into this trend is German start-up Air Up, which flavours water using scented air to trick your brain into perceiving a taste, thus providing a sweet taste without the sugar. The system involves a reusable water bottle – filled with tap water – to which you attach a scent pod that releases flavour into your mouth as you drink. Air Up has already raised an €18m Series A funding round from investors including PepsiCo and French foodtech investor Five Seasons Ventures.

Another German start-up that is hoping to disrupt the flavoured drink sector is Water Drop. This solution offers consumers flavoured capsules which they can put in their water bottle. “This is a really exciting trend because it helps from a sustainability perspective but also helps from a health perspective as well. It allows for more consumption of water,” Black observed.

Trend 3: A return to supply chain ethics and provenance

Received wisdom says COVID has made people more aware of where their food comes from and what they are putting into their bodies. “This has led from our perspective to a return to interest of people buying local and fresh and becoming very interested in exactly where their food comes from,” Black told us.

That means exciting times for heritage brands. Take tomato expert, and Italy’s largest brand, Mutti. “We’ve seen a big boom throughout Covid in this business,” Black revealed. “It’s a multi-generational 100-year brand that has very specific sourcing criteria to improve the quality of their tomatoes. We see huge tick up in interest in this space as people look to really understand that they’re getting a quality and ethically produced product that also has good taste. That renewed consumer awareness of and very clear focus on supply chain ethics, provenance and localisation is something that we’re very excited about.”

He added: “We're seeing an attraction to those brands that deliver indulgence with a degree of trust. We're seeing particularly in southern Europe a lot of attention on family-backed brands that have been doing the same thing for many years.” Spanish tinned sardine producer Ortiz is therefore another great example of a category-defining brand. “They are able to prove a level of trust and expertise that give people license to indulge.”

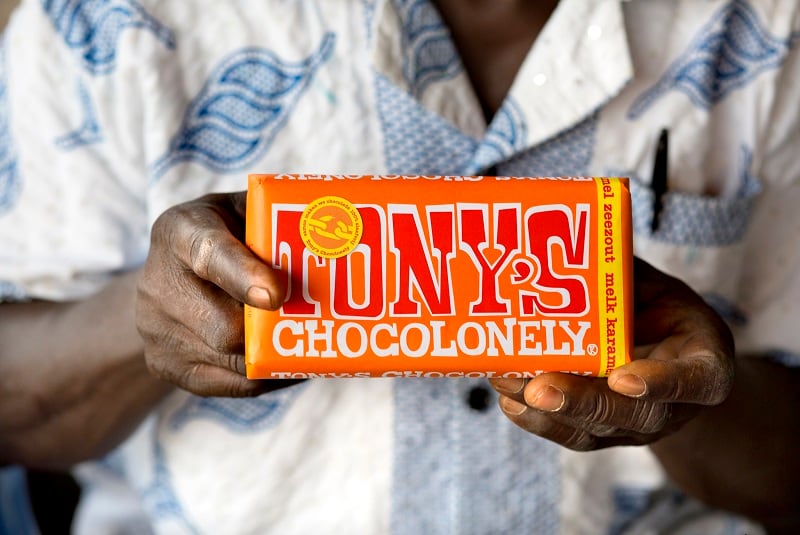

Another example is Tony’s Chocolonely – a Dutch chocolate firm focused on removing child labour within the cocoa supply chain. This concept is ‘phenomenally interesting’, Black believes, “because the 21st century consumer is asking ‘are we doing the right thing in how we spend our money?’ and Tony’s provides a solution to a problem that exists from the way that the 20th century cocoa supply chain has been built.”

The brand has also been “a phenomenal success story”, he added. “We invested in them about 18 months ago. The brand in the space of a few years has become the largest chocolate brand in the Netherlands. We have gone through a process like we do with many of our brands of internationalisation. We’ve launched the brand in the UK, US and Germany and this is driving phenomenal growth.” Tony’s is now on course to be “well over a euro 100 million brand this year, growing around 30%”.

Challenges for brands 'with purpose'

Tony’s Chocolonely has not been immune from criticism, however. For example, it was removed earlier this year from a list of ethical chocolate companies for its ties with Barry Callebaut, which has admitted that its own supply chain is not slavery-free.

Sustainability-minded Oat milk pioneer Oatly -- Verlinvest’s greatest success story over its 25-year history – has also faced a backlash for having Blackstone (the world's largest private equity firm accused of having links to deforestation in the Amazon rainforest) among its backers.

These instances beg the question: do those companies that take the highest moral ground risk having the furthest to fall?

According to Black, it’s neither realistic nor favourable to expect challenger brands to avoid working with ‘differently minded’ partners as they scale up and enter the mainstream.

“Ultimately the brands that we’re partnering with have a very clear understanding of how they want to shape the world and ignoring or not engaging with partners that are able to help them achieve that mission in our view is not the right way of creating change,” he said. “So for Oatly, their ultimate goal is to create a brand that provides a sustainable alternative to dairy on a global scale. That has to be the number one mission. Similarly, with Tony’s: their mission is to make chocolate 100% slave free. By refusing to engage with others, we miss an opportunity to educate them in our practices and ways of having impact, and importantly an opportunity to create the change that is ultimately the mission of our business.”