A report has underscored the UK’s position as Europe’s most vibrant hub for fast-growing technology-enabled businesses. Investment into UK tech start-ups grew more than anywhere else in the world in 2019, according to figures by Dealroom and TechNation.

UK tech start-ups shrugged off uncertainty over Brexit and raised a record £10.1 billion last year, a £3.1 billion rise on the 2018 total and a leap of 44% year-on-year.

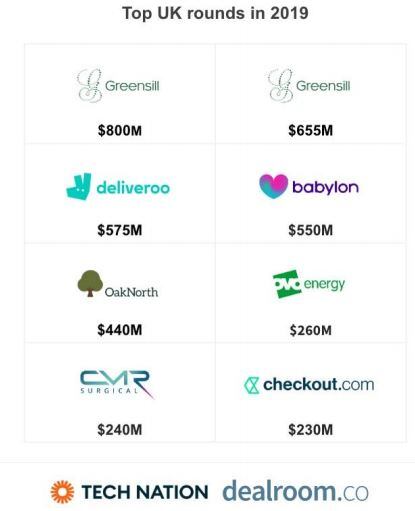

Much of this was won by food tech businesses. Out of 697 early stage VC funding rounds below the $25m mark last year, 91 were in the food tech space. The $575m acquired by the food delivery app Deliveroo in its funding round in 2019, led by Amazon, was the third largest venture capital investment round in the UK last year. At an earlier stage, London-based Taster raised €7m. (Operating in London, Paris and Madrid, Taster is made up of three food brands which make meals that people can buy online via food delivery platforms.)

UK tech firms beat France and Germany combined

British tech start-up companies secured more new capital than their French and German counterparts combined and accounted for a third of the venture capital invested across Europe, according to the data.

The UK received more funding than Germany and France combined, which came in second and third place at £5.4bn and £3.4bn. The UK growth surpassed that in all other countries, including in the US and China, where tech funding fell 20% and 65% respectively. France grew by a little over a third compared to 2018, while Israel’s investments rose by a fifth.

On a global scale, the UK’s performance in 2019 means it now sits behind only the US and China in terms of total venture capital funding received in 2019 and on a city-level, London joins the Bay Area, Beijing and New York at the top of the world’s most-funded locations. Companies headquartered in London raised £7.4bn during 2019.

Investors eye European food logistics and delivery businesses

However, venture capitalists continue to have a healthy appetite for European food logistics and delivery businesses, which attracted over €1.6bn in 2019, according to Dealroom data.

In addition to Deliveroo and Taster, the food delivery firms which raised substantial funding in 2019 were Spanish start-up Glovo (€319m) and Helsinki-based Wolt (€118m).

Tech Nation’s chief executive, Gerard Grech, told FoodNavigator that the tech sector has ‘changed the food sector in all respects’ in the last decade, creating billion pound food delivery companies like Just Eat and, at the other end of the scale, tech companies with a ‘purpose’ that are working to reduce food waste, like Olio.

“With the UK attracting record sums of venture capital investment, there are likely to be more innovative tech companies springing up that will influence the shape of the food industry even further, particularly as we look at how to make the most of the world's resources by adopting practices like vertical farming."

UK is best in Europe for unicorns

The strong performance of British start-ups in all sectors (financial technology, AI deep tech and energy and clean tech were the strongest performing sectors) created eight new unicorn companies (those worth more than $1bn) in the UK, taking the total number based in the UK to 77. Double the total number in Germany (34) and almost four times as many as Israel (20) and three times as many as France.

Since 2014, the UK has produced more than twice the total number of $1bn tech companies than any other country in Europe and sits behind only the US and China when it comes to building fast-growing global firms.