The meat alternatives market has attracted an influx of investment in recent years. According to figures from the Good Food Institute, the alternative protein sector secured US$14.2 billion in private capital over the past decade, with annual investments nearly doubling every year to 2022.

A boom in innovation has followed, with food scientists working to develop plant-based products that mimic the taste, texture, and aroma of meat.

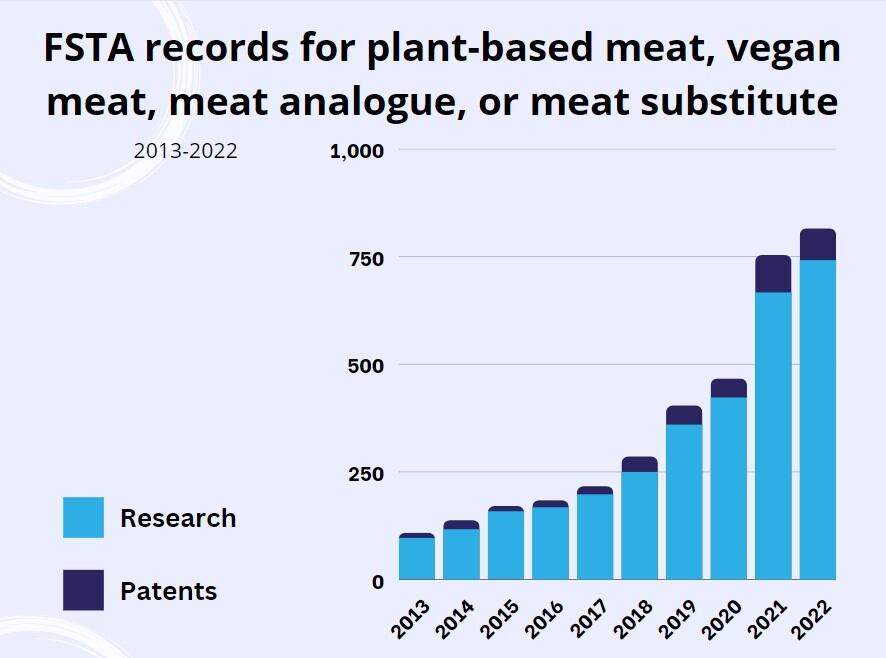

This is evidenced by the jump in the scientific literature and patent filings indexed in the Food Science and Technology Abstracts (FSTA) database produced by educational not-for-profit IFIS Publishing.

The database is used by food researchers at leading academic institutions, government organisations, and food businesses including Nestlé, PepsiCo, Coca Cola and General Mills. In total, FSTA contains 6224 records related to plant-based meat and meat substitutes, with a clear acceleration in published material over the last decade. In 2022, 815 research papers and patents were indexed, up 277% from the number five years before.

Plant-based meat: A category on a cliff edge?

This hive of R&I activity has translated into a plethora of product launches.

In the meat analogue fixture, companies have leveraged food science to stand out on the increasingly crowded shelf, providing a defensible intellectual property position that delivers a unique selling point. Over the five years to 2022, the number of patent filings in the FSTA database rose by almost 290%.

As food innovators have rushed in to fill a perceived demand for meat analogues the category has become saturated. In such a circumstance, you would typically expect a shakeout as companies that don’t make the cut fall by the wayside. What has shocked many commentators is the extent to which we have seen big-name brands struggle to connect to consumers.

Beyond Meat became the latest high-profile casualty of lacklustre sales in the plant-based sector last month, when the group reported revenue fell by 31% in the three months to the end of June.

In its quarterly financial update, the plant-based pioneer – the first to produce burgers that appear to ‘bleed’ – observed it had been hit by ‘softer demand in the plant-based meat category, high inflation, rising interest rates and ongoing concerns about the likelihood of a recession’.

Beyond Meat is far from the only plant-based brand feeling the pinch.

Monde Nissin, the Filipino food giant that owns mycoprotein maker Quorn Foods, cited ‘continued category challenges’ when it reported an 8.8% drop in sales at its meat alternative business last quarter. But, despite the decrease, the group was quick to stress Quorn increased its UK market share.

Indeed, Quorn is the beneficiary of market consolidation in the UK, a country where plant-based sales have declined by 6%. Less fortunate smaller rivals like Meatless Farm and Plant & Bean have had to call in the administrators.

What’s behind the decline?

Pundits suggest inflation and the cost of living crisis are helping take plant-based meat sales off the boil. While shoppers would traditionally reduce meat and dairy consumption to lower grocery bills, it transpires swapping them out for plant-based alternatives is actually more expensive.

Plant-based meat makers striving to reach critical mass are struggling to secure price parity against a competitor in the meat industry that has been laser-focused on efficiency, margin and volumes for decades. Nielsen data demonstrates that, on average, plant-based meat is 2x as expensive as beef, more than 4x as expensive as chicken, and more than 3x as expensive as pork per pound.

In a recent consumer survey published by Mintel, 34% of respondents said price is a barrier to purchase. Budget-conscious consumers are less likely to try new foods – and this is probably all the more true because plant-based meat alternatives continue to struggle with other reputational issues.

Mintel’s research highlighted ongoing challenges around organoleptic performance, with 48% of consumers reporting concern over the taste and flavour of plant-based meat alternatives and 24% citing texture issues as a reason not to buy.

“Plant-based meat alternative sales have slid from their peak in 2020 as consumers abandon the category in favour of less expensive protein options. The category continues to struggle with negative perceptions even among those who follow a reduced meat diet,” explained Caleb Bryant, associate director of food and drink reports at Mintel.

The science supporting plant-based meat

The plant-based meat sector is one that is rightly characterised as food tech forward.

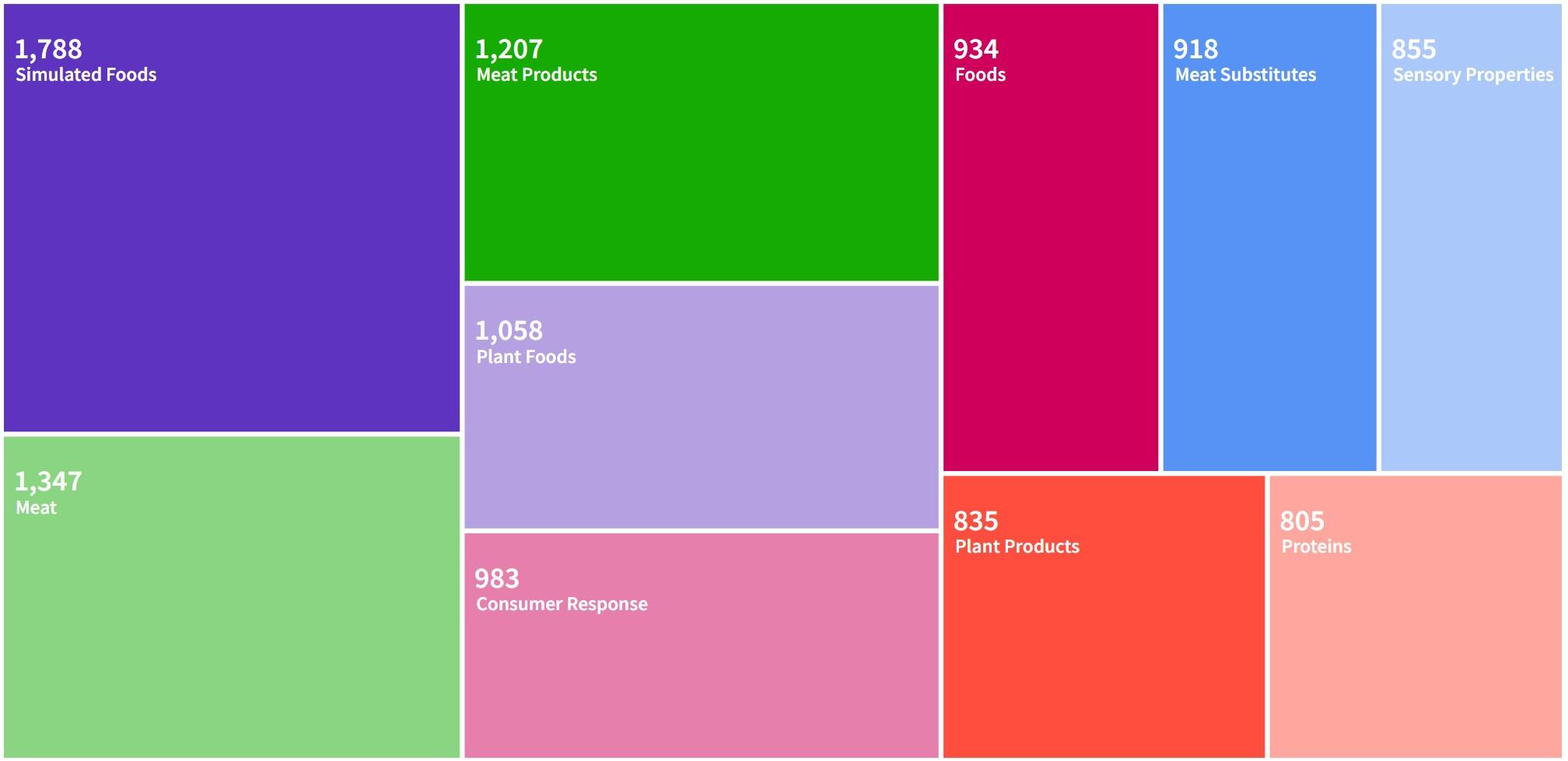

Researchers have been grappling with the sensory challenges of meat mimicry, as evidenced by an analysis of the top descriptors within FSTA’s content on meat analogues. Among the most common index terms can be found ‘consumer response’ and ‘sensory properties’.

If we drill down into research on sensory properties, it becomes clear where the major challenges lie. Keyword analyses reveals food researchers are concentrating on improving the organoleptic properties of plant-based meat, with a particular focus on physical properties, texture, flavour and colour.

Based on Mintel’s consumer research, it seems more work is needed to produce an eating experience to challenge consumer perceptions that plant-based meats don’t deliver on taste and texture.

It is also telling that the most common descriptor occurring in FSTA’s catalogue of plant-based meat research is ‘simulated foods’. Slightly further down the list of common terms can be found ‘processed foods’, a descriptor that occurred 714 times, while ‘processing’ cropped up on 698 occasions.

This reflects the level of processing required to take a plant protein and transform it into something that delivers an eating experience akin to animal protein. But it also presents a core category challenge.

As an analysis of IFIS Publishing’s Plant-Food Database reveals, health and nutrition are trending areas of plant-based study. Health concerns were once considered a top selling point for the plant-based meat sector. Today, health is becoming something of a hurdle due to associations with high levels of processing.

Given the rising pushback we are witnessing against ‘processed foods’ in the popular imagination, it is perhaps not surprising that Mintel found a fifth of shoppers (21%) believe meat substitutes are ‘too processed’, while 35% say meat is a better source of nutrition.

Meat analogue makers are caught between a rock and a hard place. Further research into ingredients and processing technologies is required to produce plant-based products that better imitate meat. But at the same time, a growing cohort of consumers claim to reject the very processes that make meat mimicry possible.

You can’t please all the people all the time. But will the meat substitute sector be able to please enough people, enough of the time, to ensure a thriving future for the category?