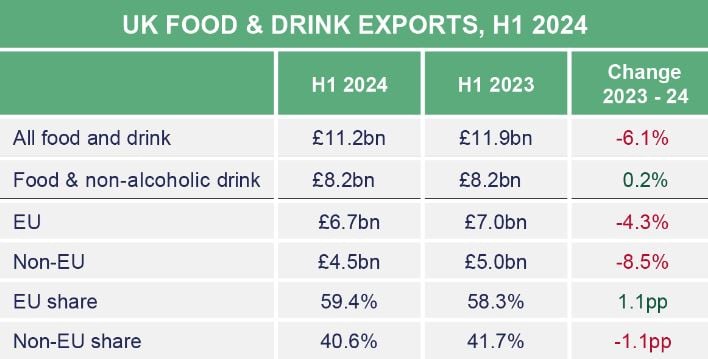

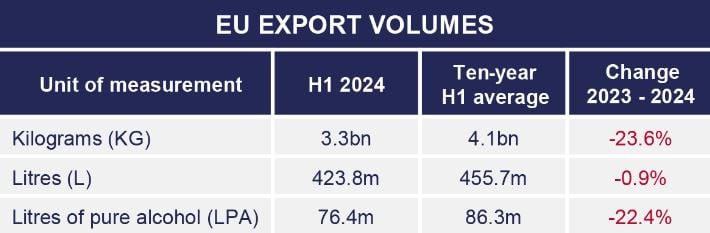

The UK’s biggest trading partner, the EU, dropped near a quarter (23.6%) of volume imports from the territory for the first half of the year compared with H1 2023.

Exports to the rest of the world were relatively flat at 0.8% up, though it’s not a patch on those to the EU, which account for 59.4%, UK Food and Drink Federation data shows.

That’s why “more than half (59%) of manufacturers are saying [the UK’s] relationship with the EU should be a top priority for the new [UK Labour] government”, says the FDF.

Why are UK food exports declining?

Trade to the EU is becoming more challenging for British food and drink businesses as growing bureaucracy, like additional checks, come into force. This includes the second phase of the delayed border changes that were introduced in the spring.

The new border checks added on fees for businesses, as well as increased check rates for meat, milk and fish products from this month.

Further, more controls will be applied to fresh produce from 1 July next year, adding even more administrative burden to companies already creaking under costly bureaucracy that reduces flexibility and increases food and drink costs, especially for smaller businesses.

“The UK’s food and drink businesses make brands and products that consumers love, not just at home but across the world,” says director of industrial growth and sustainability Balwinder Dhoot.

“However, these figures show manufacturers are facing increasing bureaucratic barriers when exporting, particularly to the EU.”

Where can the UK export food to?

The UK government was challenged by Dhoot to do more to build exporters’ confidence and support businesses to compete better overseas and expand into new markets, this could include “removing bureaucratic trade barriers”, adds Dhoot.

Trade agreements with reduced red tape have proven to work, such as with India where H1 exports rose 11.9% to £127m.

FDF identified UAE as another market where UK food and drink businesses could see additional success on top of its 2.4% growth in H1 2024.

“An ambitious trade agreement with the Gulf Cooperation Council could drive significant growth in trade, as we’ve seen under the UK-Australia FTA, where exports have increased 7.1% to £196.7m, says the FDF.