GLP-1 receptor agonists are now being widely prescribed for varying degrees of obesity. But, along with appetite suppression, this new class of medication appears to influence a far more socially embedded habit.

Studies are revealing that the GLP-1 receptor in the brain, once activated, reduces dopamine release from addictive substances like alcohol.

In a small but potentially game-changing randomized controlled trial, patients with alcohol use disorder reduced their alcohol intake by 41 percent per week over nine weeks after being put on a dose of semaglutide (the drug sold under the Ozempic and Wegovy brands). They also reported a similar decrease in cravings compared to the placebo group .

Indeed, a systematic review covering six studies with over 88,000 participants showed that GLP-1 receptor agonists may reduce alcohol consumption, particularly in individuals with obesity.

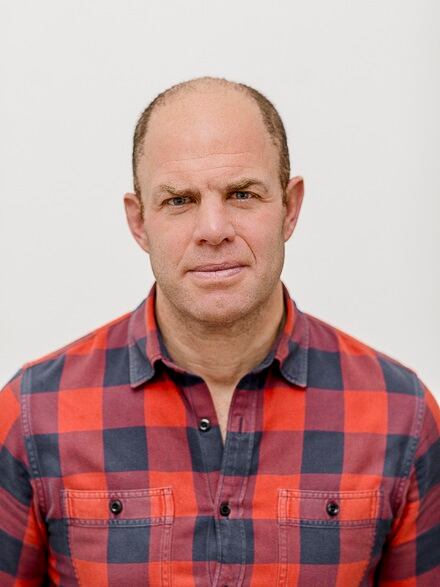

“GLP-1 drugs don’t just curb appetite – they dull the desire to drink at a metabolic level. With cravings suppressed and tolerance lowered. GLP-1 users report skipping drinks, stopping earlier or losing interest entirely,” explains Tom Ellis, CEO of Brand Genetics, a brand growth consultancy.

Ellis, who ‘decodes human behavior to reveal pathways to brand growth’, has found that as a result, occasions like social drinking, comfort drinking and even reward rituals are declining.

“At the same time,” Ellis adds, “we’re seeing a shift from habitual to intentional consumption.”

“Just water for me”

Simply put: when alcohol doesn’t offer the same buzz – either physically or psychologically – people are more likely to say no to that second drink.

Alcohol among GLP-1 users, thinks Ellis, may act more as a catalyst than a sustainer: they might have one drink to start the evening off, but then won’t continue to drink after that.

“The desire to continue drinking often fades quickly, raising important questions for product development.

“Will we see demand shift toward more intense, flavor- or effect-driven experiences delivered in smaller quantities?”

He points to bars that are already selling mini Ozempic-friendly cocktails (like the MarTiny sold at a popular UK seafront bar) at a lower price, with lower alcohol and lower calories.

What can alcohol brands do today to adapt to the new reality of a growing audience of drinkers who are becoming more intentional about what they drink?

Ellis explains that the “brands that succeed will be those that deliver on taste, social connection and emotional reward without relying on volume or impulsivity. Quiet attrition is likely for those that don’t adapt.”

The rise of GLP-1 might also see the emergence of non-alcoholic drinks that offer not just taste and ritual, but also nutritional value – perhaps even functioning as meal replacements in social settings.

Alcohol brand marketing will also need to change and create new rituals around low- or no-alcohol products. Ellis agrees: “Traditional marketing narratives built on cravings, comfort and “treat yourself” risk falling flat in a world where reward circuits are dulled.

“The shift may also reframe the whole narrative even for those not using GLP-1.”

Drink, buddy?

Will consumers who are not on a GLP-1 plan be drawn into this new order of sobriety? Ellis muses that it certainly feels like these drugs are adding further fuel to the fire of a reduction in alcohol consumption and to intentional consumption of more health-enhancing alternatives – be that zero-alcohol or fortified/enhanced.

“GLP-1s are not likely to eliminate drinking culture, but they are accelerating a shift that’s already underway – toward more intentional, health-oriented consumption. For beverage companies, this is not just a disruption but an opportunity: to innovate, diversify, and resonate more deeply with a changing consumer.”

Anecdotally there seems to be a shift to more of a café vibe in pubs and bars; more focus on conversation, games, activity – to shift drinking from the focus to the accompaniment of the social experience.

Ellis points to research, albeit from an alcohol-free beer brand, in the UK that shows that drinking alcohol now ranks only fourth among the top reasons why Brits visit pubs.

“Nearly two-thirds (62%) of Brits now feel comfortable going to the pub without drinking alcohol, and the volume of non-alcoholic beverages sold has risen by 42% over the past five years.”

While it’s too early to know the degree in which the wider public will be influenced by the ‘GLP-1 effect’, the commercial implications for the alcohol sector are potentially profound. As one era of consumption fades, another begins. The brands that evolve fastest will be the ones still standing when the buzz wears off.