With an annual revenue of more than $60bn (€56bn), it’s unsurprising that growth is central to the world's largest beer maker's strategy.

Increasingly, the no and low alcohol beer category is playing into that game plan. In response to growing demand, Anheuser-Busch InBev (AB InBev) has been building out its no- and low-alcohol offerings.

These days, products with an ABV of 4.5% or lower make up more than half of its portfolio. AB InBev is selling these products across 55 brands and 41 countries, with key markets including Brazil, Mexico, South Africa, Canada, Belgium, China, and the UK.

But to continue to grow the category, the beer major must overcome two major barriers. The first is taste, and the second is social stigma.

How can body and aroma be developed in non-alcoholic beer?

AB InBev has developed its own techniques, which we profile in Part 1 of our ‘Inside the brewery’ deep dive: Making 0.0% ABV beer with body and aroma: Inside the brewery with AB InBev.

Stigma: A ‘big barrier’ to increased non-alcoholic beer consumption

Social stigma in non-alcoholic beer consumption – whereby consumers feel embarrassed to choose drinks containing less alcohol – is real. In geographies with less developed non-alcoholic beer markets it’s felt more acutely, but in countries with a more established history of low and no alcohol beer consumption, social stigma appears to be declining.

In Germany, for example, which boasts a long history of low-alcohol beer consumption, stigma has long been on the way out. Even back in 2017, just nine percent of Germans said they would be embarrassed to be seen drinking low or no alcohol beer, according to market research firm Mintel.

Do consumers feel stigma when ordering a low or no alcohol beer?

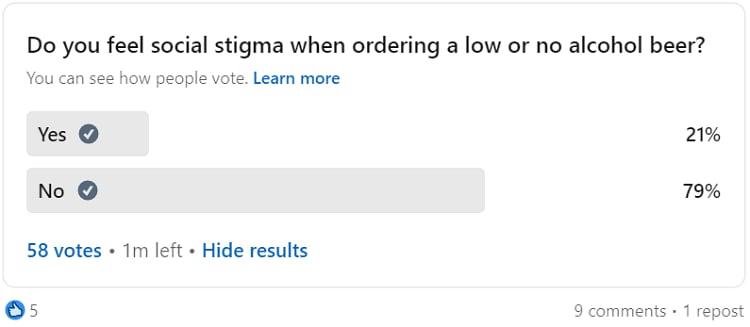

FoodNavigator ran a poll on LinkedIn to gauge its followers’ responses.

Just 21% responded said they feel social stigma, whereas 79% said they do not.

Comments queried whether stigma could be influenced by country, market, and gender.

Whereas stigma is on the decline in countries with mature non-alcoholic beer markets, such as Germany and the UK, it continues to plague the category. Stigma is a ‘big barrier’ to increased non-alcoholic beer consumption, according to Bruno Cosentino, global VP, core and corporate brands, at AB InBev.

How to overcome stigma? Use known brands

Aside from selling a ‘superior’ product, which AB InBev claims to be doing thanks to its non-alcoholic beer brewing techniques, the other way of overcoming the ‘stigma barrier’ is to use known brands, believes the beer major.

Of course, this option is only available to breweries with significant market share. AB InBev is one such brewer. In Belgium, for example, AB InBev’s lager market share stands at 54% and its non-alcoholic beer market share is 60%, which it attributes to non-alcoholic versions of brands such as Jupiler – Belgium’s leading beer brand.

Other well-known AB InBev-owned brands have also expanded into zero alcohol, including Leffe, the UK’s largest alcohol brand Stella Artois, and other popular beer brands Hoegaarden, Beck’s, and Corona. Overall, AB InBev boasts around 30 non-alcoholic beer brands.

Although not all the company’s non-alcoholic beers are linked to existing brands, most are. The brewer has found this strategy makes it easier to ‘amplify’ and ‘speed up’ introduction to market, explained Andres Penate, global VP, legal and corporate affairs, at a recent trip to AB InBev’s brewery in Leuven.

Another benefit in launching within established brands is that it signals a particular taste profile to the consumer. In so doing, there is 'one less friction point for adoption', said Penate. “It also gives the non-alcoholic beer brand a head start in terms of trust with the consumer. So why not use these advantages?”

Spotlight on marketing

How a brand is marketed can also help to reduce social stigma.

AB InBev is ramping up its marketing of non-alcoholic offerings through a recent tie-up with the International Olympic Committee (OIC). From 2024 through to 2028, Corona Cero zero alcohol will be the official beer of the Olympics Games.

From a growth perspective, this makes sense. Corona is the fastest growing lager brand in Europe, and AB InBev’s fastest growing premium global brand. It’s also what AB InBev describes as a ‘co-ed’ brand, meaning both men and women feel equally comfortable drinking it, explained Jason Warner, CEO, Europe Zone.

“There tends to be a slight bias with some of our brands to having more men participating in the brand than women. With Corona, we see it as very even.”

AB InBev is also confident in the brand’s appeal. The company launched Corona Cero in 2022 and has since rolled out into 11 countries. Beginning in the UK, Corona Cero launched in Spain last year, and this year is selling into Italy.

“This is a brand that’s really starting to get to scale. It’s growing fast, and since we introduced this brand into non-alcohol, we’re the fastest growing lager brand in Europe. This is a brand that has real traction, is moving very fast, and performing extremely well…”

Non-alcohol beer as an ‘adult refreshment’

Another way to grow the category, while further embedding non-alcoholic beer consumption in social norms, is to expand drinking occasions associated with the category.

While 40% of non-alcoholic beer is consumed by people looking to moderate their alcohol consumption, according to IWSR data, a whopping 60% is incremental. That means that most non-alcoholic beer sales are not cannibalising the beer category. Rather, they’re consumed instead of other non-alcoholic beverages.

“Social norms are very important when shaping behaviours,” explained legal and corporate affairs expert Penate. Non-alcoholic beer can prove a great tool for the social norm of ‘alternation’, whereby consumers are swapping out some alcoholic beer for a non-alcoholic alternative, he explained. Non-alcoholic beers are also a great tool for responsible drinking, so that people don’t drink and drive, for example, he continued. This makes for new drinking occasions.

“This is very interesting for the development of the category,” believes core and corporate brands lead Cosentino.

Europe Zone CEO Warner agrees, explaining that AB InBev wants to move the category into ‘adult refreshment’, to offer something that’s low in sugar and calories. “It’s a very powerful sweet spot.”