When one thinks of eastern European cuisines, meat is often a staple. The alternative protein trend has been slow to take hold, and according to recent research out of Serbia, consumers are ‘pretty satisfied’ eating their traditional meat-based dishes.

“Meat analogues and substitutes are not even being considered yet…” noted researchers of a study published in Earth and Environment Science last year. “Animal welfare, environmental and sustainability issues are less of a concern because of the lower incomes in the eastern compared to the western part of Europe.” Vegetarianism, the researchers continued, remains in its ‘infancy’.

However, there are signs change is afoot. According to data from Euromonitor, retail plant-based meat sales rose sharply (+43%) in eastern Europe last year to reach €176.6m.

Whether the alt protein trend will stick in eastern European countries or not, local innovators are aware of the market opportunity that may exist domestically, and most certainly exists further afield. Western Europe remains hungry for animal-free alternatives, with Meticulous Research estimating Europe’s plant-based food market to grow at a CAGR of 10.1% from 2022 to 2029 to reach $16.7bn (€15.6bn).

As a result, a growing number of start-ups located in Europe’s eastern regions are innovating with alternative proteins for local and international markets. Three of the newest to enter the scene are located in Ukraine and Romania and north-eastern Lithuania.

Plant-based meat whole cuts made in Ukraine ‘for the world’

Ukraine is known as the ‘breadbasket’ of Europe. Prior to Russia’s invasion of the country almost a year ago, 70% of the country’s land was dedicated to agricultural production. The nation is a major producer of sunflower, corn, soybeans, wheat and barley.

Although agricultural production is now understandably disrupted, innovative research and development continues to take place. Green Go’s work with plant-based ingredients to develop meat and seafood alternatives is case in point.

The start-up is on a mission to develop plant-based food products that are ‘tasty and accessible to everyone’, the company’s creative director told delegates at ProVeg Incubator’s recent Demo Day – its ninth edition.

Green Go is unsatisfied with the plant-based alternatives currently on the market, which it describes as having an unrealistic appearance and texture, ‘poor’ flavour, taste and smell, and ‘unnatural’ cooking behaviour.

The start-up is solving these issues through knowledge attained by working with a variety of plant proteins. The company initially started R&D work with tofu. From there, it has expanded into pea, soy, and wheat proteins.

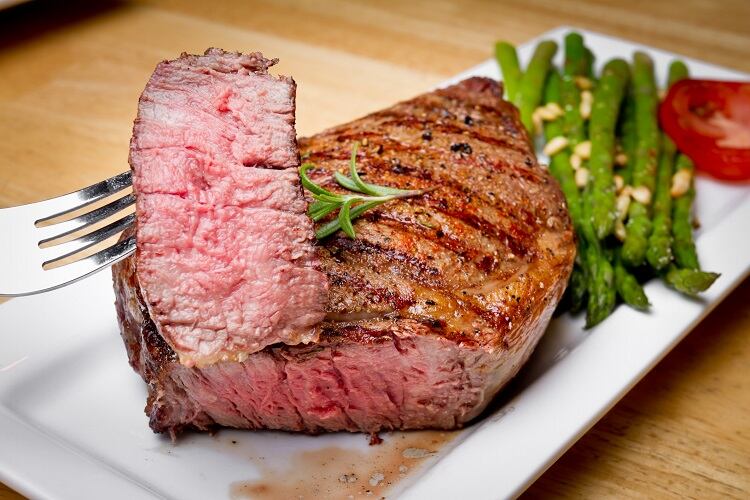

Its ‘wow’ product, the creative director explained, is its ‘GreenBeef Steak’. “It has a meat-like structure, excellent juiciness, realistic cooking behaviour, and premium marbeling,” we were told. Other products in its portfolio include plant-based alternatives to ribeye, shrimp, calamari, and tofu-based cheese.

The start-up plans to produce in Ukraine and sell ‘all around the world’. “It’s not a secret that production of any goods in Ukraine is very cost-effective…and so you can reduce your cost price by producing in Ukraine,” the spokesperson explained. Not all of its products will reach the international market, however. “I believe we should be focused on whole cuts, like steaks.”

From a health perspective, the products’ nutritional profile is ‘very similar’ to conventional meat products, but with fewer calories, the creative director told delegates. “We typically use a combination of wheat protein, pea protein, and soy protein, but we have separate products based on pea protein [only],” she continued, suggesting the brand is also catering to consumers with soy intolerances.

Plant-based sashimi…from the Black Sea?

In neighbouring Romania, innovators are similarly developing alternatives to conventional animal-based products. Start-up Bluana Foods is looking under the water, however, to mimic red tuna and salmon.

Bluana has its eye on the plant-based sashimi market. Market research, CEO Florin Iriescu explained at the ProVeg Incubator event, suggests that 80% of consumers are dissatisfied with the current seafood alternatives on the market. These products are developed with ‘little consumer insight’ in a lab, with ‘little regard for taste’.

“The same old ingredients are thrown together to [produce] something which is cheap, but definitely not tasty.”

Bluana’s approach is to focus on an ‘extra ingredient’, we were told: gastronomy. Indeed, Iriescu also serves as the company’s head chef. “We are focusing on taste and clean labels, we are using healthy ingredients to develop red tuna and salmon sashimi that tastes, feels, and smells like the real thing.”

If the start-up refuses to use commonly found alternative proteins, such as pea and soy, which plant-based proteins is it using?

Its first sashimi alternative products were made from potato protein, the CEO explained. In the coming year, Bluana plans to incorporate other ingredients, ranging from moringa to microalgae protein, shiitake mushroom, and kombu.

The company is confident its technology can compete with other seafood alternatives on the market. “This is a relatively new category, but some players are already present in the market,” said Iriescu. “However, we are the only ones at the crossroads between healthiness, excellent taste, and texture.”

Indeed, Bluana claims to have conducted more than 1,000 sensory trials with its prototype to date, with 80% of consumers reporting they would buy the product. The company has also observed interest from industry, with German fish distributor Kanzow Hamburg having inked a letter of intent.

The start-up expects food service to account for 70% of its revenues in the future, with 30% coming directly from its website.

Looking to the future, in 2023 the start-up plans to develop a line of consumer-packaged goods, and between 2024 and 2026 it plans to sign a contract manufacturer, scale up its technology, and reach 100,000 consumers.

The next stage of development, we were told, would occur between 2027 and 2010, when Bluana plans to enter the cell-based meat sector.

Mycoprotein for the Baltics and Nordics

Up in north-eastern Europe lies the Baltic nation of Lithuania. Here too, innovators are experimenting with unconventional proteins, such as fungi.

Founded by Nerijus Budreckis and Gediminas Blažys, Lithuanian start-up BioGNR has developed fermentation-based technology to produce mycoprotein. The protein alternative is significantly more environmentally sustainable than conventional proteins such as beef. Indeed, compared to mycoprotein, beef uses 91 times more water, is responsible for 42 times more CO2 emissions, and uses 1023 times more land.

BioGNR’s mycoprotein is branded Mico-22, which has a ‘meat-like’ texture and ‘no off-taste, compared with plant-based protein sources’, the company’s business development manager, Ugnė Butvilaitė, explained. “Mico-22 has a high nutritional value. It is high in proteins, fibres, contains all essential omega acids and is low in fats,” she added at the ProVeg Incubator event.

What makes BioGNR’s mycoprotein product stand out from the crowd, however, is its ‘unique hyphae alignment technologies’, which relies on a combination of different texturization techniques.

To develop Mico-22, the start-up initiates a liquid-state fermentation process, before moving onto purification, concentration, and hyphae alignment. It is then ready to pack and deliver to its food industry manufacturer and food ingredient distributor consumers, Butvilaitė told delegates.

The start-up has its eye on the Baltic and Nordic regions for initial market entry, as well as Poland and Germany. In this region, competitors include The Protein Brewery, ENOUGH, Mycorena, and Naplasol Plant Proteins.

“Nevertheless, to be unique in the market, we are working for exceptional texture, which we will create by hyphae technology.”

The start-up is currently trialling its prototypes with industry, and believes it has already achieved the ‘right’ nutritional value and taste. “Texture still needs to be improved, and that’s what we are working on from the beginning of [2023],” the business development manager revealed.