Alternative protein is a trend in its own right, and one that’s been on the radar for a number of years.

Within this ‘mega trend’, a number of areas are attracting increased attention. As we head into the new year, the Good Food Institute (GFI) – a non-profit advocating a switch to more sustainable foods – has selected its top seven.

1. Fermentation-based dairy alternatives

In 2022, GFI predicts more consumers will have a chance to taste test alt dairy products produced via precision fermentation. This technology enables the programming of micro-organisms to produce complex organic molecules, such as proteins.

Precision fermentation-derived dairy first hit the market in 2021, when Brave Robot ice cream launched in retailers across the US. The ice cream was made with Perfect Day’s fermented whey protein.

Since then, animal-free dairy ingredients have been sold in a number of products, from Modern Kitchen’s cream cheese, Climate Hero Cake mix, and in milk at select Starbucks locations.

Coming up in 2022, GFI expects precision fermentation will expand into non-dairy categories on-shelf. The EVERY Company (formerly Clara Foods) has, indeed, already launched the world’s first fermented egg proteins. Late last year, the firm rolled it out in partnership with Pressed Juicery Smoothies.

And Motif Foodworks will license its myoglobin HEMAMI ingredient to food makers. The supply start-up claims the ingredient improves the ‘meaty’ taste of plant-based beef analogues.

2. Blurring the alt protein lines

GFI has observed the lines blurring between the three alternative protein pillars - plant-based, fermentation, and cultivated meat - and expects this to continue into 2022.

One prominent example on the other side of the pond lies in the Impossible Burger’s use of fermentation-derived heme in its plant-based matrix. As mentioned, Motif Foodworks is preparing to license its fermentation-derived heme to makers of plant-based meat analogues.

It is likely ‘hybrid’ or ‘blended’ plant-based meat products will launch this year, noted GFI. While ‘hybrid’ has in the past referred to a food item containing two or more distinct protein sources, here GFI means plant-based products that are ‘enhanced’ with cultivated fat to improve sensory properties.

Again, in the cultivated meat category, GFI says industry may see cultivated meat products reach the market as blends with plant protein ingredients, which can both lower costs and appeal to consumers who are looking for added nutritional elements such as fibre.

Another category ‘blurring the lines’ is plant-based dairy, whereby plant-based milk and cheese companies are using traditional fermentation techniques – based on nuts and other plant-based ingredients – to get an authentic ‘sharp’ and ‘creamy dairy taste’ of conventional cheese.

3. Plant-based diversification

In 2021, not only did plant-based product categories continue to diversity, but GFI judges them to have reached ‘higher fidelity’ to their animal counterparts. It is expected these products will reach greater audiences in 2022.

In alternative seafood, for example, the first half of 2021 saw ‘record investments’, totally $116m – and surpassing 2020’s total investments. The space has exploded, and now more than 87 companies making alt seafood products, either from plants, microbes, or animal cells. GFI predicts alt seafood options to expand their presence in restaurants, grocery, and online in the coming year.

Whole-cut formats is another growing space. To date, ground and restructured meat analogues have largely been leading the plant-based movement – such as ground beef, sausage, and chicken nuggets – yet GFI predicts 2022 will see the expansion of whole-cut product formats. These are designed to meet an ‘even wider variety of cooking needs’. Juicy Marbles, which makes a plant-based steak ‘marbled’ with sunflower oil, recently launched its plant-based filet mignon direct to consumers.

Other expanding categories include alternatives to processed meat such as bacon and pepperoni, eggs, and milk.

4. More regulatory approvals on the cards

In 2020, the world’s first cell-based meat ingredient received regulatory approval for commercialisation. The product in question is a GOOD Meat’s cultivated chicken, which received the regulatory nod just over a year ago in December 2020.

GFI expects 2022 will be the year where more consumers may take their first bite of cultivated meat and seafood products. While unlikely to be in Europe, the USD and FDA have been working on a joint regulatory framework for cultivated meat since 2018.

A number of companies across the pond, including UPSIDE Foods, Wild Type, and BlueNalu, have suggested they’re at the starting gates ready to launch – as soon as regulatory approval is received.

5. Sustainability ‘top-of-mind’ for consumers and investors

The sustainability benefits of alternative proteins over animal-based foods is well publicised, from reduced greenhouse gas emissions to water use, land use, and air pollution.

However, according to GFI there is ‘still opportunity’ within the alternative protein chain to reduce environmental impact further by upcycling side stream materials, as well as using sustainable packaging, renewable energy, and efficient transportation.

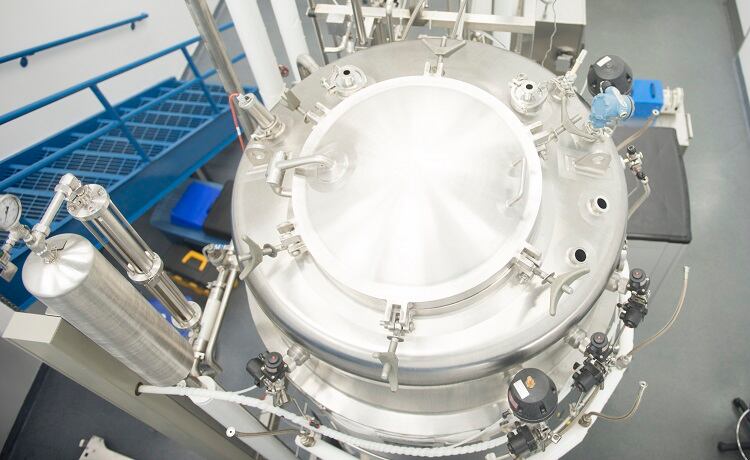

Some industry players are already working to boost their sustainability credentials. France-headquartered pea protein supplier Roquette, for example, has built its newest facility – based in Manitoba, Canada – in areas that grow plant proteins to cut down on transportation miles.

And Finnish precision fermentation company Solar Foods is leveraging greenhouse gases as inputs in its fermentation processes.

“Sustainability is an important motivator for plant-based food consumption, particularly among younger consumers,” noted GFI’s report author and corporate engagement coordinator Maille O’Donnell.

“We also expect alternative proteins to be increasingly identified as a key ESG investment industry, supported by ESG frameworks used in investor due diligence that are increasingly embedding considerations of alternative proteins.”

6. Investment injections

Alternative proteins continued to raise some serious capital in 2021, and GFI foresees this trend will continue. One of the biggest funding rounds of the past months was secured by Israeli cultivated meat start-up Future Meat Technologies, who raised a record-breaking $347m Series B round.

A good number of alternative protein operations raised rounds in excess of $100m in 2021, and many in excess of $200m. These include Impossible Foods, Eat Just, Aleph Farms, Perfect Day, The EVERY Company, and NotCo.

GFI also expects more alternative proteins businesses to float on the stock exchange in 2022, following recent IPOs from Oatly, Biomilk, Veganz, Gosh! Foods, Next Ferm, and Bettermoo(d).

Buyouts of alternative protein firms by traditional meat players also indicates ‘increased involvement’ from ‘major meat industry incumbents’, suggests GFI. Vivera and BioTech Foods are two examples of businesses acquired by JBS in the

past year.

7. Increased government involvement

Public funding in the alternative protein space is on the rise. Governments around the world, including the European Union, Israel, and Canada, have granted more than $66m into research projects to date, and GFI expects more to follow.

Of course, this represents just a fraction of what has been privately raised, which totaled more than $3.5bn in the first half of 2021 alone.

“Public funding for research is essential to scaling the industry at the needed pace, and we expect to see more public funds dedicated to addressing high-priority infrastructure and research needs that will benefit the entire industry,” noted GFI’s O’Donnell.