The Israeli seed specialist recently unveiled a new variety of protein-rich sesame seeds which it said could help solve the taste and texture challenges of plant-based food and beverages. But with prices for plant-based foods still dwarfing traditional meat and dairy, the company claims its tech can also help drive down plant-based meat prices and progress the next generation of plant-based products.

“Prices will drop when demand increases and the industry finds a better solution to the current sources it’s using,” said Equinom CEO and founder Gil Shalev. The company is encouraging the transition from protein isolate to concentrate. Protein Isolate is highly processed, claimed Shalev, and uses a lot of water, energy, and chemicals. Protein concentrate, on the other hand, created by dry fractionation, uses no water and much lower energy use.

“Protein isolate is more favorable because it has a higher protein content, but we are working on releasing a high protein pea concentrate that will compete with protein isolate."

Equinom claims its yellow pea has nearly 50% more protein than the current market varieties.

“We also improve the amino acid composition and we are working to improve specific molecules to improve nutritional value,” said Shalev.

"Another way in which we can assist is by bringing new varieties ‘closer to home’ - reducing the need to import source ingredients from across the world. We can tailor seeds to suit specific climates."

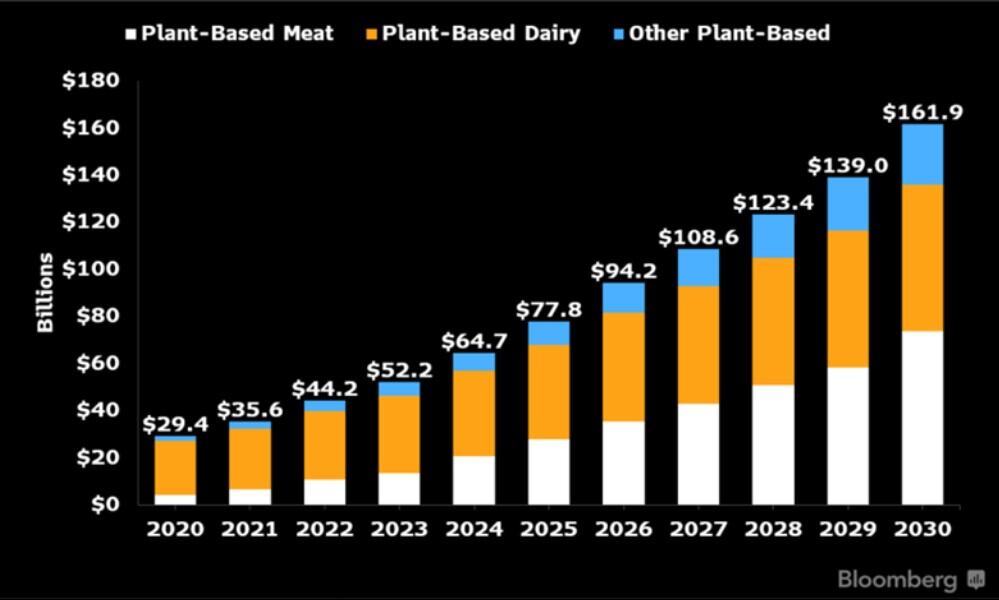

Shalev’s comments come as a new report from Bloomberg Intelligence estimates the plant-based foods market could make up to 7.7% of the global protein market by 2030, with a value of over $162 billion. That’s up from $29.4 billion in 2020, but still trailing global animal and dairy protein demand which is poised to reach $1.2 trillion by then.

According to the new report, industry giants including Beyond Meat, Impossible Foods and Oatly are driving an increase in plant-based food options as they partner with restaurants and major chains. More traditional and established competitors, like Kellogg and Nestlé, are looking to gain an edge by ramping up their distribution of plant-based products, and producing promotional campaigns that showcase their variety of options. As consumers become familiarized with plant-based products and initiatives, BI foresees an evolution in consumer habits over the next decade.

Source: Bloomberg Intelligence, OECD Agricultural Outlook 2021-2030, GFFI 2020 State of the Industry Report

Jennifer Bartashus, senior consumer staples analyst at Bloomberg Intelligence said: “Food-related consumer habits often come and go as fads, but plant-based alternatives are here to stay – and grow. The expanding set of product options in the plant-based industry is contributing to plant alternatives becoming a long-term option for consumers around the world. If sales and penetration for meat and dairy alternatives continue to grow, our scenario analysis suggests that the plant-based food industry has the potential to become ingrained as a viable option in supermarkets and restaurants alike. Meat and dairy alternatives could even obtain 5% and 10% of their respective global market shares in the next decade.”

The Bloomberg Intelligence report suggested Asia-Pacific is likely to dominate the plant-based protein market reaching $64.8 billion by 2030, up from $13.5 billion in 2020 as the region is particularly vulnerable to limited food supply. Comparatively, Europe and North America will see roughly $40 billion in sales, with Africa, the Middle East and Latin America all seeing between $8-9 billion each.

International restaurant chains, including Taco Bell, Chipotle, Jamba Juice and Starbucks will be significant players in increased sales and consumption of plant-based alternatives. Large chains offering burger, sausage and milk alternatives will encourage consumer habits to adjust to plant-based food products. Bloomberg Intelligence expects faux-chicken to be particularly primed for growth over the next year.