Despite recent entries from some deep-pocketed players, the non-dairy yogurt category remains surprisingly fragmented with no runaway leader, meaning there is still plenty of runway for new brands to gain traction, claimed founder Jody Polishchuk, who said consumers are looking for products with a more appealing texture, functional benefits, novel flavors, and less sugar.

“I think what surprised me when I started digging into the competitive set was that the bar was actually quite low when it came to taste and texture. There are some great products out there, but I think some of the better ones have not got their pricing architecture right.

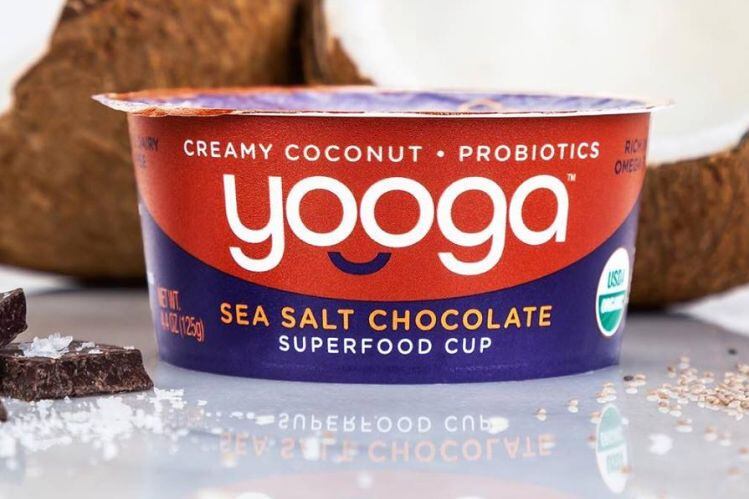

“Yooga [an organic plant-based yogurt sweetened with cane sugar and monk fruit] contains probiotics, omega-3s from finely milled chia seeds, and innovative flavors [such as turmeric golden milk and sea salt chocolate] and has less than half the sugar of the leading brand in the segment.

“It also doesn’t have that runny, gelatinous, or grainy texture and mouthfeel that you get in a lot of other plant-based yogurts, and consumers tell us that it’s by far the best plant-based yogurt they’ve had.

“But [at $1.99/cup] it’s also at the right price point,” said Polishchuk.

“Right now there is no clear consensus winner in the category and everything to play for. The whole thing is up for grabs for whoever can really nail product and pricing… I think retailers to begin with just wanted to build a set, but they are going to become a lot more data focused now the category is becoming more established.”

‘No one has really cracked the code yet’

Yooga ‘superfood cups,’ which launched in November 2018 via Rainforest Distribution and are now in around 550 stores mainly in the northeast, are launching in Southern California this month (Erewhon, Jimbo’s, Bristol Farms, Clark's, Jensen’s, Lassens etc).

They will hit select Walmart stores in July, and head to Northern California in September via distributor Dairy Delivery, said Polishchuk, who hired Presence Marketing as national broker in May 2019.

The brand, which has attracted some high-profile early investors including EVOL Foods founder Phil Anson and KeVita co-founder Bill Moses, is already outperforming brands that have been around a lot longer in a market in which “no one has really cracked the code yet,” claimed Polishchuk.

“After six months on shelf at 43 New Jersey ShopRite stores, Yooga is now outperforming established dairy-free yogurt brands such as Daiya, Kite Hill and Lavva in dollars per point of distribution.”

Finely milled chia seeds

Asked how the chia seeds impacted the texture of the products, he said:

“We have 1,000mg of plant-based omega-3s from very finely ground chia seeds. From the market research we did, we learned that there is a segment of consumers that doesn’t really love the consistency of whole chia seeds when they are soaked in a liquid and so we’ve been able to deliver on the functionality that consumers expect from chia and overcome the textural issues.”

INGREDIENTS (Yooga blueberry): Water, organic coconut cream, organic blueberry puree, organic evaporated cane juice, organic chia seeds [a source of the short chain omega-3 fatty acid ALA - Alpha Linolenic Acid], organic fruit and vegetable juice for color, organic tara gum, xanthan gum, sea salt, organic sunflower lecithin, organic natural flavors, citric acid, mixed tocopherols, Ganeden BC30 (probiotic), monk fruit extract.

Each cup of certified organic blueberry Yooga has 6g sugar (compared with 12g sugar for Forager plant-based blueberry yogurt; 14g sugar for Kite Hill plant-based blueberry yogurt; and 18g sugar for So Delicious plant-based blueberry yogurt)

Chia Viva! pudding

Yooga draws from the functionality of Chia Viva! a coconut milk chia-based pudding launched by Polishchuk in 2015 that is being relaunched in November with a refreshed brand and formula to more clearly distinguish it as a pudding/dessert [vs a yogurt] that is merchandized in the refrigerated dessert segment.

He added: "The DNA of the two brands is similar but there are widely different packaging and consumption occasions. Chia Viva! did very well considering when we launched the pricing was all wrong and it was being positioned in the yogurt segment. The sell in was actually incredibly easy, but the problem was merchandising."