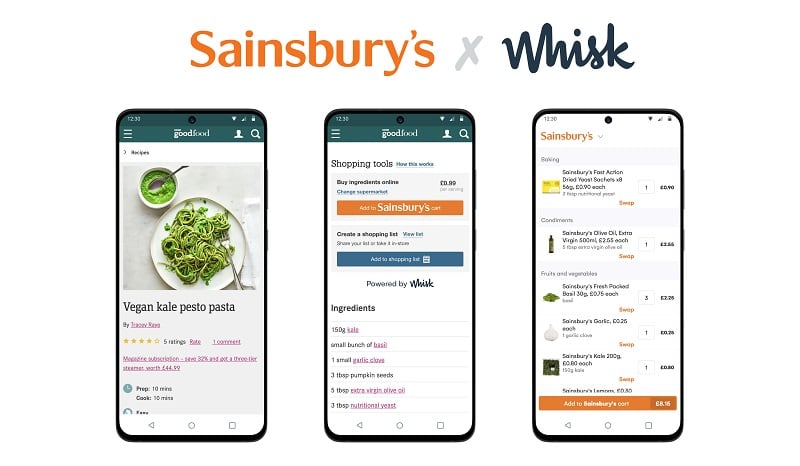

The Whisk app allows consumers to turn any recipe from a network of publishers and brands into a ‘smart shopping list’ which they can instantly purchase for click and collect or delivery from a partnering supermarket across the UK and Europe.

Whisk now has five UK grocery partners, with Sainsbury's joining Asda, Ocado, Tesco and Waitrose. It has 46 retailer partners globally and works with over 50 major brands across its different product offerings, including KraftHeinz, Unilever and General Mills. It powers shoppable recipes for publishers such as BBC Good Food, Jamie Oliver.com and the Food Network.

The app uses artificial intelligence to ensure that a recipe's ingredients are matched with the correct and currently available products at each store to provide for a ‘seamless customer experience from recipe to shopping trolley’.

The app helps consumers plan, cook and shop more easily for the recipes they find, Whisk’s founder Nick Holzherr told FoodNavigator.

“Users spend hours looking at recipe content from Instagram, recipe books, online, TV and they end up cooking the same 7-9 recipes on repeat. They don't end up acting on what they get inspired by. There's lots of reasons why but ultimately that process of finding a meal recipe, getting a shopping list, cooking it is full of friction. What we're trying to do is solve that and help users act on the inspiration they find.”

With over 500 million recipe interactions each month, the app offers the world’s largest retailers and CPG brands an opportunity to get more consumers buying more food and beverage products, he said.

This latest tie-up with Sainsbury's comes at a time when more consumers are discovering online grocery retailing, brought on by the enforced restrictions and self-isolating as a result of the covid-19 pandemic.

Commentators remain bullish on the outlook for online shopping, a trend that has been accelerated by COVID-19 but one that many believe will ‘stick’ post the pandemic.

James Leech, Head of Product at Sainsbury’s said: “As one of the premier grocers in the UK, Sainsbury’s is a leader in online grocery delivery and e-commerce. We know from our user feedback that a Sainsbury’s integration will be popular with users - at a time when online grocery shopping is critical in the UK.”

This December, UK shoppers spent £11.7 billion on take-home groceries in the busiest month on record for British supermarkets, with digital orders accounting for 12.6% of grocery spend during December, compared to only 7.4% last year, according to recent Kantar research. In April 2020, worldwide Google searches for food delivery and local food reached all-time highs.

Interestingly, while online shopping has grown, with many brands reducing production to focus on only their best-selling SKUs during the pandemic, the number of products on shelves has decreased.

Sainsbury’s noted more shoppers than ever are cooking at home, looking for recipe inspiration, planning their meals and shopping lists further in advance and relying on click and collect options from supermarkets, as evidenced by its Q3 grocery sales which were up 7.4% year-on-year. “As lockdowns continue into 2021, the new partnership with Whisk will help to ensure that Sainsbury’s continues to meet customer demand and that what users see online is actually available in their local store,” it said.

Tapping the smart kitchen trend

The full app experience is also accessible from Samsung Family Hub refrigerators, a fact which presents further opportunities for retailers and CPGs seeking to capitalise on rising demand for smart kitchen appliances among consumers, according to Holzherr.

The global smart kitchen appliances market size was valued at USD 9.87 billion in 2019 and is anticipated to expand at a CAGR of 19.1% over the forecast period, according to Grand View Research. Shifting consumer trends toward technology-led products is driving the need for electric and energy saving appliances in the kitchen environment.

“The smart kitchen market is predicted to essentially double from 2019 numbers by 2025. A lot of the stockists of smart kitchen appliances ran out of stock when Covid hit,” he said.

“This pandemic has made everyone so much more converted to technology than you could ever imagine,” Holzherr told us. “It's such a stark difference of everyone being converted to technology more than they were before. That doesn't just affect grocery shopping. It affects everything in our lives. Everyone will be much more tech savvy after this pandemic.”