Beyond Immerse expansion strategy

- Beyond expands into functional beverages with new high‑protein Beyond Immerse drinks

- Each beverage delivers strong plant protein fibre antioxidants and low calories

- Brand pivots from meat mimicry to broader protein‑first growth strategy

- Weak sales and shrinking distribution likely pushing Beyond toward category diversification

- Functional nutrition boom and GLP‑1 trends drive rising protein demand

It’s a decade since Beyond Meat first made waves with its plant-based Beyond Burger in the US, a signature product that helped fuel its IPO in 2019. No one at that time could have predicted the company’s future: one where it drops the ‘meat’ branding and decides to enter a non-food category.

And yet here we are. Today, Beyond is announcing it’s also a drinks brand with the launch of Beyond Immerse – a range of protein beverages for the health-focused and wellness-minded consumer.

What’s in Beyond’s new protein drinks?

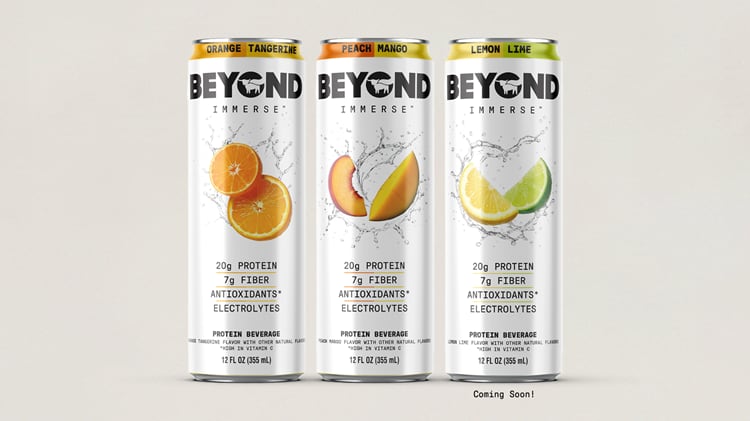

Beyond Immerse is a range of sparkling beverages available in three flavours: peach and mango, lemon and lime, and orange tangerine. But it’s not the flavours that will be drawing consumer attention, it’s the drinks’ positioning as a functional protein beverage.

Each drink contains up to 20g of plant protein (including pea protein, a primary ingredient in the Beyond Burger), 7g of tapioca fibre, antioxidants like vitamin C, and electrolytes. The offering is going up against another very popular high-protein drink on the market, the protein shake. But with between 60 and 100kcal in each drink, Beyond is clearly differentiating its new product from its traditional, milky counterpart.

Beyond Immerse, according to Beyond, is “crisp, refreshing and without any of the heaviness of a protein shake”.

Why is a plant-based meat company selling beverages?

It’s not every day a meat alternative company launches a beverage. Impossible Foods isn’t doing it, neither is Quorn, nor Nestlé’s Garden Gourmet. But Beyond is, at least for a limited time via its direct-to-consumer sales channel in the US.

Beyond hasn’t responded immediately to a request for comment, but a quick look at recent financial results could offer a clue as to why. Beyond has been struggling, with significant decreases year-on-year in both net revenues and gross profit. Not only are consumers buying fewer of its products, but fewer retailers are selling them.

In mid-2025, the business made the bold decision to remove “meat” from its name to become simply “Beyond”. The idea was to shift focus from meat mimicry to become a protein-first company. Its first launch since the rebrand, Beyond Ground, is a mince-like product that actively promotes its protein and fibre content, but steers clear of “meaty” terminology.

Beyond’s foray into protein beverages suggests it’s doubling down on this strategy. Whether expanding beyond its Beyond Meat range will be enough to halt its declining profits remains uncertain.

Beyond taps into the functional food and drink craze

What is clear is that functional food and drink is booming. Valued at $364bn (€317bn) and forecast to reach $793bn by 2032 (Fortune Business Insights), the category is attracting intense interest from both major FMCGs and ambitious start‑ups. High‑protein, functional drinks are drawing particular attention as the sports nutrition trend accelerates.

But it’s not just “everyday athletes” driving demand: the GLP‑1 wave is also fuelling appetite for protein, set to become 2026’s defining food trend. Beyond is ready to compete – across both food and drink.