By 2050, it is estimated global populations will reach close to 10bn. At this point, the UN predicts demand for protein will have increased by more than 50% compared to 2020 levels.

Given the planet’s limited natural resources, this is cause for concern. Meat and fish consumption is on the rise, prompting entrepreneurs to rethink the efficiency of protein production.

“We really need to make protein production more sustainable,” Katelijne Bekers, CEO and co-founder of alternative protein start-up MicroHarvest told FoodNavigator.

“It would be great if everybody could go vegan within a couple of decades, but I don’t think that’s realistic.”

MicroHarvest believes the solution lies in the power of microorganisms. Leveraging microbial fermentation technology means more protein on less land, and contain significantly higher protein content, the CEO explained. “You can do it 24/7 anywhere in the world, without depending on seasons or climate.”

The Hamburg-based start-up is taking a three-pronged approach to disrupt conventional protein production in food, feed, and petfood sectors.

Faster, more efficient, and sustainable

MicroHarvest is producing single cell protein from microbes, and claims to be doing so faster than any other protein production system in the world.

How does it achieve this? “It’s the combination of the strain and our production technology that is responsible for this speed,” explained the CEO. While a number of strains exist that can produce biomass at this speed, Bekers said, MicroHarvest is amongst the first to make the connection between these strains and protein ingredients for food and feed, we were told.

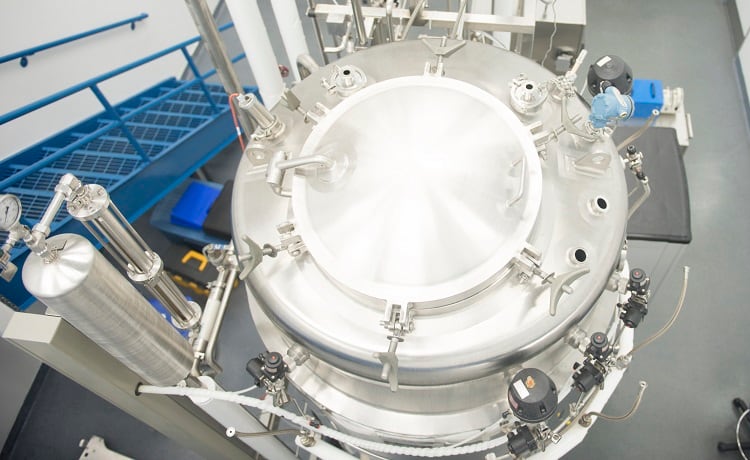

Protein production begins with MicroHarvest’s bacterial strain and growth medium (sugar derived from agricultural and food side streams). A fermentation process allows for ‘fast exponential growth’ of biomass, which is then separated to harvest the cells. A selective breakdown of the biomass can then take place, before a dehydration process – which increases the protein’s stability and shelf-life.

This conversion of raw materials to protein can occur in one day, at a speed Bekers stressed is ‘unparalleled’. Soy protein, for example, takes three months, and animal protein takes between months and years to produce an equivalent amount.

MicroHarvest claims to be faster, more efficient and more sustainable than other alternative protein sources, from CO2 fermentation to cell culture, methane fermentation, fungi, and yeast. The ingredient has a crude protein content of between 60-70%.

This year, the start-up has already achieved its goal of producing 100kg of protein per week. By 2024, it estimates it will be producing a multifold of this. This fast growth also makes for lower production costs and energy consumption.

Targeting the B2B feed and food markets

MicroHarvest is targeting three global markets: animal feed, pet food, and human protein ingredients. “We will show within a niche market in animal feed that we can scale, build our reputation, and then move into the next market.”

In terms of specific feed sectors, MicroHarvest is investigating aquaculture as well as livestock, with plans for market entry as early as next year (2023).

Having entered feed and pet food markets, MicroHarvest plans to turn its attention to the human protein ingredients sector. According to BCG the alternative protein ingredient market stands at $14bn, and is growing with a CAGR of 14% to 2025.

Bekers herself has experience working in the B2B ingredients space, with more than seven years combined at Ohly and Corbion.

Being able to produce such a significant amount of protein is what sets MicroHarvest apart in this sector, Bekers suggested. “This is what’s necessary, because companies like Cargill and Nestlé [for example] don’t want 10 tons, they want thousands of tons, and being able to scale to that size, and how fast you can ramp up, [is what makes you] a relevant supplier for them.”

The CEO described the protein ingredient has tasting slightly acidic, with a smell and taste not dissimilar to yoghurt. There is also an umami element, which Bekers suggested will work well in feed and some food applications.

Focusing on food at a slightly later date than the other two markets is a strategic decision, given the European Commission’s ‘stringent’ regulatory approval process for novel foods. “We want to start in feed markets because our strain is not consumed at large scale yet,” said Bekers. Currently working with a contract manufacturer, MicroHarvest has plans to build its own factory, adding that moving forward, its business model lends itself to decentralised production.

By 2028, the company plans to be selling aquafeed, human nutrition, pet food, and specialty micronutrient feed.

MicroHarvest has closed a Seed round from FoodLabs and plans to raise a Series A this year.