The association between fast food consumption and the development of non-communicable diseases such as obesity, type 2 diabetes and coronary heart disease is well documented.

Observational evidence suggests that adults who regularly eat takeaway meals have poorer diet quality, increased adiposity, type 2 diabetes and coronary heart disease. And a fresh study recently published in BMJ Journals, ‘Takeaway meal consumption are risk markers for coronary heart disease, type 2 diabetes and obesity in children aged 9–10 years’, concluded that the same is true for children.

“More frequent takeaway meal consumption in children was associated with unhealthy dietary nutrient intake patterns and potentially with adverse longer-term consequences for obesity and coronary heart disease risk,” the authors of the report observed.

Research examining environmental factors that increase takeaway consumption has focused on exposure. People who live in – or commute through – areas with a high density of fast food restaurants are more likely to buy takeout food.

But new technology is making it even easier to buy takeaway food, with delivery options and business models from the likes of Just Eat or Deliveroo putting the option to order in at everyone’s fingertips.

New tech drives delivery boom

This is leading to a boom in the foodservice sector. According to the MCA Foodservice Delivery Report, food delivery was worth £8.1bn in 2018 – up 13.4% year-on-year.

Sixty percent of UK adults are active delivery users who, on average, order two times per month. In total, this equates to 851m meals ordered in 2018. MCA predicts that the delivery market shows no signs of slowing – and will be worth an estimated £9.8bn by 2021.

Just Eat and Deliveroo are linking restaurants and fast food chains with couriers to enable consumers to access brands like Harvester and Burger King from their living rooms. New business models built around ‘dark kitchens’ are also emerging, cooking purely for delivery.

In contrast, supermarkets are struggling to maintain share in a highly competitive market. According to the latest data from Kantar Worldpanel, in the 12 weeks to 14 July, supermarket sales in the UK contracted for the first time in three years, dropping by 0.5%.

The decline was spurred by a decline in footfall, Kantar revealed. “The main factor behind the sales drop-off is shoppers heading out to stores less often… This year households are making one fewer trip, which may not sound like much but is enough to tip the market into decline.”

Will Broome, CEO and founder of retail app developer Ubamarket, believes that supermarkets are struggling to keep up with rapidly changing consumer expectations.

“It is a case of supermarkets needing to adapt to changing consumer trends and lifestyle and implement retail tech in order to bring people back into supermarkets,” he told FoodNavigator.

A matter of convenience

Ubamarket commissioned research to investigate why people are increasingly turning to takeout and delivery channels over shopping in the supermarket. Unsurprisingly, the convenience of ordering food for delivery was touted as a chief reason for growth of the market.

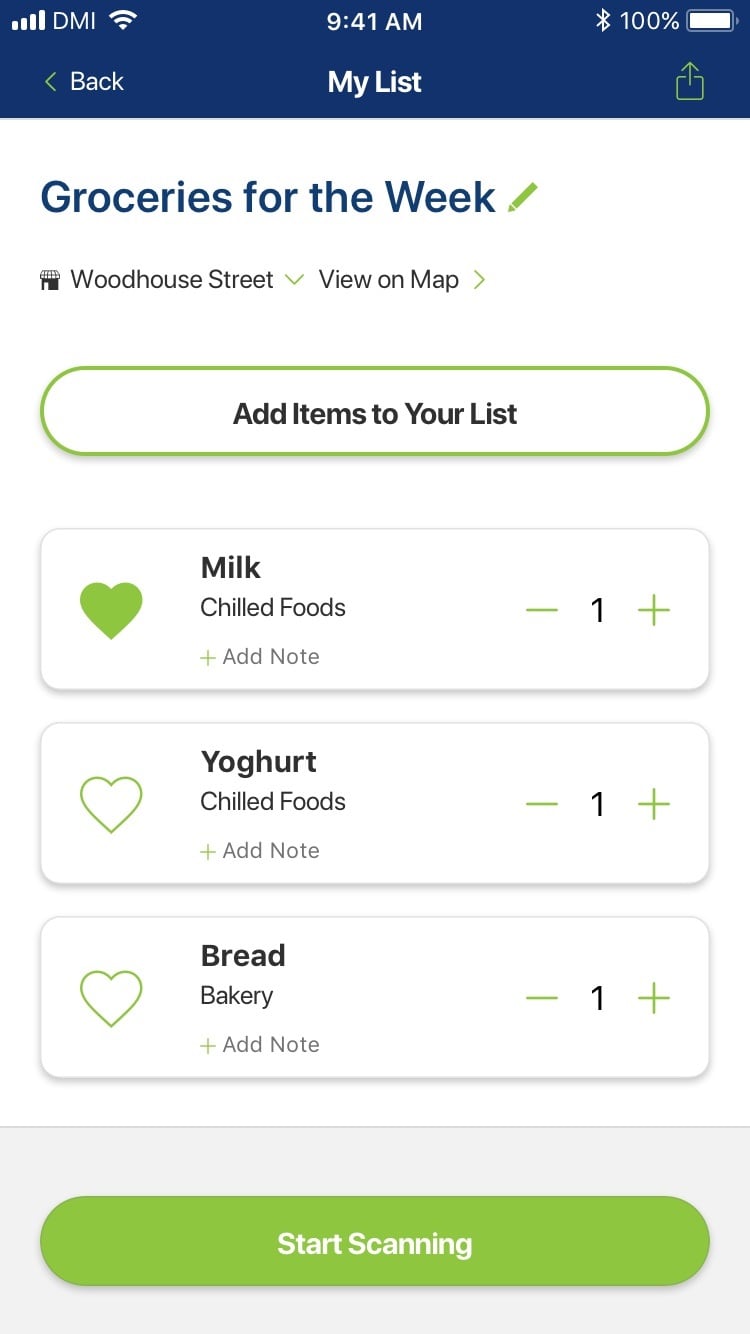

According to Broome, Ubamarket has a range of features which helps personalise the in-store experience such as:

- Shopping list guides you to product

- Scan as you go and in-app payments = no queues

- Track in-store spend

- Benefit from real time offers

- Keep all of your e-receipts

- Product tracking

- Nutritional shopping- allergen alerts feature which tells you if there are certain allergens in products as well as if the product is suitable for vegetarians and vegans

- Recipe shopping

The system also offers benefits to retailer business models, he claimed. These include:

- Increase basket size

- Loyalty uptake to 100%

- Personalised offers

- Collect behavioural data

- Future-proof your store

- View shopping history

- Works with existing hardware

- Integrates with loyalty schemes

- Simple in-app payment function

The Ubamarket survey found 30% of UK consumers said travelling to the supermarket to do a traditional weekly shop is an ‘inconvenience’. About the same number, 31% of respondents, suggested that delivery services are ‘too quick and easy to say no to’. A quarter of UK shoppers claimed that cooking is a ‘boring’ task.

Digging beyond this, the research also detected a knowledge gap, with 10% of Brits confessing they don't know how to cook a good or healthy meal from scratch.

“Our research has revealed that nearly 7 million Brits do not have time to cook food in the evening. However, people may not be aware that home-cooking can be just as quick, save customers money and provide many health benefits,” Broome said.

How can grocery fight back?

The grocery sector does, nevertheless, offer some important benefits over delivery.

Ubamarket has developed a white-label shopping app that allows customers to shop by recipe, by the layout of a store and by being able to 'scan-and-go' products without having to queue. The app is currently being rolled out across the UK with retailers including Warner's Budgens, Spar and Co-Op.

The development enables shoppers to create lists based on recipes – making it easier to make healthy choices and avoid impulse purchases. “The app allows you to shop by recipe so that you don’t ‘give in’ to impulse purchases in the junk food aisle,” Broome explained.

“By only purchasing the items you need it helps consumers reduce food waste as well as help retailers track demand for products so that they can stock up on the food which has the most demand.”

Ubamarket’s research found a significant 59% of shoppers are not confident of the ingredients contained in food they order online or in-app. With a growing number of people affected by food allergies or following restricted diets, supermarkets also have the opportunity to out-perform here, Broome believes.

“The allergen alerts feature informs customers whether a product contains gluten, dairy or is suitable for vegans and vegetarians - it helps those with diet or lifestyle requirements to shop at ease.”

Broome also thinks supermarkets can compete on convenience by doing more to streamline the shopping experience – making it easier for shoppers to access healthy food and follow recipes.

“Many of us lead very busy lifestyles, so retailers should adapt their offerings to create an efficient shopping experience. This would encourage people to shop in stores for their grocery shopping instead of ordering takeaways,” he claimed.

“If shops were to implement retail tech, such as apps that guide you around the store, allow you to write shopping lists and facilitate scan-and-go technology, that would encourage shoppers up and down the country to make the most of the benefits that bricks and mortar stores have to offer.”

Source

'Takeaway meal consumption and risk markers for coronary heart disease, type 2 diabetes and obesity in children aged 9–10 years: a cross-sectional study'

BMJ Journals

DOI: http://dx.doi.org/10.1136/archdischild-2017-312981

Angela S Donin, Claire M Nightingale, Chris G Owen, Alicja R Rudnicka, Derek G Cook, Peter H Whincup