A host of factors are needed for the industry to advance from niche into the mainstream, the summit heard.

In recent years consumer demand for plant-based protein has often outpaced the industry's supply chain capabilities. And as the alternative protein sector continues grows, building the ingredients, infrastructure, investment, services and manufacturing ecosystem will be critical to deliver innovative foods that not only meet the need of the consumer but also business objectives now and in the future.

There are yet more challenges in this industry: taste and texture; price; regulatory requirements; flagging investment and financing struggles; nutritional credentials. These were all hurdles identified at the summit.

More prosaic challenges exist. Shelf-life and standardisation is a challenge, as is securing talent. Skills gaps are now common, for example, in a quickly innovating space. Young start-ups in the sector are also particularly keen to protect their IPs. Brining manufacturing processes in-house might therefore seem like an attractive option. But this is not as cost-effective as hiring a contractor, which allows more scope to produce in large volumes.

Miguel Angelo De Facci de Oliveira, COO at NOVAMEAT, the Spanish company using 3D printing technology to create meat alternatives, said: "The alternative protein space is coming to terms with the reality of what is needed to build self-sustaining businesses, where the integration into food supply chains and the industrial footprint requirements therein become crucial survival challenges."

Why government support is ‘crucial’…

Government support is needed to propel this market, said Carlotte Lucas, senior corporate engagement manager at food sustainability NGO the Good Food Institute. It recently found that plant-based growth is decelerating in Europe. “If governments realise the role alternative proteins play in addressing so many of the critical issues they are trying to address from food security to climate change to biodiversity loss and if they then put in the necessary investment to scale up the required infrastructure then the alternative protein industry can accelerate at a speed we don't even recognise today,” she told FoodNavigator at the event. “But we need government support to make it happen.”

Not that this isn’t already happening. A recent GFI has reported details some of the key policy developments that took place across Europe in 2022.

The Netherlands announced €59 million in funding for cultivated meat and precision fermentation, the world’s largest-ever public investment in the cellular agriculture field.

Denmark committed to a 675 million kroner (€91 million) investment to advance plant-based foods, following an announcement made in 2021.

The European Union established a budget of €13.1 million for HealthFerm, a research collaboration of 22 partners across Europe focussing on the health and sustainability of plant-based fermented foods.

The UK’s Biotechnology and Biological Sciences Research Council has also set aside £20 million (€23 million) towards capacity building, research, innovation, and business-led commercialisation in the sustainable protein industry.

… So is open access R&D

Open access R&D is also critical for collaboration and ideas to blossom, Lucas told us. “All of the companies here are doing R&D in-house but everything is hidden behind IP. They are not sharing their learnings. This makes sense and it's how business work. But if the government funds R&D in universities, that can serve as foundation for all other companies to build from. That would accelerate the change and speed of innovation immensely and is something that we at the GFI are actively lobbying for and supporting via are own research grant programme. We've given out over 6 million dollars so far to researchers.”

On this point, the sector is recognising the need to build partnerships. In separate news away from the summit, for example, Quorn’s parent company Marlow Foods, has just announced plans to supply the protein in Quorn, mycoprotein, to other food and beverage manufacturers. There’s a risk this move may devalue the Quorn brand, admitted Marlow Foods CEO Marco Bertacca. But the company ultimately believes collaboration is the only way to propel the meat alternatives category.

Supply chain bottlenecks

Back at the summit, the logistical and scaling challenges in this sector were illustrated by La Vie, the plant-based bacon brand which recently gained nationwide listings at UK supermarkets Waitrose and Sainsbury's and Burger King UK. The brand claims its patented vegetable fat recipe allows it to create juicy meat-like experiences 'like no other'. After launching in France, where the product is made, it is also available the Benelux, Switzerland and is preparing to launch in Germany, Austria and Ireland.

The brand's trajectory has been 'unusual and amazing', said COO Matthias Neuner, who worked for more than 20 years at Nestlé prior to joining La Vie.

"We have cases where we get approached by retailers who say they want to list us,” he told FoodNavigator. “It's not us who are approaching them.”

“In one example, a big retail chain from Scandinavia asked, 'when can we have the product'? Our answer had to be 'sorry, we don't have a supply chain into Scandinavia because it's long distance and our chilled product won't hold for that long so we cannot supply you at this stage’.

“We know we have to find solutions in terms of supply chain and manufacturing networks to reach out to these more remote destinations across Europe because you always need to be able to guarantee the best possible freshness to consumers and trade customers.

“If the transport and logistics network into the country and into the supermarket is to complex then it doesn't work in the current set up.”

It's the taste, stupid

But it is taste that is key for this sector to grow, stressed Neuner. “We see increasing velocities at retail level. We see increasing orders from our customers. All that confirms that there is a fair amount of repeat purchase happening.

“The biggest success factor for me is taste. If you win on taste, then you attract the mainstream consumers as they don't want to compromise.”

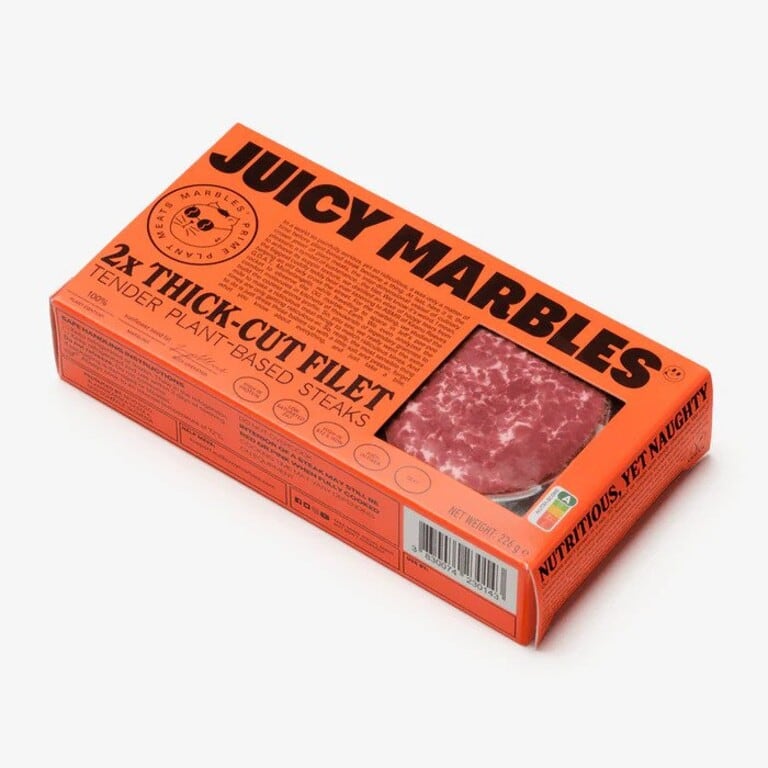

The biggest threat to this market becoming mainstream is consumer acceptance, agreed Tilen Travnik, co-founder and CEO of Juicy Marbles. The Slovenian start-up claims the crowns of creating ‘the world’s first marbled plant-based steak’ and the world’s ‘biggest piece of plant meat’ – the Whole-Cut Loin, which has just listed in Waitrose supermarkets in the UK. It also sells online via Mighty Plants, where it is enjoying a 20% repeat purchase rate.

“It’s an indulgent product that can bring back the emotional and dietary comfort of eating meat without eating meat,” he told FoodNavigator.

Made of mainly soy and sunflower oil, the technology behind the product is a "mechanical formation of fibres and then a special technology that intertwines the lean tissue with the fat tissue,” Travnik explained. “We call it 3D tissue assembly technology.” This is faster than 3D printing, he said, because it’s a ‘tissue by tissue’ rather than a ‘fibre by fibre’ production process.

"For many challenges, like scalability, there are solutions,” he added. “What does hinder our plans is whether we can make this product a weekly ritual for people and will they after trialling will they continue including it in their weekly nutritional routine."

The need for next generation tech and the volume problem

It’s widely believed that cracking the whole-cut conundrum will help meat alternatives companies find mainstream appeal.

To illustrate, Dutch start-up Rival Foods, a spin-out of the renowned Wageningen University & Research, attended the summit to promote its unique new protein structuring shear cell technology. This combines heat, mild pressure, and a low, linear shear force to transform a wide variety of plant-based ingredients into large, structured juicy protein-rich culinary products.

Recreating the thickness of a whole cut is a challenge with the current crop of high moisture extrusion technology, which has become the popular way to produce meat alternatives, Rival Foods CEO Birgit Dekkers, told us. Shear cell technology, on the other hand can ‘form and align proteins in a certain direction and create a fibrous texture’. “We can do that at a unique thickness, and we can incorporate a lot of water and therefore we can really recreate the texture, the juiciness and the mouthfeel of so-called whole cut products.”

The company’s chicken alternatives will be sold for the first time this summer in food service in the Netherlands. But to achieve scale – and hit the targets set by its financial backers – it needs to produce 1,000 kilos an hour, as is typical in the meat industry itself. At present, it is producing 100 kilos per hour.

"We have the ambition to have our products out there globally,” Dekkers said. “We have a solution to create unique products with unique texture and taste and juiciness. By scaling up the technology we're able to do that at a better cost competitiveness and that's what we're working on.”

Also working on whole cuts is Revo Foods. The Vienna-based start-up is already making plant-based seafood such as smoked salmon, and salmon and tuna spreads. Its first whole-cut vegan salmon fillet, made from algae, pea protein and mycoprotein from Swedish company Mycorena and using 3D food printing technology will be available in supermarkets later this year.

The young company needs capital to upscale this technology, admitted Revo Foods CEO Robin Simsa. “For big supermarkets we don't have the volume yet,” he told us. “Hopefully by the end of next year we will be able to do it.” But he insisted 3D printing can scale ‘as it’s not much different to production methods that have been used for decades already’. “Chocolate or pasta lines have a system that deposits a material which goes into a 2D conveyor belt,” he said. “All we're doing is adding a third component to it, like a third movement axis. So from a technology standpoint, it is not that revolutionary. But the products that you can create are really revolutionary we think. Our whole cut salmon fillet has a very fine distribution of muscle and fat material. You can’t create that with standard extrusion processes. It has the functionality of a salmon fillet. It has layers, which separate when you press it with a fork. I don't see another way of achieving this except with food printing.”

Collaboration between plant-based and cell-based ‘will be vital’

A final question: is the cultivated sector a challenge to the plant-based based sector?

Attendees denied that the swift moving cultivated meat and dairy sectors pose a potential threat to the plant-based protein sector. Lab-grown meat, cheese and fish has yet to be approved in Europe. But cell-based and plant-based products are substitutes for conventional animal products and are therefore vying, eventually, for the same end consumers.

The GFI’s Lucas, however, explained the industry is putting hope in the much-lauded hybrid category. “We see the future to be hybrid,” she told FoodNavigator. “This is a combination of different aspects of each of these technologies: plant-based, fermentation, cultivated, to ultimately create the best end product.”

Case in point, French start-up Gourmey, which makes cell-based foie gras, was the sole cultivated meat company at the summit. Its product – which aims to launch in Singapore, the US and then Europe within three years – is a hybrid one. The product is made by combining the company’s patented fat technology which mimics animal fats with cultivated meat grown from duck liver cells.

Gourmey Head of Business Development Adrien Langeard told FoodNavigator: "The reality is that cultivated meat in the short term in order to be vital needs to use hybrid products in the formulation. Collaboration between cultivated meat and plant-based knowledge will be vital.”