Overweight and obesity rates have reached ‘epidemic proportions’ across the European region and are still escalating, according to a recent report from the World Health Organization.

The report revealed that in the European Region, 59% of adults and almost one-in-three children are overweight or living with obesity. Obesity prevalence for adults in the European Region is higher than in any other WHO region except for the Americas.

“The countries in our Region are incredibly diverse, but every one is challenged to some degree,” observed Dr Hans Henri P. Kluge, WHO Regional Director for Europe.

The UK was no exception. The country had the third-highest adult obesity rate of the 53 countries that make up the WHO’s European Region. Poor diets account for one in seven UK deaths, while excess obesity-related disease accounts for 8% of all government healthcare expenditure.

But while the figures made for sobering reading, Dr Kluge said there is also reason for optimism. “By creating environments that are more enabling, promoting investment and innovation in health, and developing strong and resilient health systems, we can change the trajectory of obesity in the Region,” the public health expert suggested.

The role of retail

In this context, ATNI – a benchmarking initiative on nutrition - and Share Action have released research that places the food environment created by UK supermarkets under the microscope.

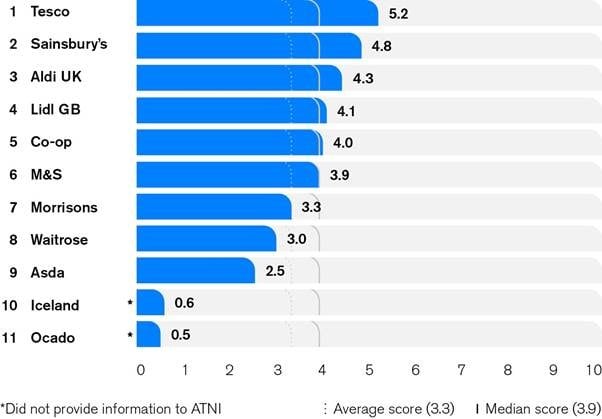

The ATNI UK Retailer Index 2022 compares the performance of 11 major UK food retailers across eight topics described as ‘critical to consumer health’. These include product formulation of own label items, in-store promotion, pricing and placement, media and on-pack advertising, labelling, infant and young child nutrition, and stakeholder engagement.

The retailers that the Network assessed account for over 80% of grocery spending in the UK, a fact that ATNI said gave them both a ‘huge opportunity’ and ‘responsibility’ to make healthier food more available, accessible and affordable.

“With two in every three pounds spent on food going to supermarkets, these companies have a major influence on the nation’s health,” Lily Roberts, Senior Campaigns and Research Officer at ShareAction, said.

“For supermarkets to hold the line on delivering affordable healthy products is more relevant than ever, with extra threats to food security posed by the COVID-19 pandemic and the impact of the war in Ukraine,” Inge Kauer, Executive Director, Access to Nutrition Initiative, added.

The best – and worst – performers on healthy food environments

Of the 11 retailers assessed by ATNI, nine of those included in this Index took the opportunity to share additional data throughout the research process. This, the researchers said, stands as evidence that better nutrition is a major topic that UK retailers take seriously.

But how is that translating in store?

The ranking shows a ‘wide disparity’ in performance between different retailers. Tesco, which recently committed to increasing sales of healthier food products from 58% to 65% of all sales by 2025 – following a shareholder resolution filed by ShareAction – tops the table with a score of 5.2 out of 10.

The supermarket giant is followed by Sainsbury’s (4.8) and ALDI UK (4.3). In contrast, Iceland and Ocado scored just 0.6 and 0.5, respectively.

“The ranking shows there is much room for improvement across the sector regarding nutrition-related topics, as the average score was just 3.3 out of 10,” ATNI said.

Some examples identified by the assessment include:

- Lidl GB and Sainsbury’s are the only two companies that have allocated responsibility for delivering their nutrition strategy a senior executive or CEO;

- Five companies (ALDI UK, Lidl GB, M&S, Sainsbury’s, and Tesco) have set targets to increase their sales of healthier food products over time, and all of these, except for M&S, have also set specific targets to increase their sales of fruit and vegetables;

- Two companies (M&S and Tesco) use the UK Government’s definition of healthier products to guide their product reformulation and marketing work;

- Only Co-op and Waitrose commit not to run in-store promotional activities directed at children featuring any less healthy products;

- Lidl GB, M&S, Sainsbury’s and Tesco use their membership or rewards schemes (available to all customers) to incentivise the sale of healthy products;

- All but Iceland, Ocado and Tesco were found to have made some efforts to restrict the usage of child-oriented characters on own-brand products;

- Iceland is the only retailer that does not use traffic-light front-of-pack labels on their own-brand products, though it is generally unclear to which products the retailers’ policies on FOP labelling apply and what is the rationale for any exceptions;

- No retailer has committed to adhering to WHO’s International Code of Marketing of Breast-Milk Substitutes.

ShareAction’s Roberts, which represents shareholders who want to see systemic change in the way businesses approach issues like health, stressed that there is a strong business case for placing nutrition at the heart of strategy.

“By better integrating considerations around nutrition across their business, progressive retailers can stay ahead of growing regulation in this space while driving improvements in public health outcomes,” she suggested. “Investors are increasingly prioritising health within their policies and practices, and we expect them to continue robust company engagement on this theme.”