Coronavirus (COVID-19) had a rapid impact on the global food and beverage industry. As early as March 2020, companies were reporting “significantly reduced consumption and supply chain disruption challenges.” In spring 2020, Palsgaard set out to find out more about the impact of the crisis on consumer purchasing behaviours, focusing on differences between geographical markets and product categories. In addition to the effects of the pandemic, we explored the attitudes of food and beverage consumers to ethical and environmental issues.

We commissioned expert researchers to survey a total of 617 consumers (150 in Mexico, 162 in Singapore, 154 in the UK and 151 in the US). The survey was carried out online between the 9th and 15th of June 2020.

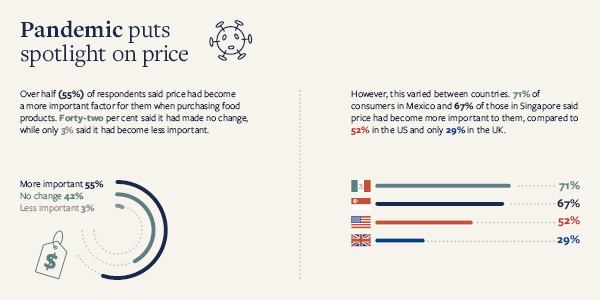

Pandemic puts spotlight on price

One of our key findings was that many consumers are thinking more carefully about cost. Over half (55%) of respondents said price had become a more important factor for them when purchasing food products. Forty-two percent said it had made no change, while only 3% said it had become less important.

However, the extent of this phenomenon varied significantly between geographical markets. Seventy-one percent of consumers in Mexico and 67% of those in Singapore said price had become more important to them, compared to 52% in the US and only 29% in the UK.

As well as different levels of poverty and inequality, these figures may reflect the degree of economic hardship caused by coronavirus restrictions in the different countries. They may also signal different expectations of price rises to come. Forty-three percent of respondents in both Mexico and Singapore expected their households to spend more overall on food than before the outbreak, compared to 33% of those in the US and 23% in the UK.

Online shopping up, eating out down

COVID-19 is widely expected to have lasting impacts on purchasing behaviours. To offer new insights into what these might be, we asked consumers to look ahead to a time when all restrictions relating to coronavirus have been lifted in their countries.

Large numbers (40% overall) said their household would buy groceries online more often, compared to 12% who said they would do so less often. Consumers in Mexico (51%) were the most likely to say they expected to shop online more often, with those in the UK the least likely (23%).

Meanwhile, almost half (47%) said they expected to eat outside their homes (for example in cafes and restaurants) less often than before the outbreak. This figure was highest in Mexico (52%) and lowest in the UK (38%). Only 19% said they would eat out more often.

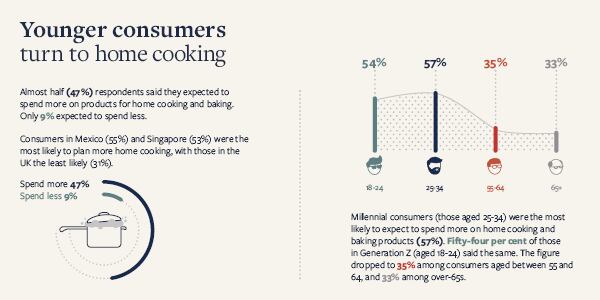

Younger consumers turn to home cooking

In line with the reduced preference for eating out, almost half (47%) respondents said they expected to spend more on products for home cooking and baking. Only 9% expected to spend less. Consumers in Mexico (55%) and Singapore (53%) were the most likely to anticipate more home cooking, with those in the UK the least likely (31%).

Responses to this question varied significantly by age. Millennial consumers (those aged 25-34) were the most likely to expect to spend more on home cooking and baking products (57%). Fifty-four percent of those in Generation Z (those aged 18-24) said the same.

In older age groups, the figure declined significantly, dropping to 35% among consumers aged between 55 and 64, and 33% among over-65s.

Coronavirus increases environmental focus

Palsgaard combines food industry know-how with a proud commitment to social and environmental responsibility. In 2010 we set ourselves the goal of completely carbon-neutral production and we achieved it in 2018. We always knew this was the right course to take, and in a market where consumers are increasingly concerned about sustainability, we were also confident that it made sound business sense.

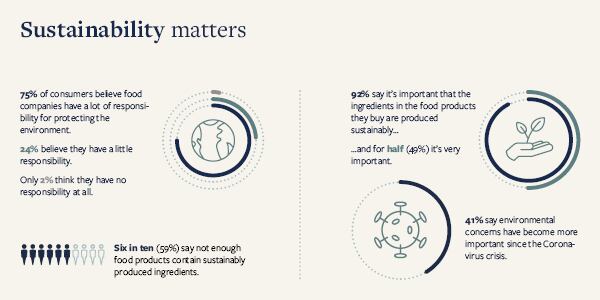

However, given that COVID-19 has increased the importance of price, it would not be unreasonable to speculate that it may also have reduced the weight placed on issues such as climate change. Our research indicated that the opposite is true. We asked: “Since the Coronavirus (COVID-19) crisis, have environmental concerns (e.g. the use of sustainably produced ingredients) become a more or less important factor for you when purchasing food products?” Four in ten (41%) answered “more important”, 55% said there had been no change, and only 4% said environmental concerns had become less important.

Possible reasons for this include a more reflective international mood, a feeling that the tumultuous change caused by the pandemic represents an opportunity for belated action on climate change, and a renewed awareness of the potential of government action. Whatever the explanation, the finding is in line with other research indicating that the environment remains a major concern. For example, an Ipsos poll1 in April 2020 found that 71% of adults globally believe that climate change is as serious a crisis as COVID-19.

Consumers want food companies to take responsibility

We also asked respondents how much responsibility they thought the food industry has for protecting the environment. Globally, three quarters (75%) believed food companies have a lot of responsibility, 23% believe they have a little and only 2% think they have none at all. There was significant variation by country, with Mexican consumers most likely to choose “a lot of responsibility” (81%) and those in the US least likely (68%).

It was also clear that consumers care about sustainability when it comes to ingredients. Over nine in ten (92%) of survey respondents said it was important that the ingredients in the food products they buy are produced sustainably, with half (49%) saying it was very important. Six in ten (59%) said not enough food products contain sustainably produced ingredients.

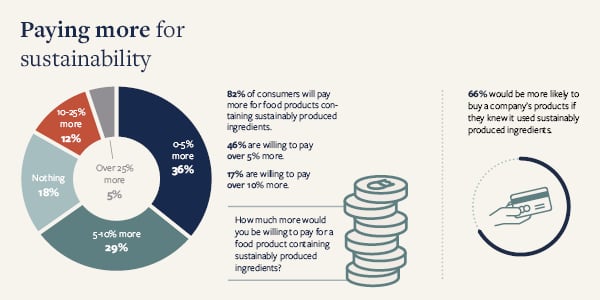

Paying more for sustainability

Furthermore, these beliefs translate into purchasing behaviours. Two thirds (66%) of respondents said they would be more willing to buy products from a particular company if they knew it used sustainably produced ingredients.

Consumers also appear to be willing to put their money where their mouths are. More than eight in ten (82%) of respondents said they would be willing to pay more for a food product containing sustainably produced ingredients. Nearly half (46%) would pay over 5% more and 17% would pay over 10% more.

There is therefore a sound business case, as well as an ethical one, for manufacturers to use ingredients produced sustainably (for example in carbon-neutral facilities).

Climate is high on the agenda – especially for young consumers

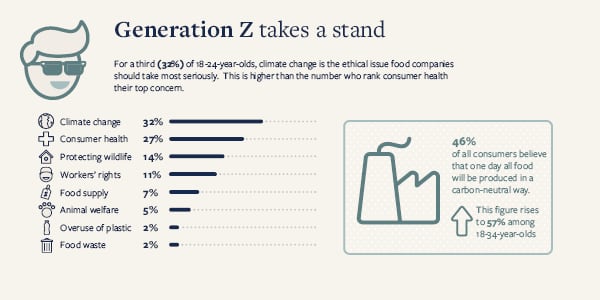

We then asked our survey respondents to rank the ethical issues they thought food companies should take most seriously.

Overall, they were most likely to select the health of consumers as the most important issue. This is probably unsurprising, given the responsibility companies have for food safety. Indeed, Palsgaard prides itself on a well-established food management system which meant we had zero product recalls in 2019.

However, climate change also ranked very highly, significantly ahead of workers’ rights, animal welfare, the overuse of plastics, food waste, and ensuring a supply of affordable food products. And among the youngest age group, it ranked as the top concern. For a third (32%) of 18-24-year olds, climate change is the ethical issue food companies should take most seriously, ahead of even consumer health.

This reflects a general trend in the research, with younger consumers broadly more concerned about the climate crisis and more receptive to the idea of change. For example, 46% of respondents overall agreed with the statement “One day, all food will be produced in a carbon-neutral way”, but this figure rose to 57% among 18-34-year olds.

Carbon-neutral production and more

In 2010, Palsgaard set itself the goal of completely carbon-neutral production by 2020. It is a matter of great pride that we achieved that target in 2018 – two years ahead of schedule. Over that period, we reduced our net carbon emissions from 12,029 tonnes to zero, achieving reductions totalling 56,175 tonnes – the same as the amount produced by 4,885 European households in a year.2

All six of our global production sites are now carbon-neutral, largely thanks to new heat recovery and insulation techniques, a switch from heavy fuel oil to certified biogas, and the use of renewable energy sources. At our main site in Denmark, all electricity is sourced from hydro power, and indoor heating is powered by burning home-grown straw rather than oil. Our Dutch factory has over 800 solar panels and has run off only renewable energy since the start of 2018.

Looking ahead

At Palsgaard we believe we have a responsibility to take action for good, and we work hard to fulfil it. And, as our research clearly shows, initiatives to benefit society and the environment – particularly on climate change – are welcomed by consumers.

Furthermore, this remains the case in a time of huge global uncertainty. Our research found that the COVID-19 pandemic has had significant impacts on many elements of purchasing behaviour, in particular attitudes to price. However, it has increased, rather than reduced, the importance of sustainability.

By demonstrating that carbon-neutral production is possible, we hope to have set an example for the whole food industry. However, this achievement was only a starting point. We are now working on new initiatives, including the creation of a solar park and a biogas facility at our main site.

In doing so we are determined to continue meeting the highest quality standards while also addressing the global challenges facing us all.

About Palsgaard

Emulsifier specialist Palsgaard helps the global food industry make the most of the ability to mix oil and water. Thanks to the company’s specialised emulsifiers (and emulsifier/stabiliser systems), bakery, confectionery, condiments, dairy, ice cream, margarine and meat producers can improve the quality and extend the shelf-life of their products. Just as importantly, they can produce better-for-you products with improved taste, mouthfeel and texture while using fewer resources.

For more information email: mds@palsgaard.dk or visit www.palsgaard.com/CSR

1 Ipsos ‘Two thirds of citizens around the world agree climate change is as serious a crisis as Coronavirus’, 22 April 2020

2 An average EU household, including its transportation, emits 11.5 tonnes of CO2 per year: https://iopscience.iop.org/article/10.1088/1748-9326/aa6da9