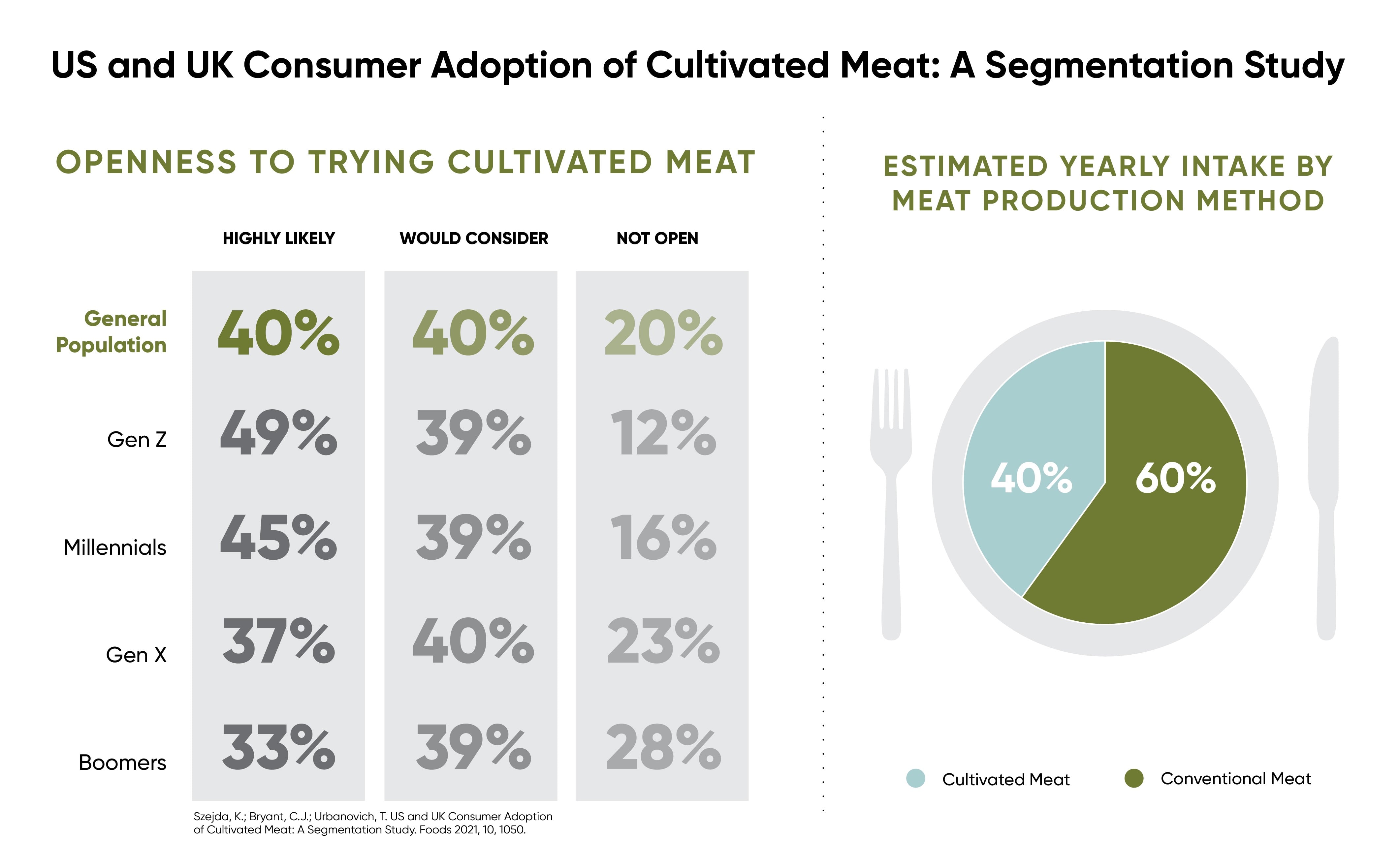

The research, published by the journal Foods, showed patterns of greater openness to trying such products by younger generational groups: 87-89% of Gen Z adults, 84-85% of Millennials, 76-77% of Gen X, and 70-74% of older baby boomers were at least somewhat open to trying cultivated meat.

The majority of 2,018 US and 2,034 UK consumers surveyed were not familiar with cultivated meat, yet upon being presented with a description of it, the respondents, on average, imagined that cultivated meat could make up about 40% of their future meat intake, with conventional meat constituting around 60%.

Aleph Farms claimed that 40% of consumers said they were 'very' or 'extremely likely' to try cultivated meat in both the US and the UK. Among these, 98-99% of them said they would consider welcoming it as a regular item in their shopping basket. The vast majority of this group were omnivores (94-95%) who consume meat 2-3 times per day in a typical week.

“The results suggest that cultivated meat is likely to be widely accepted by the general public, especially the younger generations and an eager group of early adopters who appreciate its benefits across a wide range of social issues. These groups tend to embrace change and need little encouragement to try new food innovations,” noted Szejda, Ph.D., Founder and Principal Research Scientist of North Mountain Consulting Group, who led the research. “Additionally, we observed an increase in support for the technology once consumers had access to additional information, underscoring the importance of effective science communication for consumer adoption.”

In the US and the UK, an average of 77% of Gen X and 74% of Boomers were open to trying it, in comparison to 85% of Millennials, and 89% of Gen Z.

The findings further showed that consumers preferred the terms ‘cultured’ and ‘cultivated’ over ‘cell-based’ and ‘cell-cultured’ for use in a social context and on packages, even though they perceived these terms as less descriptive. The participants preferred non-GM products over GM products. The study also found that US consumers prefer nutritionally superior meat over nutritionally equivalent meat.

Cell-based meat sector’s health and environmental credentials remain up for debate

No cell-based meat product has yet to apply for a Novel Foods Application in Europe. How can the company therefore be confident consumers will regularly buy these types of products if and when they’re available?

Aleph Farms Co-Founder and CEO Didier Toubia told FoodNavigator the company’s vision is to provide a better alternative to industrial livestock farming, which represents approximately 70% of global meat production today, by focusing on developing ‘quality products’. “This will be key to driving long-term consumer acceptance,” he said. “The company has diligently perfected the structural composition of its product so that it embodies the familiar texture, taste, cooking behavior, as well as the nutritional qualities of beef steaks that are derived from animal slaughter.”

Meanwhile, the health credentials of cultured meat compared to conventional meat are yet to be established. One study has concluded: “Unlike conventional meat, cultured muscle cells may be safer, without any adjacent digestive organs. On the other hand, with this high level of cell multiplication, some dysregulation is likely as happens in cancer cells. Likewise, the control of its nutritional composition is still unclear, especially for micronutrients and iron.”

Toubia claimed his product will have the same taste, texture and nutritional qualities as conventional meat. “The nutritional profile of our meat is comparable to conventional meat,” he said. “It mirrors the meat flavor experience, with the texture, look, taste and nutritional content expected when eating conventional meat.”

He further claimed cultivated meat can reach price parity with conventional meat ‘within a few years from full launch’ as the most expensive inputs in the cultivated meat production process -- the non-animal proteins incorporated in the growth medium used to feed the cells – which are currently produced in very small quantities (if at all) and in pharma grade will be more widely available.

“We need infinitesimal small quantities of those proteins in our growth medium, and other similar proteins are today produced at $10/kg for food (enzymes, rennet for cheese production) or consumer applications, so the potential cost reduction is validated.

“At Aleph Farms, we formulated a proprietary and optimized growth medium and have secured agreements with suppliers to ensure quantities and price for large-scale… We believe it will reach parity faster than most plant-based meat alternatives.”

There is also much debate concerning the green credentials of the cultivated meat sector. A 2019 Oxford University study concluded that if the electricity for lab grown meat production is generated from fossil fuels the carbon footprint will be very similar to conventional meat production.

But Toubia said other studies concluded that although cultivated meat production is still under R&D, when compared to conventional beef production it has the potential to substantially lower GHG emissions, land by more than 90% and water use by 50%.

“Although energy input of cultivated meat production is considered moderate, the studies stated before, are based on estimations of large-scale production where a circular approach and sustainable practices were not taken into consideration.”

He added that ‘farmed animals consume more food than they produce’. “Cultivated meat is 7x more efficient than beef cattle at converting feed into meat. Cultivated meat also needs much less land for feed inputs. This reduces land consumption of cultivated meat by 95% compared to beef. This offers opportunity to use the spare land for re-wilding habitats which would naturally reduce emissions or for producing more food for people.”

Reference

US and UK Consumer Adoption of Cultivated Meat: A Segmentation Study

Foods 2021

DOI: https://doi.org/10.3390/foods10051050