Late last year, Nestlé announced plans to report yearly on the nutritional profile of its global portfolio, starting in its 2022 Annual Report.

For the world’s largest food manufacturer, with a 2022 revenue of CHF94.4bn (€94.7bn) across 188 countries, this is no mean feat. But today (21 March) the results are in, making Nestlé the ‘first’ company to disclose its global nutritional values according to net sales of products.

The findings

Nestlé is benchmarking its entire portfolio – from beverages to confectionery and cooking aids – against the Health Star Rating (HSR) system, an Australian and New Zealand initiative that assigns health ratings to packaged foods and beverages.

Formulated products for infant and young children, as well as food for special medical purposes, are excluded from the system. For Nestlé, this means its medical and infant nutrition products – which brought in CHF15.7bn in 2022 – as well as its pet food business, are exempt.

The nutritional profile Nestlé’s portfolio

Results reveal 37% of Nestlé’s product portfolio, excluding its pet care business, achieves an HSR rating of ≥ 3.5 stars. When its specialised nutrition products are added, to which HSR cannot be applied, the figure goes up to 57%. Twenty-two percent of the portfolio has an HSR of 1.5 to < 3.5 stars, and 21% has an HSR of < 1.5 stars.

“This is a confirmation that we have done a good job and a lot over work over the last years,” Bernard Meunier, executive vice president, head of strategic business units (SBUs), marketing and sales, told FoodNavigator.

As to whether the findings were as expected, Meunier told us they are not a ‘total surprise’. The company had a feeling it was ‘in the right place’, he explained.

“It’s a good confirmation that we have come a long way and we are in a good place. But it doesn’t mean we stop there. We continue, of course, working on our products.”

Reporting on nutritional value at market level

As well as reporting on its global portfolio, Nestlé is also reporting on the nutritional value of local portfolios in 13 countries, using the local, government-endorsed nutrient profiling system. In Europe, countries include France and Germany (benchmarked against Nutri-Score), and the UK (benchmarked against the UK Government Nutrient Profiling Model).

The company decided to report separately on each country as the figures for different countries – due to each nutrient profiling system having different characteristics – cannot be compared.

In France, 34% of Nestlé products are in scope for the Nutri-Score scheme. Nutri-Score A is the classification with the highest percentage of products (17%). In Germany, where 46% of Nestlé’s products are in scope for Nutri-Score, Nutri-Score C is the classification with the highest percentage of products (19%).

In the UK, where 69% of Nestlé’s portfolio is in scope for the UK Nutrient Profiling Model – which assigns foods as either HFSS or not – most (42%) of its products are classified as non-HFSS.

Health Star Rating not perfect, but ‘very solid’

The HSR scheme launched in 2014 to help consumers compare the general nutritional profile of foods within the same category of packaged and processed goods. The voluntary front-of-pack labelling scheme gives a score from 0.5 stars to 5 stars based on an algorithm that rates products on the total energy, saturated fat, sodium and sugar content (which can lower the score), as well as the fibre, protein, fruit, vegetables, nuts and legumes content (which can increase the score).

It is the labelling scheme of choice for the Access to Nutrition Initiative (ATNI), which classifies products rating 3.5 stars or more as generally healthier. The Access to Nutrition Global Index ranks the 25 largest food and beverage manufacturers using the HSR scheme. The most recent global index ranks Nestlé in first place.

But the HRS is not without its critics. In 2018, for example, research conducted in Australia found that over half (57%) of new discretionary (most energy-dense, nutrient-poor) food products achieved an HSR rating of ≥2.5 health stars. The same researchers, in a separate paper, also found HSR was mostly used on food products considered ‘ultra-processed’.

Acknowledging the scheme is not perfect, Nestlé justified its preference for HSR, describing it as ‘one of the most robust’ in the industry. “It’s been peer-reviewed and substantially studied in advance, so it’s very solid,” Marie-Chantal Messier, head of food and industry affairs in Nestlé’s public affairs team, told this publication.

That the ATNI uses HSR to benchmark the 25 largest food and beverage companies also weighed in on Nestlé’s decision. In the interest of transparency, Nestlé is now using a ‘very similar’ basis of comparison. “It’s not the exact same basis, because ATNI only focuses on the five largest categories that we have, and only in selected markets. What [we are publishing] now is full transparency,” said Messier.

Also contributing to Nestlé decision to benchmark against HSR is that its algorithm is very similar, ‘with some tweaks’, to other popular FOP nutrition labelling schemes such as the UK Nutrient Profiling Model in the UK and Nutri-Score in Europe. “I would say they are related cousins,” explained the public affairs expert.

Where to now?

For the Maggi-to-Smarties manufacturer, the findings reflect ‘a lot of revolutions’ in its global product portfolio. Nestlé has made modifications to its portfolio, and having leveraged reformulation tools, has improved its products over time.

Whether progress has been made since 2021, when British newspaper the Financial Times published leaked internal documents suggesting 37% of Nestlé’s portfolio (excluding pet food and specialised medical nutrition products) achieved an HSR rating of 3.5 or more, is likely, despite no change in the two sets of figures.

Nestlé does not believe the leaked documents presented the ‘right’ calculation, explained Meunier. “Now, we present audited figures that show exactly the proportion of Nestlé products with an HSR of 3.5 stars and above, together with specialised nutrition.

“Those [2021] figures were out of context, and they were also not the same figures we have today because we hadn’t done the work. It’s not comparable…What we are presenting and publicising [today] is the right picture.”

Moving forward, Nestlé has committed to setting a global target for the ‘healthier’ part of its portfolio later this year. But overall, the food major is not in a race to ‘change or increase proportions here or there’. “We feel we have a good portfolio which is well balanced,” reiterated Meunier.

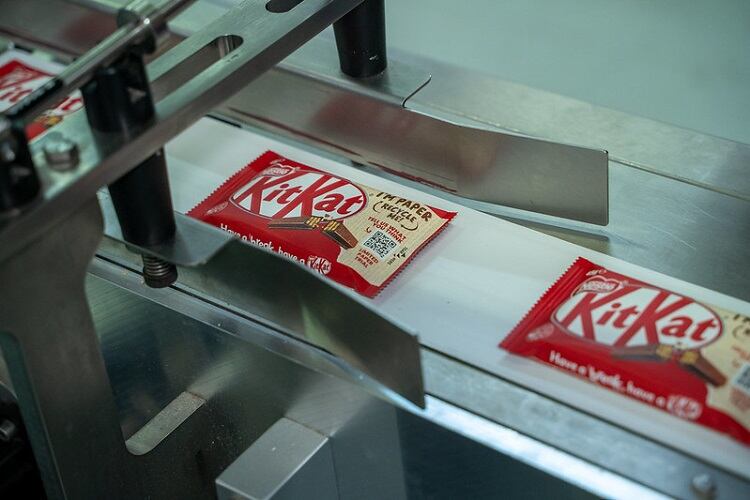

Nestlé also has no plans to turn indulgent products, such as chocolate, into health products. But reformulation efforts persist. “We will continue to improve products that can be [reformulated] by reducing sugar, sodium, and fat levels, while maintaining our winning recipes,” said Meunier. “We are in those categories to win, and to win is to get consumer preference.”

Aside from reformulation and innovation efforts, Nestlé is pulling other levers with regards to the 43% of its portfolio (excluding pet food) with less than 3.5 HSR stars. For example, Nestlé recently strengthened its responsible marketing to children practices, announcing it will voluntarily restrict its marketing to kids under the age of 16.

“We will step up our portion guidance and we will step up our education,” added Messier, which will include providing consumers and families with recipes, encouraging ‘healthy swaps’, and providing more services around what quantifies a healthy and balanced diet.

Nutrients

‘Do nutrient-based front-of-pack labelling schemes support or undermine food-based dietary guideline recommendations? Lessons from the Australian health star rating system’

Published December 2018

DOI: 10.3390/nu10010032

Authors: Lawrence M, Dickie S, Woods J.

International Journal of Behavioral Nutrition and Physical Activity

‘Analysing the use of the Australian Health Star Rating system by level of food processing’

Published December 2018

DOI: 10.1186/s12966-018-0760-7

Authors: Dickie, S., Woods, J.L. & Lawrence, M.