What is driving consumer purchase behaviour when deciding which processed food and drink to buy?

This and more can be found in the latest white paper ‘Sweet Trends Report 2024 by Südzucker’.

As a leading manufacturer of sugar and sugar specialties for the food industry, Südzucker looks beyond the horizon and focuses on the needs of consumers in order to offer its partners the best support for their products. This includes innovative plant-based sweetening solutions, market and consumer insights and application support.

To this end, Südzucker has been conducting its annual consumer survey together with Human8 Consulting since March 2021. This fourth edition of the ‘Sweet Trend Report’ also includes earlier trends revealed over the past four years.

This year’s online consumer study was conducted in March 2024 with over 6,000 consumers across six countries – around 1,000 participants per country in Poland, Germany, UK, Belgium, France and, for the first time, Italy.

The focus is on five food categories in which sugar is an important ingredient:

- Sweet biscuits and baked goods

- Chocolates

- Chilled dairy products and vegan alternatives

- Cereals and cereal bars

- Soft drinks

The target groups were spread evenly by gender and age group from Gen Z to Baby Boomers.

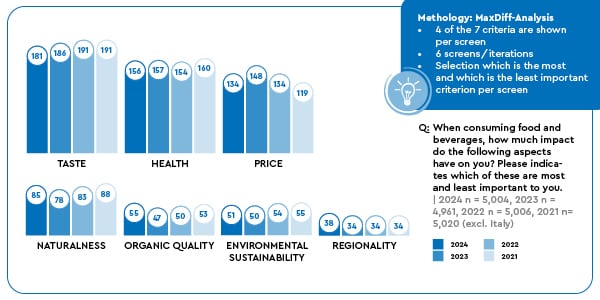

Price is less important – taste still main purchase driver

At first glance, as you can see in the graph below, data reveals that price has dropped in relevance, but is still in third place after taste and health. This does not mean that customers are no longer price-sensitive, but that they are taking a closer look at what they get for their money, considering the benefits and added value that a product will deliver.

The topics that are becoming more relevant for customers are naturalness, organic and regionality, all of which can be seen in the broadest sense under the umbrella of sustainability. As such, environmental sustainability as a purchase driver remains stable.

One reason for price losing relevance may be that the rate of inflation dropped in 2023 within Europe. Nevertheless, consumers are still keeping an eye on their money, but are no longer exclusively looking for the lowest price. They are once again placing more emphasis on the aforementioned criteria when making purchasing decisions.

Growing interest in natural, organic and regional products

Naturalness, regionality and organic are relevant purchasing criteria that are also closely linked in terms of sustainability. Organic products are seen as ‘more natural’ by 81% of participants in the Südzucker Consumer Study 2024 and 56% of respondents see organic products as ‘regional products’.1

But what exactly do consumers associate with naturalness, especially in terms of processed food and drink? And what do consumers still consider to be regional? These are interesting questions as there is no general strict definition for both terms, unlike with the term organic.

This lack of criteria is what makes it difficult, in some cases, when it comes to communicating with consumers. But these are relevant points that need to be addressed. Increasingly, consumers want to know more – not only where the product comes from, but also the relevant ingredients in the respective product.

In addition, consumers are becoming more ‘well-versed’ and more likely to scrutinise what they are told in brand or product-related marketing and communication activities.

Initial explanations and discussion approaches to these topics can be found in the ‘Sweet Trends Report 2024 by Südzucker’. The following topics are addressed in the report:

- Changes in the key purchase criteria What influences the product selection?

- Consumer profiling How to reach consumers?

- Naturalness What do consumers associate with naturalness?

- Regionality What do consumers understand as ‘regional’?

- Organic How did the view on organic products change?

- Sustainability and sustainable farming What do consumers connect with them?

To gain insights into changing consumer behaviour, and how we can potentially address changing consumer needs together, for example via joint product development, download the ‘Sweet Trends Report 2024 by Südzucker’.

Creating added value

Südzucker offers valuable partnership opportunities at various levels, such as marketing and market intelligence specialists as well as Research and Development (R&D) experts. The aim of such partnerships is to create added value for your activities. Südzucker supports you and offers exchange in the following fields, among others:

The entire network of the Südzucker Group is available through this partnership. This includes more than 260 R&D experts. These specialists span across the Sugar Division and other relevant domains, thereby presenting opportunities for the exploitation of synergies throughout the whole group.

To learn more about Südzucker’s analysis of consumer purchasing behaviours, visit Südzucker.com or its LinkedIn page.

References

1. Sweet Trends Report 2024.