In today’s complex world, which is becoming increasingly affected by climate change, energy and resource consumption as well as the drive for better nutrition, more and more consumers re-evaluate their own behavior. On top of this, the ongoing COVID-19 pandemic as well as other global crises, like the war in the Ukraine, affect us all in our lives and accelerate behavioral but also mindset changes significantly. Among others, of course, also around food consumption. This leads to consumers increasingly asking for more transparency and security from their product and service suppliers.

Consumers are surrounded by numerous products, be it private label or brands across all kinds of industries. Food or non-food, for daily consumption or occasional use. The big question they regularly face is “which product or brand to buy?” – the answer to this question is influenced by a multitude of needs and purchase drivers that are not always easy to separate.

As a leading provider of sugars and sugar specialties for the food industry, Südzucker keeps a close eye on consumers’ needs of today and tomorrow. To identify trends early, Südzucker regularly conducts end consumer research to transform the insights into new end consumer products or to develop future-oriented ingredient solutions and services for the food and drinks industries.

Südzucker Consumer Trend Research 2022 – Reconciling Emotions & Rationality

Thus, to serve our partners in the food industry better, we have, conducted another research study* around consumer needs and purchase drivers for processed foods and drinks, building on last year’s zero measurement, which will serve as yet another building block in a continuous observation of consumer trends.

This online study was conducted in March 2022 with approx. 5,000 end consumers across five countries (1,000 participants each, interviewed in: Germany, Belgium, France, Poland & the UK).

We’ve focused on five food product categories that contain sugar as a key ingredient:

- Sweet biscuits and baked goods

- Chocolates

- Dairy and vegan alternatives

- Soft drinks

- Cereals & cereal bars

The target groups were spread evenly by gender and age group from Gen Z to Baby Boomers.

The research yet again made clear that we’re looking at a consumer of two minds, trying to reconcile emotions & rationality in his choice of foods and beverages. While the emotional mind focuses on indulgence and sweet little moments, the rational mind wants to keep expenses at a manageable level. In between, sustainability and having an influence on global topics like climate change give the end consumer purpose, which he wants to see from brands and companies as well. All this puts the consumer into this field of tension.

Taste is Still King

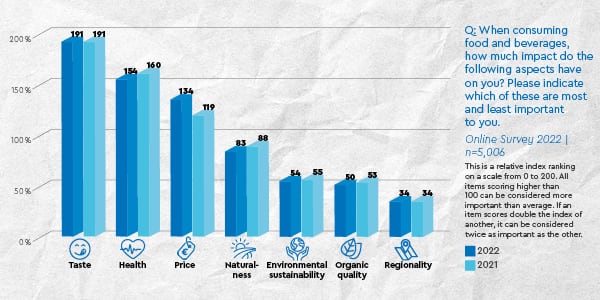

Nevertheless, decision making is still dominated by more emotional criteria, when it comes to food and beverage consumption, especially related to the taste and sensory profile of these products. Taste was and still remains king and the key purchase driver for consumers, even in direct comparison with health aspects or price.

In comparison to last year’s study, despite everything that has happened, taste even stayed stable, whereas health aspects have decreased and price has gained in relevance. With the increasing importance of product pricing we can observe the influence of external factors, like the war in the Ukraine and rising energy costs that lead to a record high inflation rate of the last two decades in Europe. This of course affects all of us significantly in our purchasing power so that consumers think more about what to consume and at what price. Nevertheless, even in this critical thinking, taste will still not be traded for lower prices. Interestingly enough, a better perceived taste is the main reason for the majority of participants (78%) why they consume organic products.

The emotional toll the ongoing COVID-19 pandemic and other global crises inflict on all of us lead consumers to a higher need in emotional time-outs and moments of retreat and indulgence, in which consumers tend to set aside the critical observation of nutrition and health and focus more on these sweet little moments.

What this means for reformulation of product recipes, sugar reduction and sweetener alternatives, read on in our dedicated whitepaper.

Sustainability Brings Purpose

Sustainability is a complex, wide-ranging topic, consisting of a multitude of different aspects, influencing factors and ways for the individual consumer to contribute. It comes as no surprise, also looking at different legislative changes and stronger communicative presence across different European countries, that sustainability also rises more and more in importance for consumers – mainly driven by younger generations, like Gen Z and Y, but of course more and more steered also by the generations with the strongest purchasing power.

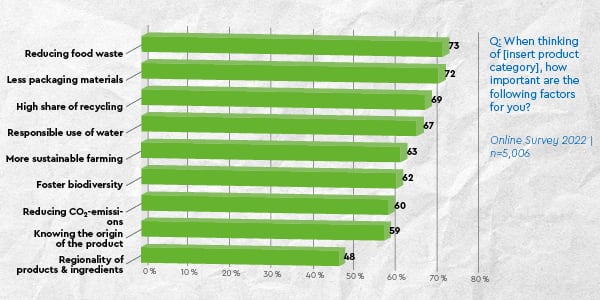

Besides the omni-present topics of reducing food waste, increasing the share of recycling and decreasing the amount of packaging in general, sustainability aspects around farming, including responsible water usage and fostering biodiversity, were mentioned as very important criteria by over 60% of consumers, when deciding which brands and products to consume. Surprisingly (still) more relevant than reducing CO2-emissions.

Regionality even increased across almost all categories in importance compared to last year, not only as a building block of sustainability, but also what claims consumers look for on packaging when deciding if the product can be considered healthy.

For more details on this, or also what consumers think of when talking about the term “More sustainable farming” have a look at our whitepaper as well.

These of course are only some of the many highlights we identified in this year’s consumer tracker, that are of course not to be viewed singularly or independent of each other. All these aspects and many more create an interconnected web of complex influencing factors when consumers decide which products and brands to buy.

Creating Added Value for the Consumer

Whether it is about developing new products, occupying your specific market regarding certain criteria like organic quality, biodiversity, etc. or if you are looking for deeper insights for your communication, Südzucker is more than happy to partner with you.

Reach out to us and:

- make use of our marketing and market intelligence experts to gain more insights into different consumer needs

- partner with our R&D specialists for application support, recipe reformulation or in specific product groups sugar-reduced solutions,

that keep the same taste and texture as the full-sugar variant, or

- challenge us for co-development of product innovations on plant- and sugar beet based sweetening solutions

By cooperating with us you can get access to the Südzucker Group’s vast network of over 260 in-house R&D specialists with dedicated teams in the Sugar Division and beyond to leverage further synergies within the whole group.

Soon we will also offer the whitepaper as a free downloadable on our website www.suedzucker.com keep your eyes open there or also on our LinkedIn channel for further information.

We are looking forward to hearing from you.

*this consumer research has been conducted together with InSites Consulting

About Südzucker Group

Südzucker is a major player in the food industry with its sugar, special products, starch and fruit segments, and Europe’s leading ethanol producer with its CropEnergies segment.

In the traditional sugar business, the group is Europe’s number one supplier of sugar products, with 23 sugar factories and two refineries, extending from France in the west via Belgium, Germany and Austria, through to Poland, the Czech Republic, Slovakia, Romania, Hungary, Bosnia, and Moldova in the east. The special products segment, with its consumer-oriented functional ingredients for food and animal feed (BENEO), chilled/frozen products (Freiberger) and portion packs (PortionPack Europe), operates in dynamic growth markets.

Südzucker’s CropEnergies segment is Europe’s leading producer of renewable ethanol, with production sites in Germany, Belgium, France and Great Britain. Other products in this segment are protein food and animal feed products as well as biogenic carbon dioxide. The new starch segment comprises AGRANA’s starch and ethanol activities. The group’s fruit segment operates globally, is the world market leader for fruit preparations and is a leading supplier of fruit juice concentrates in Europe.