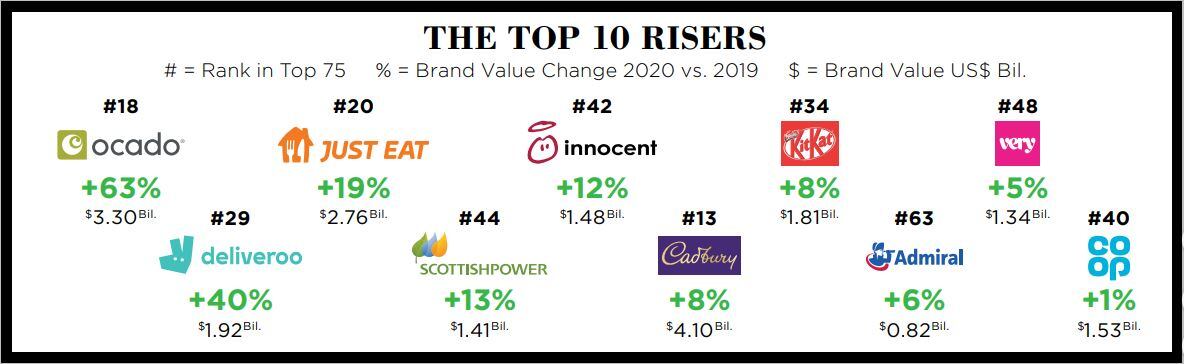

Food related brands collectively rose 8% from the previous year despite the total value of the 75 brands across all 25 consumer-facing sectors dropping 13%. What’s more, seven of the 10 top risers in the report were from food related sectors.

Here are some standout trends revealed by the report:

COVID has clearly boosted online retail and take-away brands

Online retail and take-away brands Ocado, Deliveroo and Just Eat were the UK’s fastest growing brands this year.

Already gathering pace pre-COVID-19, Ocado’s online capabilities and perceptions of strong differentiation from other grocery retailers made it this year’s fastest growing UK brand, increasing +63% in brand value to $3.3bn (£2.7bn) and reaching no.18 in the Top 75 ranking.

Home delivery services threw the UK’s restaurant and takeaway industry a lifeline as it was locked out by COVID-19. Intense competition between Just Eat (no.20) and Deliveroo (no.29) increased due to takeover deals and accelerated consumer demand for home-delivered restaurant and take-away food over the last year. This allowed Deliveroo to grow by +40% in brand value to $1.9bn (£1.6bn), and Just Eat +19% to $2.8bn (£2.2bn), making them the second and third fastest growing brands respectively.

People want pampering during the pandemic

Cadbury and KitKat both increased their brand value as consumers have sought more indulgent moments, particularly during lockdown. Cadbury (no.13; $4.1bn; £3.3bn) is behind many of UK consumers’ most-loved confectionery brands such as Dairy Milk, Flake, Creme Egg and Crunchie.

KitKat’s (no.34; $1.8bn; £1.5bn) product innovation and expansion into gifting and seasonal confectionery has also boosted the iconic brand. KitKat has gone premium and gone direct. The brand has launched its first direct-to-consumer offering: the KitKat Chocolatory provides unique premium flavours that are personalised and customised, and shareable digitally.

Both Cadbury and KitKat increased their brand value by +8% and attract younger, affluent shoppers.

Brits still love a cuppa

The lockdown effect has also helped Lipton, the biggest-selling tea brand in the world. Parent company Unilever is reportedly considering selling Lipton owing to concerns about declining profits as younger consumers opt for herbal teas and coffee over traditional black tea. Despite this, Lipton (in 6th place) has managed to retain its brand value and has climbed two places this year.

Home alcohol sales have soared

Without pubs and restaurants to go to, consumers sought solace in a few beers or G&Ts at home, sending take-home alcohol sales soaring, noted the report. Even once pubs reopened, over half of the consumers said they felt uncomfortable about going out, and alcohol sales for home consumption remained 41% higher than usual in early July.

Entering on the coattails of this trend and onto UK Top 75 for the first time, at no.70, is gin brand Gordon’s ($651m; £531m). The report added that Gordon’s commitment to innovation has revitalised the brand’s equity in the UK. Fuelled by flavoured gins and liquors, the category has exploded in recent years, more than doubling its shopper base from 14% in 2015 to 34% in 2020, while helping establish gin as the nation’s favourite tipple.

The health trend has taken a back seat… but will come back stronger

More home cooking and home snacking has meant people are buying not just more food and drink (13% up between June 2019 and June 2020), but also more calorie-dense products, with total calories purchased around 17% higher than a year ago.

Is there still momentum around healthy eating? "In the short term the quick answer to that is no," said Giles Quick, head of consumer usage and consumption at Kantar. Health, he said, is taking a back seat in the face of reduced consumer confidence and increased economic hardship.

He identified a lipstick effect taking hold -- the theory that when facing an economic crisis consumers will be more willing to buy less costly luxury goods - amid the stress of the pandemic.

"When you're stuck at home and can’t see your mates, you turn to a chocolate bar or biscuit," he told FoodNavigator. In times of low consumer confidence, people turn to cheap treats and high fat products. 'Heritage brands' (note Cadbury's aforementioned success) also tend to gain. And with consumer confidence often typically taking two or three years to recover after a recession, he predicts these trends to be with us for a while.

However, "health will come back even stronger once consumer confidence returns and re-emerge in a slightly different form”, he said. It will, he explained, be re-articulated into the idea that fewer calories not only help our bodies, but the environment too. Concepts such as ‘locally-sourced’, ‘sustainable’ ‘safety and trust’ and ‘purity’ will become strong words and important in determining brand success owing to the lasting effect of COVID.

Brands that can successfully tap the shift to home working are also set to gain, he believes. "I think something that's absolutely going to determine success of different brands at the moment is the almost inevitable increase in working from home in the long term." That's bad news for sandwich makers and lunch box providers. But better news for brands reliant on home cooking.

Campaigns work

Many brands in the top 75 have successfully used campaigns to connect with consumers, the report noted.

In late 2019, Cadbury partnered with Age UK to tackle loneliness among elderly people, removing the words from the iconic Dairy Milk chocolate bar to raise awareness of their plight; it donated a portion of sales to help Age UK provide services and support as part of its “Donate your words” campaign.

Lipton has focused its marketing on a message of togetherness, and how sharing tea with others can help alleviate loneliness. Lipton said that despite millennials being well connected via social media, they often suffer hidden loneliness that could affect their mental health. 'Project Unlonely' led to the launch of a global “You.Me.Tea.Now” campaign, which encouraged people to foster quality real-life connections and conversations – over a cup of tea – that could help people feel better. Other advertising has focused on the health benefits of drinking tea, urging consumers to “Love your heart”.

In late 2019, Gordon’s created a branded experience to spice up London commuters’ journey home, with 'The Gordon’s Line' taking passengers along the Thames, with complimentary G&T, snacks and a saxophonist for entertainment. During the COVID-19 lockdown, Gordon’s partnered with Kaya FM to launch a radio conversation series to support people in the hard-hit entertainment industry.

In April, supermarket Co-op (no. 40 on the list with a value of $1.53 – up 1% from 2019) scrapped the Easter campaign it had planned and donated airtime to the work of Fareshare, a charity that tackles hunger and food waste, and created a new TV spot relevant to a consumer base in the midst of the COVID-19 lockdown. The new ad was a thank-you message to the people whose work was keeping the country going, with the tagline “Even though we’re apart, we can still help each other out”. In stores, the business urged shoppers to make donations at the till to support food banks. The brand had earlier announced a partnership with Mind UK, the mental health charity.

This year, Co-op launched its own meat-free brand as it seeks to cater to the growing vegan market, and is changing its packaging to reduce plastic waste, becoming the first UK retailer to introduce recyclable pizza packaging.

Beverage brands have successfully adapted to the sugar tax

The launch of a sugar tax on soft drinks in the UK last year has led consumers to look a little more closely at labels and more carefully consider the impact of what they drink on their health, the report observed. The sugar content of drinks previously assumed to be a healthier option than fizzy beverages – juices and smoothies in particular – has made this a challenging time for brands with a fruity focus. But fruit-based brands have found new ways to promise health, adding vegetables, herbs, botanicals and 'superfoods' such as acai and goji berries to their recipes to boost their wellbeing credentials. By aligning with changing views of health, smoothies have managed not just to sustain sales but increase them.

Smoothie brand Innocent (the 128th most valuable brand in the UK), for example, has gained 12% in value since 2019. It has steadily extended its range from smoothies into juices, sparkling juice and dairy-free milks, and has now moved into shots combining fruit, vegetables and vitamins, designed for the health-conscious consumer on the go. The shots followed the launch of an Innocent Plus range of juices made with botanicals and vitamins as well as fruit and vegetables.